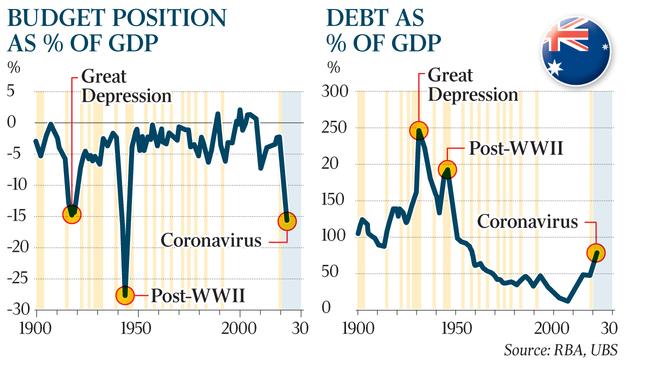

Coronavirus: Trillion-dollar debt to rival post-WWII years

COVID-19 will force the federal and state governments into their highest levels of debt since the post-World War II years.

The COVID-19 pandemic will force the federal and state governments into their highest levels of debt since the post-World War II years, with expensive stimulus measures and a plunge in tax receipts to push public debt to $1.5 trillion next year.

Servicing the debt could also push future governments to consider new and radical options, with a range of suggestions canvassed on Tuesday by experts, including a renegotiation of the GST, an overhaul of the tax and industrial relations systems and diluting of superannuation concessions.

UBS chief economist George Tharenou said debt across governments would increase by $500bn by the end of next year — the equivalent of 80 per cent of gross domestic product — pushing it to levels not seen since the 1950s.

Mr Tharenou expected combined state and federal budget deficits in the 2021 financial year to reach 16 per cent of GDP — the highest since World War II.

“These levels are unprecedented for Australia but other countries have been there for decades,” Mr Tharenou said.

The Institute of Public Affairs and the Grattan Institute said commonwealth gross debt could nearly double in the next three years to reach $1 trillion, while UTS Business School economist Warren Hogan doubted any federal treasurer would deliver a budget surplus for a quarter of a century. He predicted Josh Frydenberg would deliver budget deficits of $300bn in the next two financial years.

The Treasurer, who delayed the May budget until October, in December forecast an $11bn surplus over the next two budgets.

“This is generational, we’re looking at 25 to 30 years to get back to surplus,” Mr Hogan said.

Even factoring in the federal government’s massive $130bn wage subsidy plan, economists expect the economy to shrink by about 10 per cent in the second quarter and unemployment to climb as high as 10 per cent or more, before rebounding sometime later this year when the coronavirus is contained.

KPMG chief economist Brendan Rynne said about a quarter of the $700bn in expected company and income tax receipts over the next two years could evaporate.

“The revenue impact could be roughly the same as the increase in costs,” he told The Australian.

Dr Rynne said restoring the budget to balance would be “tomorrow’s problem”. “On the basis that you apply an incremental tax at a rate that balances payback and economic growth, the likely timeframe is going to be a couple of decades,” Dr Rynne said.

Moody’s Investors’ Marie Diron said Australia could maintain its AAA credit rating if the economic slump was temporary.

Moodys has rated Australia since 2003, with Ms Diron telling The Australian: “As far as Australia is concerned, it has capacity to absorb a temporary shock. So as long as we’re not seeing long permanent impacts, then the rating is likely to remain AAA.

“On the fiscal side, there will be worsening of the metrics, but as long as companies remain open and people remain employed — and so far that’s our assumption — we think the economy can ride through this difficult patch.”

The huge fiscal cost of the pandemic is leading to early debates about how to handle the recovery, with calls for tax and industrial relations reforms to encourage economic growth.

Institute of Public Affairs executive director John Roskam said “we could see $1 trillion of debt within three years”, with the interest payments alone costing every Australian $900 a year.

Total gross debt going into the crisis was about $550bn.

“If we are ever going to repay this, we have got to be a lot more productive than we have been in the last 10 years. Business as usual will mean that we will never pay back the debt. This is Australia’s banana republic moment times 10. The unprecedented level of debt means we are going to have to tackle red tape,” Mr Roskam said.

“In the medium term, tax reductions are going to have to be part of the recovery plan, industrial relations reform is going to be part of the recovery plan, and … the GST deal with the state has to be renegotiated.”

Grattan Institute chief executive Danielle Wood said governments should close tax loopholes to help pay off the massive debt burden. She said superannuation concessions should be reviewed, and urged the consideration of land and inheritance taxes.

“Inheritance taxes are among the most efficient taxes and in a world where we are talking about how we share the burden … maybe, just maybe, that could be part of the conversation,” Ms Wood said.

She said fiscal consolidation should occur gradually.

“We should not be trying to pay the debt down too aggressively too early. This is a once in a generation if not a once in a century economic shock,” Ms Wood said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout