Australia has not always had a AAA credit rating. We were downgraded in the 1980s and only had the top billing restored because of the careful budget repair undertaken principally by treasurer Peter Costello in 2003.

The consequences of a ratings downgrade for a country are significant and damaging, increasing the burden of interest payments on existing debt as well as on any new debt issued.

In Australia’s case, a ratings downgrade would almost inevitably lead to a ratings downgrade for several states, including Victoria, Queensland and Tasmania. Given that it is not possible for a sub-government to have a higher credit rating than the nation, this could also affect Western Australia. The big banks would also have their credit ratings downgraded.

The net effect – and this is the big story – is that interest rates would be higher for longer for governments, businesses and households if Australia’s credit rating was downgraded.

Sadly, the Prime Minister doesn’t have the faintest clue about the thinking of the ratings agencies (they can be criticised for their past treatment of private capital instruments but not for their ratings of countries), rattling off misleading figures comparing budget outcomes with the 2022 pre-election economic and fiscal outlook.

Read my lips, Anthony Albanese, the ratings agencies don’t give a toss about fanciful forecasts made long ago. What they look at is the hard figures. The fact is that government spending under Labor has gone from $627bn in 2022-23, or 24.4 per cent of GDP, to $777bn this coming financial year, or 27 per cent of GDP.

The two budget surpluses are now behind us and, in any case, were primarily the result of much higher than anticipated commodity prices, rampant bracket creep and close to full employment.

The two key points are: first, the surpluses had almost nothing to do with actions taken by the Labor government and, secondly, they won’t be repeated any time soon.

The 10 budget deficits that are now forecast and that gross government debt will rise above $1 trillion next financial year are major considerations for the ratings agencies. The fact that annual net interest payments will reach nearly $30bn by the end of this decade based on optimistic forecasts will also be factored in.

The off-budget spending which has become a feature of this Labor government will simply be rolled in with the rest. The idea that this spending will generate superior returns in the future is laughable and the officials in the Department of Finance who sanctioned this accounting treatment should be ashamed of themselves.

And just to make it clear to Albanese, who dodged the question about cancelling 20 per cent of student loans, the effect is to increase government net debt and to lift net interest payments. There’s no free lunch there.

The ratings agencies will also be focused on the implications of the deteriorating fiscal positions of some of the states and the implicit guarantee that exists to the effect that the commonwealth government would bail out a failed financial state. Here’s looking at Victoria, but possibly also Tasmania, particularly if that state chose to proceed with its ill-considered stadium.

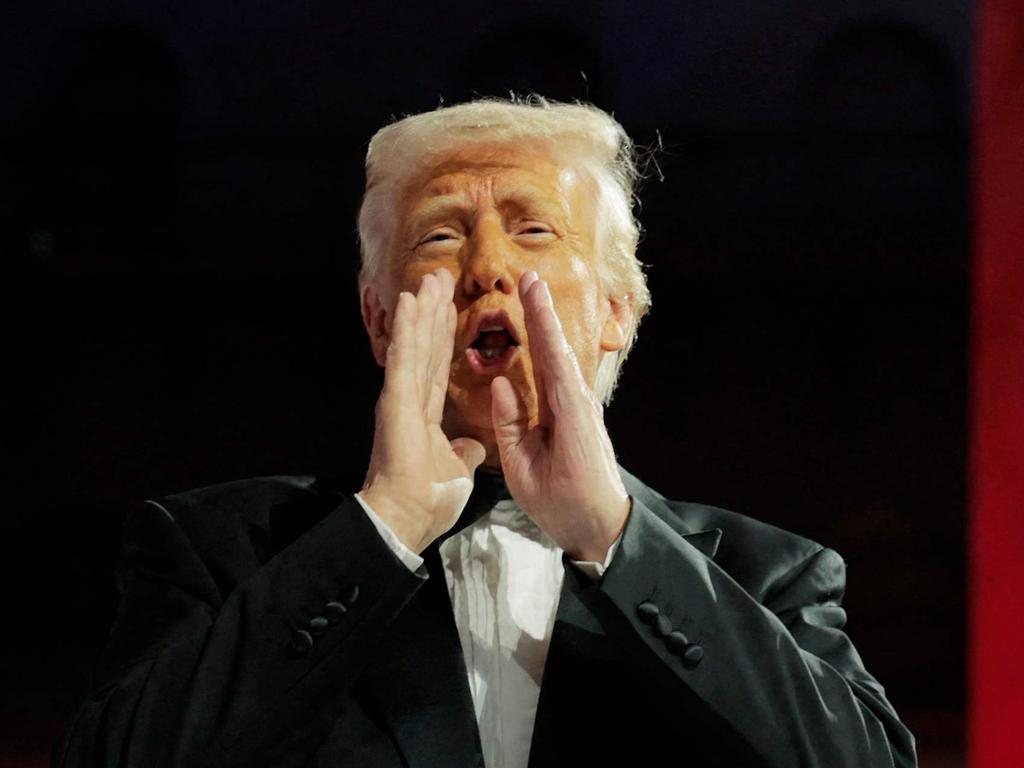

Ultimately, the potential for a ratings downgrade, costly though it could be, may end up being the trigger that brings an incoming government to its senses. (In a similar manner, we have seen the bond market tame US President Donald Trump and pull him back from implementing his most damaging economic measures.)

While Australia may have a lower debt burden than many other countries, we are a small open economy with a relatively narrow and inflexible tax base. Government spending is way too high – it should be returned to between 23 and 24 per cent of GDP as quickly as possible – the public sector is bloated and the rate at which debt is accumulating is truly alarming. Something will have to give.