Election 2025: Anthony Albanese scores AAA for denial as S&P credit rating at risk

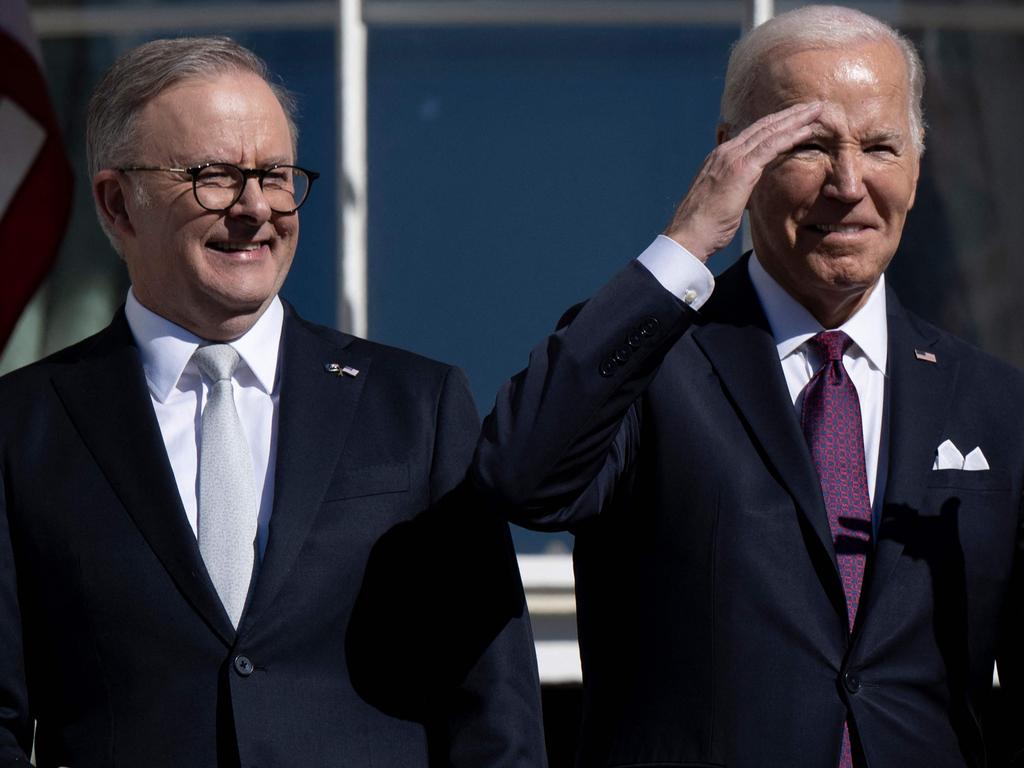

Anthony Albanese has lashed out at S&P for warning that Australia’s AAA credit rating is at risk due to the election spendathon and the massive growth of off-budget funds.

Anthony Albanese has lashed out at S&P for warning that Australia’s AAA credit rating is at risk due to the election spendathon and the massive growth of off-budget funds, declaring that the global credit ratings agency “must have been beside themselves” when the Coalition was in power.

The Prime Minister’s dismissal of the warning from S&P came as Jim Chalmers unveiled a meagre $1bn improvement in the budget bottom line and demanded the Coalition immediately “come clean on their cuts”.

After S&P released a report on Monday warning that the erosion of Australia’s fiscal discipline was a risk to the credit rating, Mr Albanese said in a nationally televised interview: “Well, there is no suggestion frankly; the AAA credit rating is there.

“They must have been besides themselves, whoever wrote that particular report, when the Coalition left us with a $78bn deficit,” Mr Albanese told ABC’s 7.30.

“We turned that into a $22bn surplus. We followed that with a $15bn surplus.”

Mr Albanese’s extraordinary attack on the ratings agency comes as he faces growing pressure over integrity issues during the election campaign, with Coalition ads labelling him a “liar”.

Mr Albanese has claimed Peter Dutton will cut Medicare without any evidence, used a renewables lobby group calculation as the basis for his claim the Coalition’s nuclear policy will cost $600bn, and claimed he had no responsibility for directing preferences to the Greens candidate in his electorate, who argued Israel was committing genocide.

Aiming to use the final week of the campaign to ramp up claims the Coalition planned “secret” cuts to essential services, the Treasurer released Labor’s pre-election costings showing a slight improvement to the budget outlook by further slashing the use of consultants and increasing international student visa fees to $2000.

The more than $7bn of savings was used to offset $10bn of policies announced during the election campaign, with $4bn of this provisioned for in the March budget that forecast a decade of deficits.

Dr Chalmers claimed the improvement in the bottom line showed Labor had offset all its election commitments, despite handing down a budget last month with pre-election policies increasing the deficits by a net $35bn over the forward estimates.

Labor’s policies in the last budget alone exceeded the $31.7bn Bill Shorten was planning to spend over four years if he won the 2019 election, although the former Labor leader also outlined revenue measures that were forecast to improve the bottom line by $17bn.

Despite spending decisions of the four budgets from the Albanese government adding a net $112bn to projected deficits over the next four years, Dr Chalmers said the $1bn saving showed the government was “managing the budget and the economy in a responsible and a considered and a methodical way”.

The government forecasts deficits over the next four years to total more than $150bn, while there is forecast to be $103.9bn of spending on off-budget funds in the five years to 2029-30.

Off-budget spending was projected at $33.7bn over five years before Labor was elected in 2022. S&P criticised the use of the measure as obfuscation of the budget’s true fiscal position.

The Coalition is planning on axing some of Labor’s off-budget funds – including the $10bn Housing Australia Future Fund and the $20bn Rewiring the Nation fund – but would pay for its proposed $120bn nuclear power plant program through an off-budget vehicle.

Labor is using Smart Energy Council figures to claim the nuclear policy will increase off-budget spending by $600bn.

In a pre-election warning to Labor and the Coalition over unfunded spending promises and the growth of off-budget measures, S&P warned that the erosion of “sound fiscal management” was threatening Australia’s credit rating which would increase the commonwealth’s interest repayments. “The AAA rating on Australia may be at risk if election promises result in larger, structural deficits, and debt and interest expenses rising more than we expect,” the report says. “The budget is already regressing to moderate deficits as public spending hits post-war highs, global trade tensions intensify, and growth slows.

“How the elected government funds its campaign pledges and rising spending will be crucial for maintaining the rating.”

S&P warned the Albanese government’s expected deficit next year could push overall government debt – including the states’ – into a “rare” position not seen since the global financial crisis. “If major election commitments aren’t funded via additional revenues or savings, the deficit could widen further,” it says.

The report says the rapid growth of off-budget spending is “increasingly obfuscating Australia’s fiscal position and borrowing needs”, and the global credit rating agency would ignore this tactic to lower headline deficits.

“Our preferred fiscal measure is the annual change in net general government debt,” the report says.

“We believe this better reflects the country’s underlying fiscal position because it captures all spending within it.”

Responding to the S&P report, Dr Chalmers declared: “The biggest risk to our AAA credit rating is Peter Dutton and the Coalition.”

Dr Chalmers said off-budget spending would increase under the Coalition’s nuclear plan, claiming the Opposition Leader’s costings would be worthless unless they included funding for reactors that would not be built for at least another decade.

“What we’ve shown, and what the ratings agencies will know now that we’ve released our costings, is the budget under us is in a stronger position at the end of the election campaign than it was at the beginning,” he said. “That is a powerful demonstration of our responsible economic management. It also sets up a pretty clear choice.

“Peter Dutton has got secret costs and secret cuts. He won’t come clean on those cuts because Australians will be worse off when Peter Dutton cuts, Australians will pay. And so if the ratings agencies are worried about spending, we’ve been able to put their concerns to rest by releasing our costings today. It is long past time for Peter Dutton to do the same thing, to come clean on his cuts.”

Mr Dutton said the S&P report showed Labor was “reckless with taxpayers’ money”. “The only reason Labor was able to achieve surpluses in their first two years and then deficits for every year thereafter, is because they were bequeathed them from the Liberal Party,” Mr Dutton said.

Opposition Treasury spokesman Angus Taylor said the “real risk to our credit rating is Labor”.

Mr Taylor said the Coalition’s costings – expected to be released on Thursday – would show a better bottom line than Labor’s. But he would not indicate how material the Coalition’s savings would be, despite putting out a press release last week signalling a range of savings including scrapping Future Made in Australia spending and electric car tax breaks, reducing the public service workforce and dumping Labor’s off-budget vow to cut student debt by 20 per cent.

“You will have a stronger budget position under us than Labor,” Mr Taylor said.

Former Reserve Bank head of economic analysis Jonathan Kearns, now chief economist at Challenger, said Dr Chalmers’ claim that a $1bn improvement would change perceptions about fiscal management was hard to see. “I don’t know what accounting trick would give a $1bn improvement,” he said. “I don’t see the maths that anything other than both sides have been spending through the campaign.”

He said both parties needed to heed warnings from credit rating agencies. “There isn’t much difference between the fiscal outlooks based on the policies of Labor and the Coalition,” he said. “I don’t see this as being a pointed comment by S&P that would favour one side or the other. Both sides need more sustainable fiscal policies.

“If the fiscal outlook doesn’t improve through genuine fiscal reform, then eventually the increase in our debt to GDP will see Australia downgraded. Market pricing will change gradually as a downgrade becomes likely.”

AMP chief economist Shane Oliver said the government was relying on revenue upgrades from strong commodity prices rather than good fiscal management.

The Australian revealed on Monday Mr Albanese had emerged as the big spender Mr Shorten was proposing to be at the 2019 election, the main difference being the former Labor leader outlined revenue measures to pay for his policies and had plans to run surpluses. The Prime Minister has ruled out negative gearing and franking credits reforms if he is re-elected but is nonetheless implementing much of Mr Shorten’s spending agenda that was supposed to be funded by the tax increases taken to the 2019 election.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout