Election 2025: Anthony Albanese is going all Biden-lite this election with this awful unrealised capital gains tax

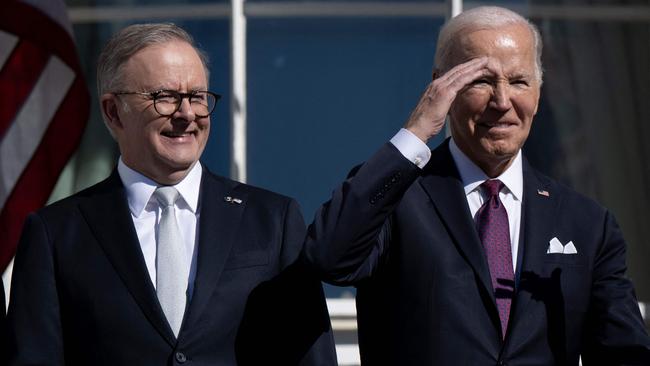

Much is made of Peter Dutton being “Trump-lite” in this election campaign, but given Anthony Albanese’s policies, it’s fair to say he could easily be construed as Joe Biden-lite.

From reducing billions of dollars in student debt at the expense of taxpayers to having immigration hit record highs, the policies are all too familiar.

Of all the Biden policies that Albanese shares, the worst is unrealised capital gains tax.

So unpopular was it that Democrat blue bloods pleaded for Biden and his replacement Kamala Harris to drop it.

Paul Keating is probably telling Jim Chalmers to do the same.

Biden committed to a 25 per cent minimum tax on unrealised gains.

Albanese wants 30 per cent.

Democrats tried the Trojan horse-style approach, wanting to levy it on the wealthiest 0.01 per cent of Americans to convince people it would only be a rich person’s tax.

Similarly, Albanese wants to introduce it to superannuation fund accounts worth $3 million.

Americans didn’t buy it. They know that introducing such a tax wouldn’t take long to spread to people of lower wealth and other structures and assets.

Will Australians buy it?

The independent Parliamentary Budget Office figures show such a tax would bring in $40 billion for the government – starting off at $300 million in the first year and suddenly taking in $7 billion per year within the first 10 years.

If Chalmers doesn’t get the support from the Greens for the introduction of this tax then that's a blow to his budget just at a time when S&P warns about Australia needing to clean up its fiscal management or risk a credit downgrade.

Unrealised capital gains tax is actually simple to understand.

Say you have $100,000 in Commonwealth Bank shares. This year the bank’s stock price has gone up 7.3 per cent. If you don’t sell those shares then you have made an unrealised capital gain of $7300. Now pay $2190 of that or 30 per cent to the government.

Don’t have the cash? Bad luck. Sell something.

Now say you bought $10,000 worth of Bitcoin. Bitcoin is up 53 per cent in the past year.

You don’t sell Bitcoin, but have still made an unrealised capital gain of $5300. You now have to pay the Australian Taxation Office $1590. Don’t have the cash? Bad luck.

Troy Harry, a wealthy Brisbane-based investor, says that he had made an investment through his superannuation fund in a risky but important private start-up company that couldn’t get funding from a bank or an industry super fund.

The company has made a gain, but Harry doesn’t have the money to pay the unrealised capital gains tax on it.

He says that means he will have to sell, but he is the major shareholder in that company and doing a forced sale will lower the share price.

That’s not good for the company or the shareholders.

What about really low risk? Got a family farm worth $1 million? Value goes up 4 per cent in a year. Even if you haven’t sold, you now owe the government 30 per cent of $40,000. So $12,000. Don’t have the cash? Bad luck.

And if the value goes down? Well don’t even think about a reimbursement of the tax you have already paid.

Business leaders such as CSL chairman Brian McNamee have made an unprecedented intervention in this election campaign to knock Labor’s plans for unrealised capital gains tax, saying that it doesn’t matter who or at what level you introduce such a tax, it’s the tax itself that is so dangerous.

McNamee knew that voicing his opinion in the middle of an election campaign would be far more powerful than raising it during the debate two years ago.

Chalmers thought announcing it two years ago meant it wouldn’t be debated in a federal election campaign.

Voters with strong business acumen and connections to the average punter, such as Sydney Swans chairman Andrew Pridham and Brisbane Broncos chairman Karl Morris, say it's a debate well worth having to remind people of the risk.

Two years after Biden announced his plan for unrealised capital gains tax, Mark Cuban, the Democrat owner of basketball team Dallas Mavericks, pleaded to Biden and Harris in last year’s US election campaign not to introduce it.

They never got the chance.

A Biden-lite Albanese now waits to see if Australians will deliver the same judgment.