No ‘silly buggers’: flood insurers reject Murray Watt’s dress down

Home insurers insist they’re not playing ‘silly buggers’ with flood victims’ claims in Far North Queensland after being slammed by politicians for attempting to shirk their responsibilities.

Home insurers insist they’re not playing “silly buggers” with flood victims’ claims in Far North Queensland after being slammed by politicians for attempting to shirk their responsibilities.

The flooding disaster in Cairns and Cape York in the aftermath of Tropical Cyclone Jasper has been upgraded to an “insurance catastrophe”, with more than 3800 claims already lodged across the region with early estimates of up to $1bn in damage.

Federal Emergency Management Minister Murray Watt said insurers had a legal and moral obligation to pay out eligible insurance claims lodged outside the limited time frame for the federal government’s Cyclone Reinsurance Pool, and any suggestion otherwise was “untrue and dishonest”.

“I am disgusted with some of the comments of some insurers we have seen over the past 24 hours, who are trying to create the impression that because of issues with the Cyclone Reinsurance Pool, that people won’t be able to claim their insurance,” Senator Watt said.

“That is absolutely untrue, it is absolutely unhelpful, and it is disgusting for insurers to try and pass the buck away from their responsibilities to pay people their insurance premiums.”

Cyclone Jasper was the first weather event to test the $10bn Morrison government reinsurance pool, which covers the cost of insurers’ payouts to affected customers within the first 48 hours of a cyclone being downgraded. It was intended to help bring down the cost of premiums in the region and make insurance more affordable and accessible.

But managing director of Sure Insurance, Bradley Heath, said insurers were working to quickly pay out claims, labelling Senator Watt’s comments as “unhelpful”.

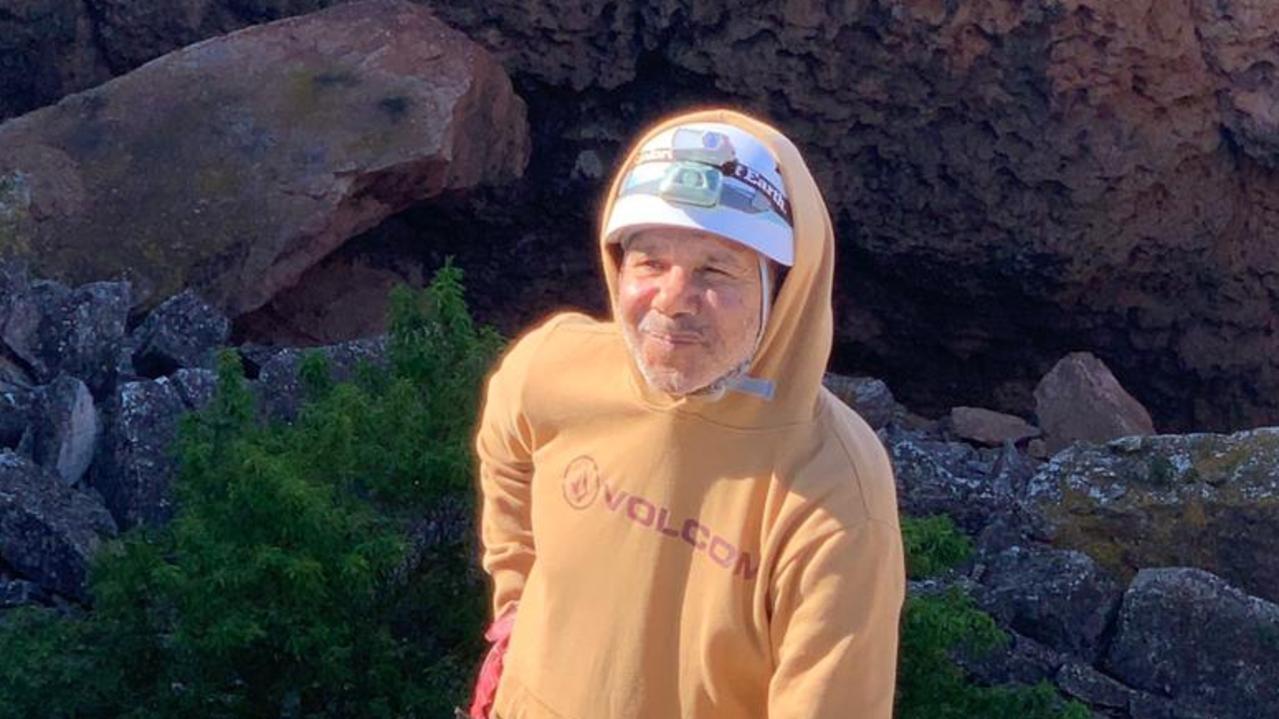

“We are not playing silly buggers,” said Mr Heath, who runs the independent insurer which largely services the Far North Queensland area.

“We’re out there pushing very hard to do the very best we can for our customers and I just don’t think the comment from the minister was helpful in the context of what we’re trying to do, not just at Sure, but as an industry.”

A parliamentary review has been undertaken, with a review of the legislation due in 2025.

Veteran LNP MP for the federal Far North Queensland seat of Leichhardt Warren Entsch – who pushed the Morrison government to legislate the reinsurance policy – said the scheme was “no doubt” flawed and he supported an increase to the covered time frame.

“That’s why there was an inquiry 18 months ago that identified a strong recommendation to lift it from 48 hours to 168 hours – the internationally recommended time frame,” Mr Entsch said.

Insurance Council of Australia chief operating officer Kylie Macfarlane said disaster response teams, including assessors and claims specialists, were already on the ground. “The clean-up has begun, but the full impact is still unfolding,” Ms Macfarlane said.

Insurers are well-prepared to respond, regardless of the Christmas break. “Customers should not be concerned about the reinsurance pool, it will not impact their ability to make a claim.”

Lack of insurance throughout the region remains an issue. The Cairns Chamber of Commerce estimates one in nine businesses in the area have been impacted by the weather event, yet more than 60 per cent were uninsured.

Skybury Farm, near Mareeba, is one such business. General manager of the family operation, Candy MacLaughlin, said they were unable to get insurance against a natural disaster, leaving them at least $500,000 out of pocket after losing a quarter of a million papaya crops.

“The only self-insurance we have is the nursery was unaffected,” Ms MacLaughlin said, meaning new crops will be ready in six months’ time.

Concerns for the welfare of residents in the Indigenous community of Kowanyama, on the western coast of The Cape, have escalated, with rains to hit decade-high flood levels by Monday. Some vulnerable residents have already been evacuated. About two-thirds of Wujal Wujal residents have been moved to Cooktown.