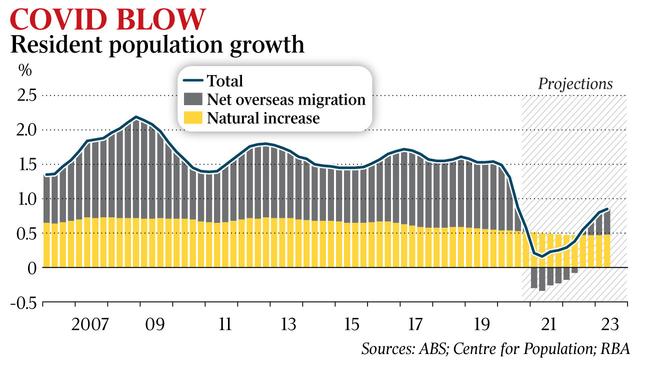

Pandemic population pause and huge stimulus leads to income growth

The pause to Big Australia will lead to higher living standards and could spark wage rises in some regions and industries.

The pause to Big Australia will lead to higher living standards and could spark wage rises in some regions and industries even though the economy will be smaller than previously expected because of COVID-19, according to analysis by the Reserve Bank.

In its quarterly statement on monetary policy on Friday, the central bank also notes pandemic-related wage freezes may have peaked, with only 10 per cent of businesses in its liaison program expecting to have one in place by the end of this year.

“The Australian economy is transitioning from recovery to expansion phase earlier and with more momentum than anticipated,” the RBA said.

“Along with favourable health outcomes and the removal of restrictions on activity, this snapback in activity has been supported by extraordinary fiscal and monetary support”.

Near zero interest rates and $250bn in direct stimulus have changed the RBA’s starting point for forecasts.

“The level of GDP is still expected to remain a little below that forecast before the pandemic, mostly due to lower population growth; in per capita terms, GDP is expected to be on a higher trajectory, supported by higher per capita household income and a strong contribution from public demand,” the bank said.

GDP per capita is a proxy for the standard of living. During recent years when population growth averaged a rich world-leading 1.5 per cent a year, with two-thirds of it due to net overseas migration, per capita incomes fell even though national output was expanding at a fast clip compared to our peers.

The RBA considered the economic effects of border closures, the return home of temporary migrants and the steep fall in population growth, expected to be 0.2 per cent this year, the weakest rise in over 100 years.

“Population growth has not fallen to anywhere near the same degree in most other advanced economies; Canada, which also had high levels of net overseas migration in recent years, is the main exception,” the bank said.

“The decline in international students, tourists and foreign workers more broadly has removed a source of demand for a range of goods and services, such as accommodation, education, food and transport. The economic effects have been felt unevenly, with some firms and regions more reliant on these temporary visitors than others”.

The RBA noted a fall in inner-city rents, more Australians holidaying at home, and only a modest effect on the broader labour market from the absence of temporary foreign workers, although sectors such as hospitality have been disrupted.

“However, a sustained period of economic recovery could lead to wages pressures emerging more quickly if new labour supply remains constrained, particularly and foremost in areas of domestic skills shortages and where substantial time is involved in upskilling domestic workers.”

In its survey of cost pressures, the bank noted the reversal of large private sector wage cuts in December, especially in business services as financiers grabbed back bonuses.

While the RBA noted subdued wage growth was likely to persist for some time, over a quarter of firms in its liaison program last month reported a freeze was in place, down from one-third at the end of last year. Looking ahead, only 10 per cent of surveyed companies expect to have a wage freeze in six months, and more firms report they expect stronger wages growth in the year ahead.