China prepares to lift ‘coercive’ tariffs on Australian wine

The breakthrough leaves only the live lobster trade and a clutch of beef abattoirs black-listed ahead of the PM’s trip to meet Xi Jinping.

Beijing has agreed to review its crippling tariffs on Australian wine, a breakthrough for the Albanese government that leaves only the live lobster trade and a clutch of beef abattoirs on China’s trade blacklist ahead of Anthony Albanese’s trip to meet Xi Jinping.

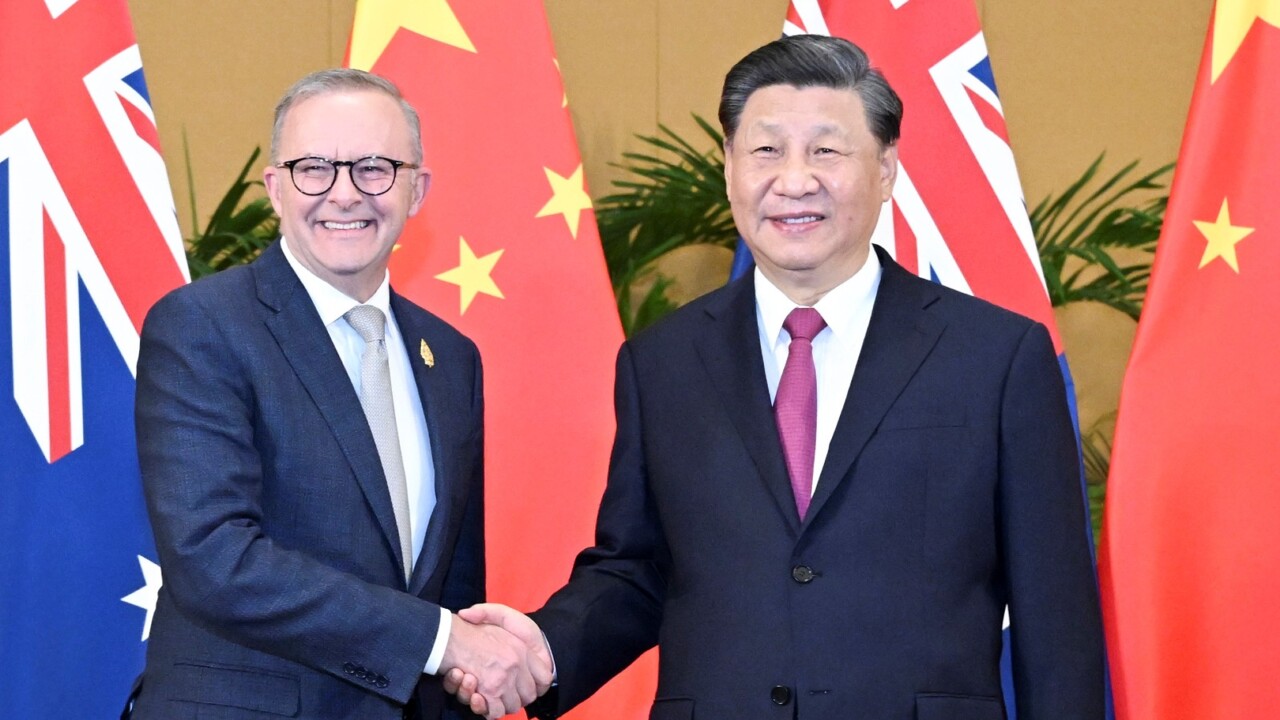

The Prime Minister unveiled the deal on Sunday as he revealed he would travel to Beijing and Shanghai from November 4 to 7 to meet with President Xi and Chinese Premier Li Qiang.

“I look forward to visiting China, an important step towards ensuring a stable and productive relationship,” Prime Minister Albanese said in a statement.

“I welcome the progress we have made to return Australian products, including Australian wine, to the Chinese market. Strong trade benefits both countries.”

The trade win comes days after the Albanese government announced that it would allow Chinese company Landbridge to continue its controversial lease over the Port of Darwin.

Beijing’s wine tariffs — which Australia challenged in the World Trade Organisation — were a centrepiece of the sweeping trade sanctions China imposed in 2020 after the Morrison government called for an inquiry into the origins of Covid.

Australia has agreed to put its WTO case over the wine tariffs on hold while China undertakes an “expedited review” of its duties, which is expected to take five months. Canberra will resume the dispute in the WTO if the duties are not removed.

China’s backdown had been widely expected in the wine industry after Beijing last month said it had proposed a “package” deal to end them, seen by Canberra as a face-saving exercise.

The WTO had in recent days delivered a draft report on the more than 200 per cent wine tariffs, which sources familiar with the matter said had found in Australia’s favour.

It follows a similar path that Australia convinced China to take in a separate case on an 80 per cent tariff placed on Australian barley. That deal was also agreed to days before an unfavourable WTO report into China’s tariff was to be released.

Opposition foreign affairs spokesman Simon Birmingham — who was Australia’s trade minister in 2020 — said the wine tariffs were “an attempt at economic coercion by China”.

“And it is no doubt, no coincidence that China and Australia received the draft report from the World Trade Organisation into Australia’s appeal against these tariffs only in the last week,” Senator Birmingham said.

“I am confident that draft report would have found that these tariffs were an act against the rules of the WTO. They are clearly in breach of the China-Australia Free Trade Agreement and the undertakings that China had given to Australia.

“And so, they should not just be reviewed, but they should be removed and removed forthwith.”

Australia overtook France as the biggest exporter of wine to China in 2019, the year before the tariffs all but eliminated the trade. At their peak Australian wine exports to China were worth almost $1.2 billion.

Treasury Wine Estates, Australia’s most valuable wine exporter, is poised to be the biggest beneficiary of the removal of the tariffs. Treasury’s Penfolds label is the best known in the Chinese market.

“It’s great news to see an agreement for a path forward to allow our Australian brands and wine to be sold in the Chinese market,” said Treasury CEO Tim Ford.

“There are only positives to come out of a favourable tariff review for the Chinese consumer, customers and wine category, for the Australian wine industry and for [Treasury].”

Australian Grape & Wine CEO Lee McLean said it had been a very difficult time for Australia’s grape growers and wine producers, as China’s tariffs compounded a slump from the pandemic and various weather events.

“So this is very welcome news for grape growers and winemakers across the country,” he said.

Li Wei, chairman of Barossa winery Swan Wine Group, said he had “encouraging” feedback in recent surveys of Chinese wine distributors.

“Some dealers who have never sold Australian wine in the past are now considering it,” he told The Australian.

Wine industry experts have forecast that, despite the end of the impost on Australian exports, the trade will not return to its previous levels. Many Australian producers remain wary of the political risk of the Chinese market while wine consumption in China has shrunk over the last four years as its economy has slowed.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout