Tax-take surge tipped to slash budget deficits

Jim Chalmers’ budget deficit is on track to be $11bn below Treasury forecasts on the back of a tax take estimated to be $12bn higher than projected, as economists warn the improvement has nothing to do with ‘any politician’.

Jim Chalmers’ budget deficit is on track to be $11bn below Treasury forecasts on the back of a tax take estimated to be $12bn higher than projected, as economists warn the improving bottom line has nothing to do with “any politician”.

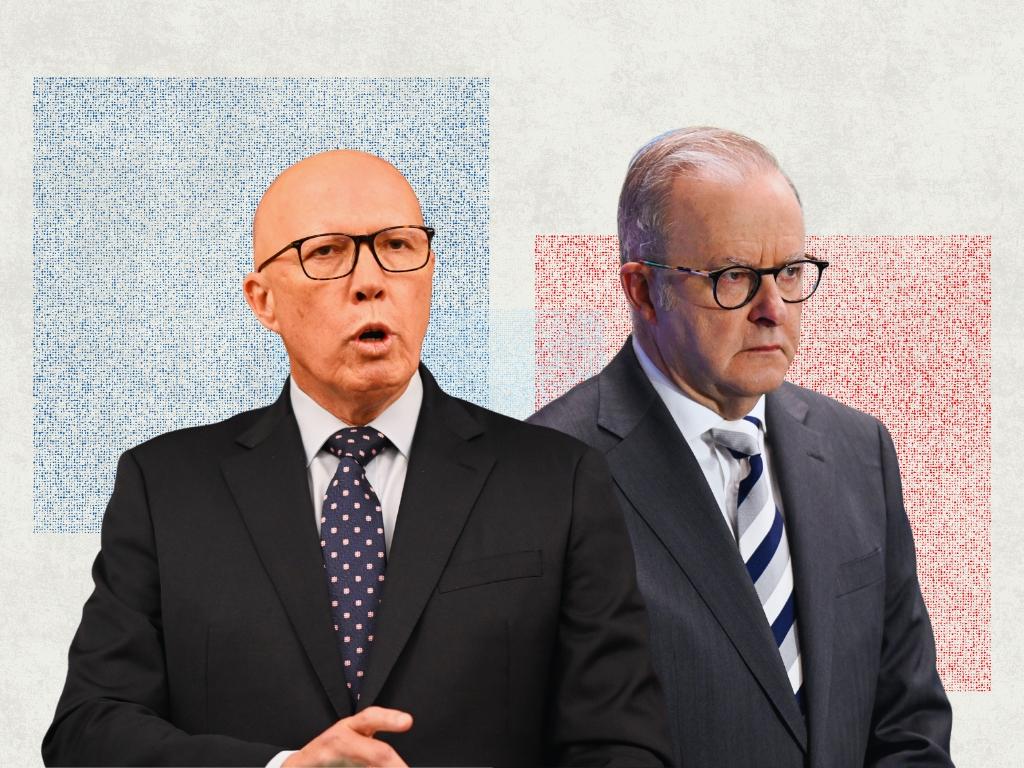

Amid ongoing speculation about whether Anthony Albanese will call an election and cancel the March 25 budget, new Rich Insight forecasts reveal “personal taxes are set to outperform because population and jobs are both set to outperform”.

Rich Insight founder Chris Richardson is estimating the tax take “may be about $12bn higher, both this year and again next” than forecast in the December mid-year budget update.

The veteran economist is projecting smaller underlying and headline deficits of $16bn and $37bn in 2024-25, but warned that “the luck won’t last … it’s the equivalent of a huge but one-off lottery win”.

“What will last, however, are the permanent promises made to ourselves off the back of that lottery win – promises that are accelerating (from both sides) as the election nears,” Mr Richardson said.

“The budget – our social compact with ourselves – took quite a lurch in recent years, with the size of government increasing by about 10 per cent. And although that’s not Whitlamesque, it is the fastest and largest increase in the size of the federal government since Whitlam’s expansion half a century ago.

“Australia is yet to figure out how to pay for that. Not that either side is addressing those issues in the current election campaign.”

Although his forecasts include caveats, Mr Richardson said in addition to personal taxes, the company tax take would be higher because “prices for our key exports have fallen more slowly than the official forecast, and the Australian dollar has fallen against the greenback”.

“That’s a double delight for mining profits, and so too for the taxes on those,” he said.

“But taxes on spending are a bit of a laggard. A key reason is that we don’t enforce our tobacco taxes, for reasons found in the dictionary under the word ‘stupid’.”

Mr Richardson said the “bottom line is that the bottom line is improving, but not because of any decision by any politician”.

“Upward revisions to the tax take since the government came to office – using the official figures for that in the ‘table of truth’ – show that the tax take benefited by $102bn in 2023-24.

“MYEFO estimated the tax windfall as easing back to $71bn this year. But, if my figures are in the ballpark, Treasury may be about to revise this year’s windfall up to more than $80bn.”

Finance Minister Katy Gallagher released monthly financial statements last Friday showing the underlying cash balance at the end of January was running a deficit of $37.1bn, which was $3.6bn lower than projected by Treasury in December.

Treasury forecasts in the mid-year budget update estimated deficits of $26.9bn and $46.9bn in 2024-25 and 2025-26.

Mr Richardson, who assumes there will be an extra year of electricity rebates, is forecasting the consumer price index to be 2 per cent and 2.5 per cent in 2024-25 and 2025-26, that the unemployment rate will remain steady at 4.2 per cent, and real GDP will lift from 1.5 per cent this financial year to 2.7 per cent in 2025-26.

If Labor doesn’t proceed with the budget, updated Treasury forecasts will be released via either an economic statement or the pre-election economic and fiscal outlook.

Ahead of the election, the Prime Minister and Treasurer are seeking to sharpen Labor’s economic narrative on the back of an interest rate cut, lower inflation and a slight uptick in GDP growth.

National accounts data released by the Australian Bureau of Statistics on Wednesday showed gross domestic product expanded by 0.6 per cent in the December quarter, the fastest pace in two years, as households and governments engaged in spending sprees.

The lift brought annual growth to 1.3 per cent, which is still one of the weakest results outside the pandemic since the early 1990s recession.

Dr Chalmers this week declared the economy had “turned a corner … what we’re seeing here is substantial momentum”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout