Gas and coal exports set to plunge

The value of resources and energy exports is expected to drop by more than $100 billion in the next two years as the global prices of coal and gas drop to pre Ukraine war levels.

The value of resources and energy exports is expected to drop by more than $100bn in the next two years as the global prices of coal and gas fall to pre-Ukraine war levels.

A government report released on Monday shows energy and resources exports hit a record $460bn last financial year, as the fallout from Russia’s invasion of Ukraine sent gas and coal prices soaring.

However, the value of exports in the sector is forecast to plunge to $390bn this financial year and $344bn in 2024-25.

The Resources and Energy Quarterly report predicts LNG export earnings will to drop by $24bn to $68bn this financial year, then fall by an extra $8bn in 2024-25.

The value of thermal coal exports is expected to fall by more than 50 per cent in the next two years, from $64bn last financial year to $30bn in 2024-25.

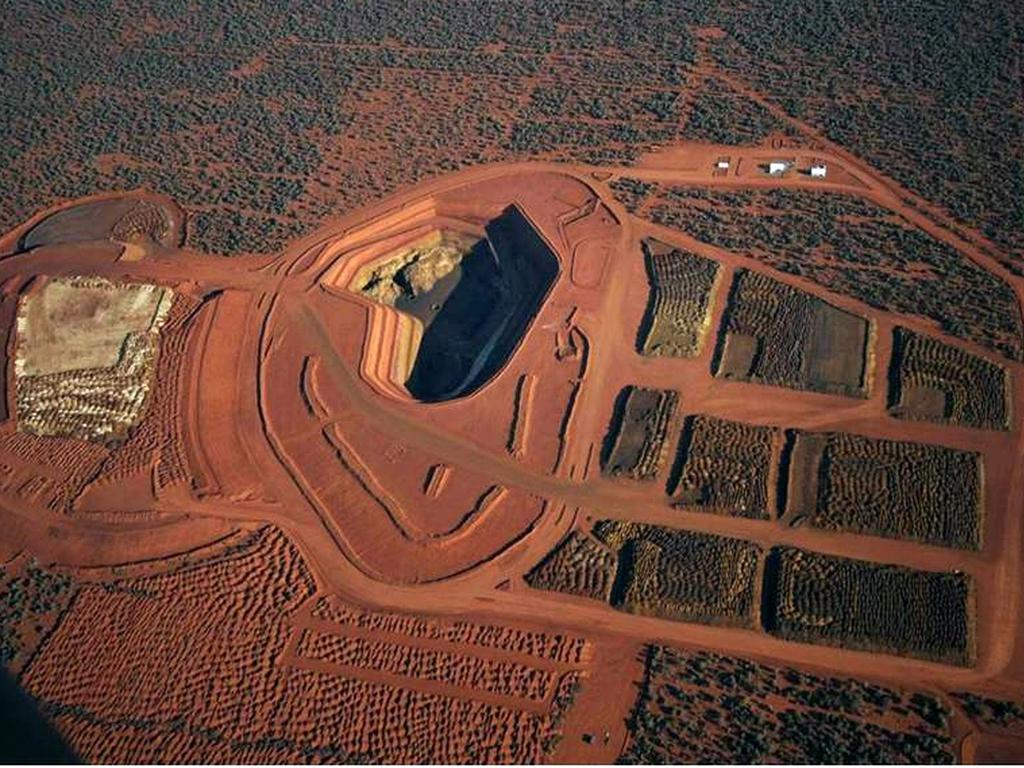

Iron ore export earnings are set to decline from $123bn last financial year to $93bn in 2024-25, while metallurgical coal exports are likely to fall from $60bn in 2022-23 to $42bn in 2024-25.

Slower global economic growth is impacting the outlook for gas, coal and iron ore.

“The key trend remains a slowing in the global economy. The rebound in Chinese economic activity post-Covid has been weaker than expected,” the report says. “The impact of higher interest rates in major Western economies is slowing growth, and persistent inflation continues to pose a risk of further monetary tightening.”

The plunge of coal, gas and iron ore prices will have implications for the federal government, which is on track to deliver a $20bn budget surplus on the back of soaring commodity prices.

However, the report says the outlook for “metals used heavily in the energy transition” remains steady with an export value of over $40bn.

The value of lithium exports nearly quadrupled in 2022-23 to more than $19bn.

Uranium prices are forecast to increase from $780m last financial year to $900m in 2024-25 as Australia’s trading partners increase their production of nuclear energy to lower emissions.

This is despite the federal government backing a ban on nuclear energy in Australia.

Resources Minister Madeleine King said the report showcased the need for the government to support the critical minerals sector and “help Australia and our trading partners meet commitments to lower emissions”. She said Australia had “abundant supplies” of minerals needed to build low-emission technologies, including lithium, cobalt, nickel, manganese and graphite.

“The road to net zero runs through the resources sector,” Ms King said. “Australia is well positioned to supply long-term demand for base metals and critical minerals such as lithium, which are crucial components of clean-energy technologies such as batteries, solar panels and wind turbines.”

Thermal coal exports to China are “picking up strongly” but are not at the levels reached in 2019-20 before Beijing imposed trade restrictions. “Chinese buying adds significant competitive pressure to the market for Australian thermal and metallurgical coal, offsetting some of the impact on prices of weaker world economic growth and/or lower energy demand,” the report says.

The report says Australia could benefit from incentives provided for low emission technologies under the US Inflation Reduction Act.

“With high critical mineral reserves, Australia is well placed to benefit from the IRA and other US incentives, and from the increased focus on supply chain security in the current geopolitical climate,” it says.

In a speech at the World Mining Congress in Brisbane last week, Jim Chalmers praised miners for helping to deliver the nation’s first surplus in 15 years.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout