High income families caught up in stage three tax cut debate still face mortgage stress

Australians banking on budget relief through tax cuts will be left disappointed with new data revealing families must have a take-home income over $150,000 to be able to comfortably live in a median home.

Hundreds of thousands of Australians facing tax increases under the Albanese government’s income tax plan are unable to own a house without coming under financial stress, new data reveals.

Analysis from housing data firm PropTrack has revealed Sydney families must make at least $200,000 after-tax to comfortably service the loan on a median property worth $1.025m without falling into mortgage stress.

Mortgaged households must have a take-home pay of around $150,000 in Melbourne and Canberra, where housing prices have now eclipsed $760,000.

Families in all capital cities except Darwin need to make six-digit after-tax incomes to avoid home loan stress.

CoreLogic’s director of research, Tim Lawless, said it is farcical to think higher-income households are immune to cost-of-living pressures.

“It’s an absolute fallacy that mortgage stress wouldn’t be impactful in high-income households,” he said.

“Most households will be feeling the cost of mortgage pressures quite significantly given how much interest rates have risen and the level of household debt we have in Australia, which is mostly dominated by housing debt.”

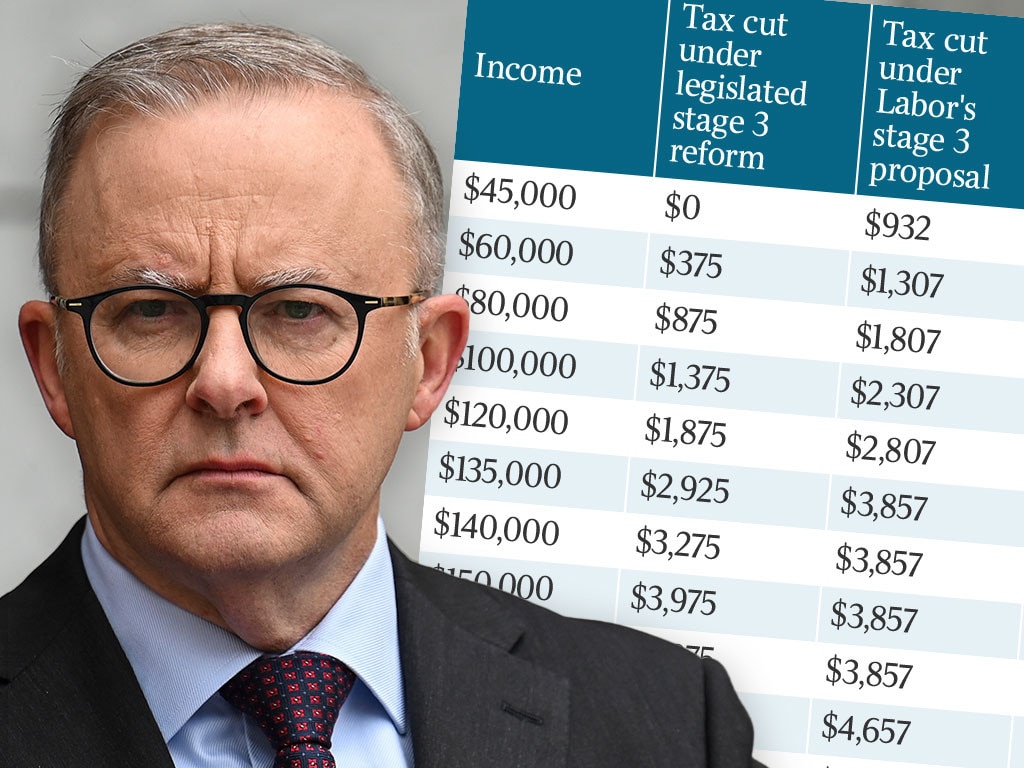

Higher-income households initially stood to have around $9,000 each year returned to their pockets through stage three income tax cuts. However, this now stands to be reduced for those earning more than $150,000 as the Albanese Government looks to change the policy in light of the global economy.

PropTrack executive director of research, Cameron Kusher, said the conservative figures reflect the ever-increasing housing costs require higher incomes to make loan repayments.

“The cost of housing in our major capital cities is so high, it does make it very tough for anyone, but particularly people earning less than, say, $150,000 a year to enter into the housing market without some sort of assistance,” he said.

But the most significant relief for households won’t solely come from tax relief, Mr Lawless said, with a fall in interest likely to offer stressed families more help.

PropTrack’s housing outlook suggests property prices may lift one per cent to four per cent nationally over 2024. However, the surprise tax change had not been factored in and may lead to softer-than-expected conditions.

“Our thinking when we were forecasting prices for 2024 was from mid-year, higher income households were going to get quite a significant reduction in how much tax they had to pay,” Mr Kusher said.

“We thought that for higher income households, putting more money in their pockets would increase their borrowing capacity and potentially drive more housing transactions and maybe even some stronger price growth at that top end of the housing market.”

On the rental side, families needed to earn at least $100,000 in more than half of Australia’s capitals – Sydney, Brisbane, Perth, Canberra and Darwin – to live comfortably.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout