Trade boom heralds Anthony Albanese’s China trip as lobster ban nears its end

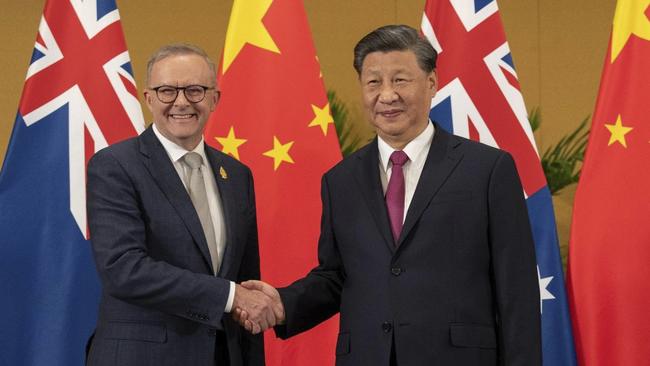

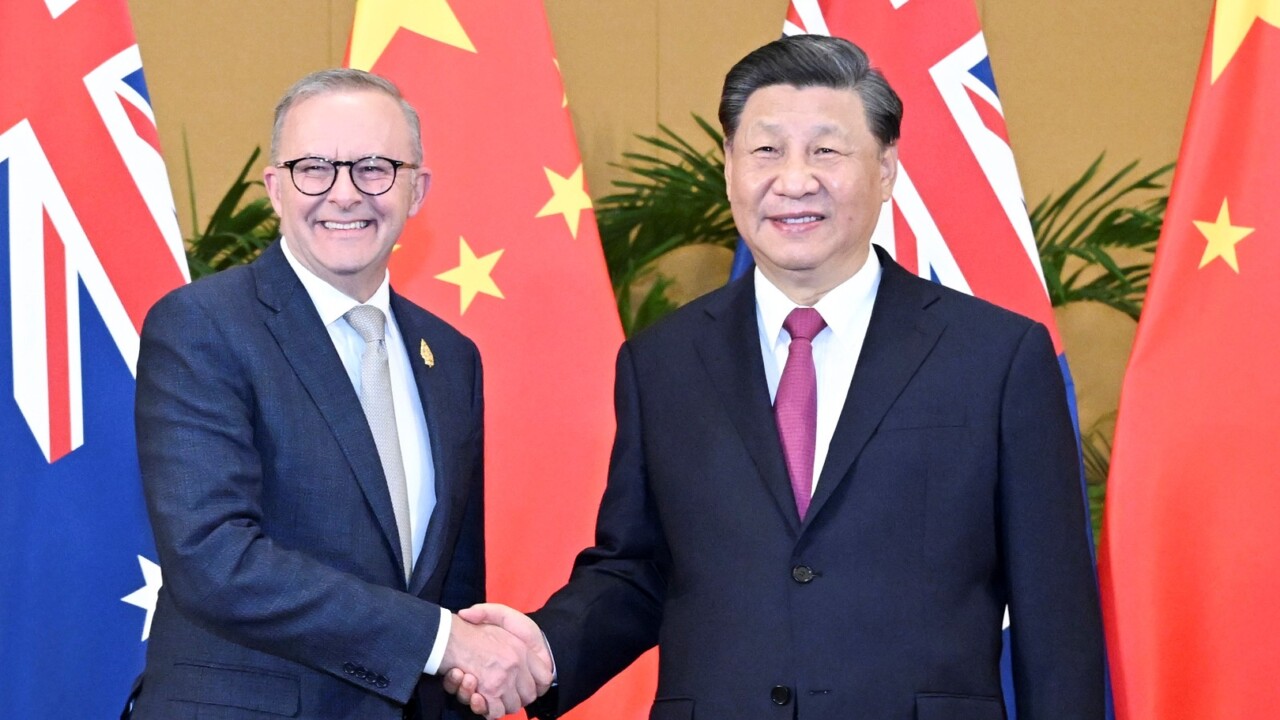

Anthony Albanese will arrive in Shanghai with Australia’s trade surplus with China bigger than any other country, and the live lobster industry hopeful its three-year black-listing could end within days.

Anthony Albanese will arrive in Shanghai on Saturday with Australia’s trade surplus with China bigger than any other country, and the live lobster industry hopeful its three-year Beijing black-listing could be days from ending.

A lithium boom, robust demand for iron ore, buoyant LNG sales and the end of Beijing’s ban on Australian coal pushed Australia’s exports to China to $133.5bn in the first eight months of the year, cruising past the previous record of $128.5bn in 2021, according to data compiled by the Department of Foreign Affairs and Trade.

The country is also setting international records. Australia is on track to have a bigger trade surplus with China in 2023 than any other country except Taiwan, according to China’s customs department data compiled by The Weekend Australian.

China’s reliance on Australia for strategically important resources is the main driver of the thumping export numbers, but they have also been topped up this year by the unwinding of China’s trade blockages on coal, copper, cotton, timber and barley.

Australia’s live lobster industry is poised to be the biggest commercial beneficiary of the Prime Minister’s three-night trip to China, the first by an Australian leader since 2016. Industry sources have told The Weekend Australian that Chinese lobster importers have been asked by their Australian counterparts to apply for licences for the prized catch.

“There’s something happening,” said a senior figure in the lobster trade, who said the industry had been told not to speak to the media about any deal. “It could be a matter of days.”

Trade Minister Don Farrell arrived in Shanghai on Friday. In the days leading up to the trip he has spoken with increasing confidence about securing a breakthrough “with a bit more push on our part”.

“Trade between Australia and China has delivered significant benefit to both our countries,” Senator Farrell told The Weekend Australian late on Friday.

“My visit is another opportunity to advocate for Australian business, including for the full resumption of unimpeded Australian exports to China.”

Senator Farrell is due to meet Chinese counterpart Wang Wentao in the coming days. Their previous meetings have been shortly followed by the unwinding of Chinese trade restrictions.

An end of the lobster ban would restore the fat margins of a trade previously worth $700m a year and be a boon to regional coastal towns in Western Australia, South Australia, Victoria and Tasmania.

It would also clear the last major trade blockage on Australian products, so long as Beijing follows through on a deal to unwind its 200-odd per cent tariff on Australian wine, which is expected to come into place next year. There are also a clutch of Australian beef abattoirs whose licences were revoked in 2020.

The Australian government has repeatedly said no serious talks about China’s bid to join the high standards The Comprehensive and Progressive Agreement for Trans-Pacific Partnership could take place until all of the trade strikes on exports previously worth $20bn were removed. Only $2bn worth of the bans remain.

Senator Farrell will accompany Mr Albanese on a visit to the Australian pavilion at the China International Import Expo on Sunday.

The Weekend Australian has confirmed the exhibitors include the Geraldton Fishermen’s Co-Operative, Australia’s biggest lobster exporter. The West Australian lobster business would be a huge beneficiary if there was a resumption of the lucrative live lobster trade.

Premier Annastacia Palaszczuk is also taking a Queensland delegation to the Shanghai trade show before heading to Beijing next week for a trade and investment-focused trip.

Businessman Warwick Smith, chair of the Business Council of Australia’s global engagement committee, said the high-level political support was crucial for Australia “as a trading nation” to defend its booming exports to China.

“In the last five years, the trade relationship with China has actually increased,” Mr Smith told The Weekend Australian, speaking from Shanghai.

“So our strategy must be to keep what we have and, in a better political and trade climate, to grow that as well as diversify.”

Rio Tinto and BHP, Australia’s two biggest taxpayers, will both be among the nearly 250 Australian firms exhibiting at expo, a sign of the importance of the trade show, which was started by President Xi Jinping in 2018.

Rio chief executive Jakob Stausholm and BHP executive Vandita Pant will both be attending.

“In many ways, China’s success is Rio Tinto’s success,” said Alf Barrios, chief commercial officer of Rio Tinto, noting that half of the miner‘s revenue comes from China.

Australia’s biggest wine business, Treasury Wine Estates, is also exhibiting, as it prepares for a return of its full Penfolds range to China.

Australia overtook South Korea in 2019 as the country with the biggest trade surplus with China, according to World Bank data compiled by The Weekend Australian, a position it held on to even during Beijing’s epic trade coercion campaign.

While a boon for Treasurer Jim Chalmers and Josh Frydenberg before him, the tighter trade fusion during a period of icy political relations caused some in Canberra and Beijing to worry the two economies had become “too close”.

“The strong complementarity can create a strong vulnerability,” a senior economic adviser to the Chinese government recently told an Australian government delegation in Beijing.

Australians have felt that vulnerability acutely. In 2018, the Lowy Institute found 82 per cent of Australians thought China was more of an economic partner than a security threat. By 2022, only 33 per cent counted China as a partner.

It has also opened a rift between China-focused enterprises and the wider Australian business community.

“China will no doubt continue to be our most important economic partner, especially given their hunger for our commodities,” said Innes Willox, chief executive of the national employer association Ai Group.

“[But] the reality is that the difficulties of the past decade have fundamentally shifted how many Australian sectors and businesses view China.”

Additional reporting: Ben Packham

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout