Homeownership getting harder from the typical Australian family

Only two in 10 homes nationally are affordable for the typical family, according to new analysis by housing researcher PropTrack. | SEARCH YOUR SUBURB

The dream of owning a home is further slipping from the grasp of the average Australian family, with buyers being met with slim pickings at the affordable end of the market.

New analysis by housing researcher PropTrack for its Affordability Hotspots Report found fewer than two in 10 homes sold nationally in the past nine months were affordable for median Australian household. In every urban area outside Darwin, fewer than a quarter of sales were affordable for the median household, with Melbourne City coming in highest at 24 per cent.

Only 40 out of 327 regions analysed recorded a quarter or more sales that were affordable.

Stagnant wage growth, continually climbing property prices and the highest interest rates in a generation has made it significantly harder to crack the market than it was a generation ago.

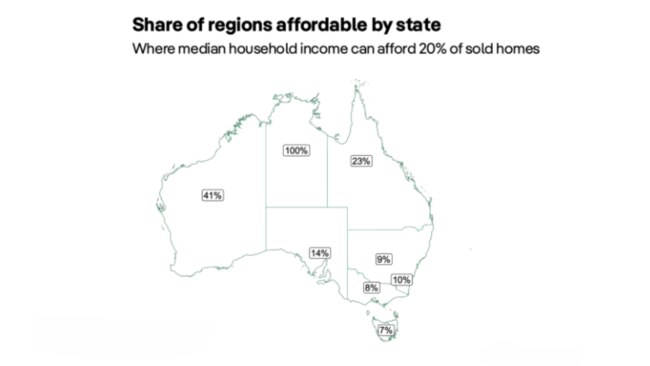

The states offering the best affordability were Western Australia and Queensland, where 41 per cent and 23 per cent respectively of recent sales were deemed affordable, which means no more than a quarter of the median household’s pre-tax income is being dedicated to the mortgage.

That drops to just 14 per cent of homes in South Australia and fewer than one in 10 in NSW, Melbourne and Tasmania.

All homes in the Northern Territory sold over the period were deemed affordable, but just 10 per cent in the ACT. While half of homes were affordable for the typical family in 1990s, PropTrack senior economist Paul Ryan said it has increasingly becoming the case that buyers – be they first-time owners or upgraders – need to be high-income earners or have a leg-up from parents.

“It shows that you need one of two things to crack into the market and this isn’t a surprise: it’s either higher incomes … or it’s bringing some wealth to the table,” Mr Ryan said.

“That’s not new news, but it is something that’s changed. It was the case in the late 1990s that for a median-income earner across the country, you could afford about 50 per cent. We’ve seen this rapid shift.”

In Sydney, the country’s most expensive city, only 3.8 per cent of homes sold in the past nine months were in range for the average family. Apartment-abundant Parramatta offered the best bang for buck, followed by southwest Canterbury and Liverpool, and the western outcrops of Mt Druitt and Auburn.

While the number was almost double (7.1 per cent) in Melbourne, buyers had limited options. Units also made the capital’s CBD were the most attainable for local buyers, with Melton and Tullamarine in the west the best options.

Buyers agent Jay Anderson said second-time buyers were still finding affordability a challenge when springboarding from their units.

“Australians never really think of units as their forever home,” Mr Anderson said.

“It’s always a stepping stone. They say, ‘we’ll buy an apartment because it’s the affordable until we get more money’. It’s almost like this transitional housing.”

Property prices are still climbing nationally, despite already surging 40 per cent over the past four years. The most significant increases have been felt in the smaller capitals, with Logan and Ipswich, southwest of Brisbane, and Perth’s southeastern suburbs topping the national affordability charts.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout