Feeble global economy and high mortgage rates to slow Australia’s growth rate

Jim Chalmers says Australia is not immune from the fallout of a teetering world economy as he shapes his second budget.

Escalating mortgage repayments raise the risk of Australian home loan defaults, the International Monetary Fund has warned, as global frailties are set to shave $10bn off the value of the local economy this year.

The IMF’s World Economic Outlook said the level of default risk in Australia’s housing market is the second-highest in the developed world, after Canada, because of sky-high house prices, high household debt and rising variable mortgage rates.

Jim Chalmers said the IMF’s “gloomy forecasts” and troubling developments in the global economy would be a “defining influence” in calibrating the settings of his second budget, to be delivered on May 9, which will include modest cost-of-living relief for families.

While last week’s pause at 3.6 per cent by the Reserve Bank, after 10 straight rises in its cash rate target, has given borrowers hope that the brutal tightening cycle is over, the IMF report is a grim reminder of the vulnerabilities in Australia’s housing market.

“Economies with high levels of household debt and a large share of debt issued at floating rates are more exposed to higher mortgage payments, with a greater risk of experiencing a wave of defaults,” the IMF said.

RBA governor Philip Lowe has said one of the reasons for the rates pause was the high incidence of variable rate mortgages.

Dr Lowe told the National Press Club last week that since last May, the average mortgage rate Australians pay had increased more quickly than in other countries.

Required loan repayments will reach a new record high of almost 10 per cent of household disposable income by the end of 2024.

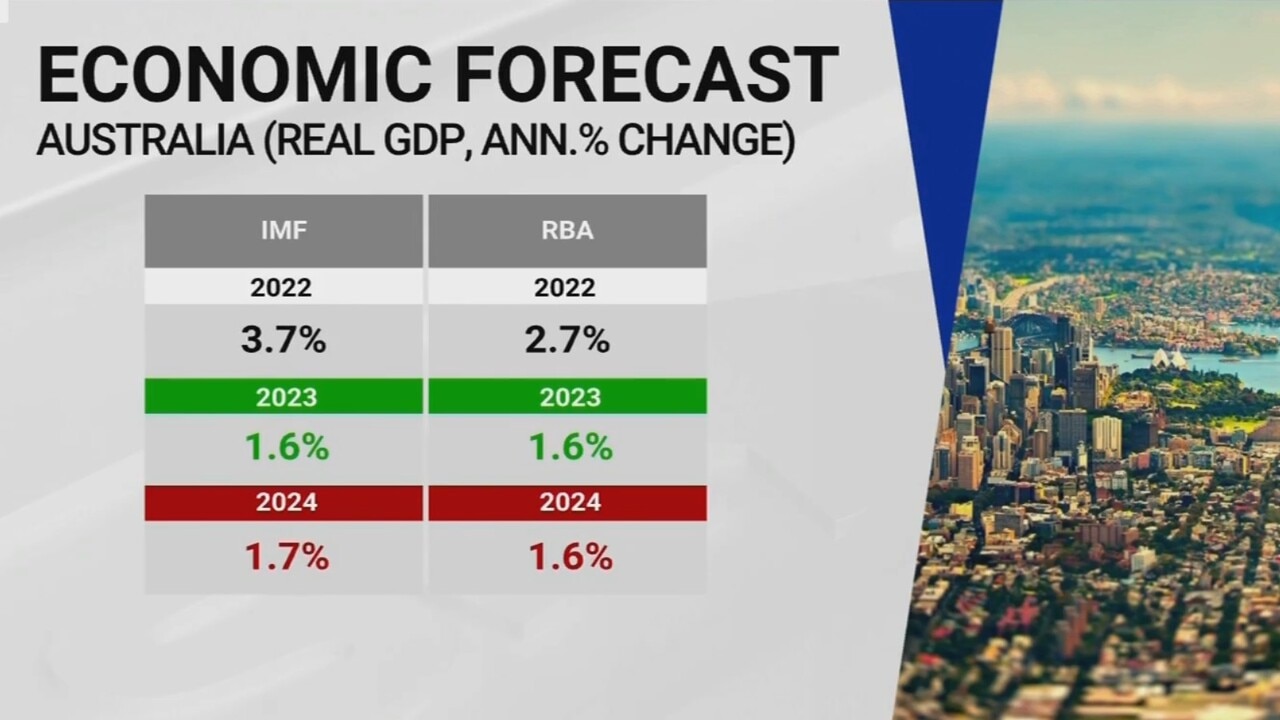

Before flying to Washington on Wednesday for meetings with G20 counterparts and high-level briefings, Dr Chalmers played down the prospect of a local recession, after the IMF trimmed Australia’s expected increase in gross domestic product to 1.6 per cent this year.

In October, Treasury had forecast growth of 2 per cent for this calendar year, a difference of $10bn in national output.

The Treasurer said the Albanese government recognised “people were under the pump”, as he revealed Treasury was factoring in a substantial slowdown in activity over coming months.

Dr Chalmers said Treasury and the RBA were not currently forecasting a recession here, as the IMF said “the world was entering a perilous phase”.

“Treasury expects our own economy to slow considerably later this year because of that combination of a slowing global economy and the impact of higher interest rates here at home,” Dr Chalmers told ABC Radio National Breakfast.

“We are in the home stretch now when it comes to putting this budget together and because the global economy will be a defining influence on that budget, getting those understandings right is absolutely crucial to landing it.”

Treasury secretary Steven Kennedy, who is accompanying Dr Chalmers to the US capital, has said a surprise population boom, which The Australian reported as 650,000 more migrants over the two years to June next year, would help to raise the level of growth.

Dr Chalmers, who will meet US Treasury secretary Janet Yellen and key officials, said higher interest rates had exposed vulnerabilities in parts of the global banking system, “adding to the challenges of persistent inflation, slowing global growth and the ongoing impacts of the war in Ukraine”.

“The IMF has forecast the worst five years of growth in more than three decades, confirming in its latest report released overnight that economic headwinds are worsening,” he said.

“Global conditions have become more complex and confronting than they were even a few months ago and Australia is not immune to these challenges.”

While conceding the budget had a structural problem that could not be ignored, the Treasurer effectively rejected a suite of contentious proposals by the Grattan Institute to fix a chronic $50bn annual deficit.

Those measures included undoing Western Australia’s $5bn a year GST bonus, lifting the GST rate from 10 to 15 per cent, rejigging the stage three tax cuts and raising more revenue from retirees, high earners and investors.

Dr Chalmers said there was some “common ground”, with Treasury working on a proposal to improve the Petroleum Resource Rent Tax on gas, one of the institute’s suggestions.

As well, he pointed to “modest but meaningful changes” in the works for superannuation tax breaks.

“I think the overall point that the Grattan Institute’s making in that report is that we do have a structural issue in the budget,” the Treasurer said.

“Even as the budget gets a bit better in the near-term because of high commodity prices and low unemployment, we’ve got structural challenges that come from the cost of servicing that trillion dollars in Liberal debt combined with the NDIS and aged care and health care and national security.

“All of these costs are putting pressure on the budget. There is a structural problem and we need to deal with it.”

Dr Chalmers has said the revenue boost from higher commodity prices in May’s budget is unlikely to be as big as it was in October, but the government would be “banking most of the upward revisions that we see in the near-term”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout