Fee bonanza may prompt rethink of the superannuation guarantee

Funds will benefit from a fee bonanza worth up to $270m a year when the super guarantee reaches 12 per cent in 2026.

Superannuation funds will benefit from a fee bonanza worth up to $270m a year by the time the superannuation guarantee reaches 12 per cent in 2026, according to analysis that backs calls for a rethink of the plan.

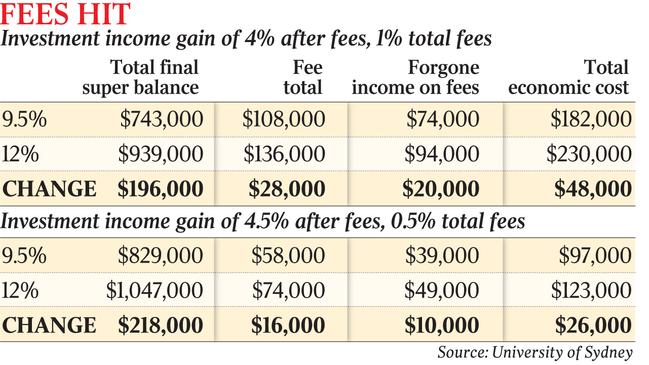

The forecasts, authored by University of Sydney economist Cameron Murray, estimates a typical worker would pay an extra $28,000 in fees across their four-decade working life.

The super guarantee — the proportion of wages that must be contributed to retirement savings — is legislated to rise gradually from 9.5 per cent to 12 per cent by 2025, but the pandemic has sharpened opposition to the rise, with Reserve Bank governor Philip Lowe warning it would lower wage growth and lead to fewer jobs.

Others, including former Treasury secretary Ken Henry, have urged the Morrison government not to change course.

Dr Murray, who is highly critical of the planned increase, said even if funds lowered their charges and improved returns, some workers still would lose an extra $16,000 to fees.

He estimated that the legislated increase would divert $76bn in wages into super funds between next year and 2026, assuming they increased about 4 per cent a year.

But Grattan Institute estimates provided to The Australian suggested annual fees would rise by only $150m by 2025, although they would “grow rapidly over time”.

“Cancelling the scheduled increases in compulsory super would cost the industry around $500m in forgone superannuation fee revenue by 2025,” Grattan Institute researcher Brendan Coates said.

Fees charged by super funds vary widely, according to official data compiled by the Australian Prudential Regulation Authority — from 1.6 per cent for the most expensive products to below 1 per cent for others.

Bernie Deane, chief executive for Industry Super Australia, which opposes any change to the legislation, said drawing links between rising superannuation contributions and fees ignored the “gouging taking place in the retail sector”.

“Industry funds are leading the way on net returns and low fees, and the Productivity Commission’s evidence base in its report shows that,” he told The Australian.

The Productivity Commission, in a report released last year, found average fees at retail funds — which held around $591bn in assets in June — had average fees almost double that of industry funds, which held $748bn.

“Annual fees exceed 1.5 per cent of balances for an estimated 4 million member accounts (holding about $275bn),” the report says. “Almost all of these accounts are in choice products offered by retail funds.”

But Dr Murray said the superannuation system was “one of the most economically inefficient ways to support retirement incomes”. “Raising compulsory contributions will only add to these costs, creating even more jobs for fund managers who pay themselves from our retirement savings,” he said.

Dr Murray said the superannuation sector employed 55,000 people, extracted about $34bn in fees in total, and was “unbelievably expensive”.

According to fund analytics service SuperRatings, the most expensive funds for default accounts with a $50,000 balance charge about 1.55 per cent in fees — including administrative charges and investment management costs. The median fee was 1.2 per cent, or about $601.

While Dr Murray estimated the legislated increase would divert $76bn in wages to super funds by 2026, the Grattan Institute modelling instead suggested the prospective diversion was closer to $40bn. This is because it assumes 20 per cent of the increase in super would be borne by employers rather than workers.

“It’s still a huge drain on households’ spending power as we climb back out of recession,” Mr Coates said. “By the time it is fully implemented in 2025-26, a 12 per cent super guarantee will see up to an extra $20bn channelled into compulsory superannuation each year, or close to 1 per cent of Australia’s gross domestic product.”

He said the “danger of lifting superannuation during a recession is workers will lose their jobs”.

Two-thirds of economists surveyed by the Economic Society of Australia — including RBA board member Ian Harper — have advised against lifting the contribution rate.

Despite possible lower wage growth and the possibility of being “ripped off by fees”, Mark Wilkinson, 25, is hopeful the increase will mean a more comfortable retirement.

“I don’t think I’ll notice that increase in my pay cheque, but at the same time I’m sure it’s going to have a huge pay-off when I’m older,” Mr Wilkinson said.

Liberal MPs including Tim Wilson, Andrew Bragg and Dave Sharma are pushing for the government to scrap the increase — a suggestion that comes as Josh Frydenberg mulls the final report of an retirement income review.

While the Treasurer is expected to outline details before next month’s budget, Superannuation Minister Jane Hume has suggested she is “ambivalent” about the increase.

But former Labor prime ministers Paul Keating, the architect of compulsory super, and Kevin Rudd last week blasted moves to defer or stop the increase.

Mr Rudd described suggestions the compulsory super increase would come at the expense of wages — a position advanced by the Grattan Institute and Dr Lowe — as “the biggest bullshit argument I have ever heard”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout