Easing of restrictions sparks record home loan surge

New home lending gathered momentum in July, with owner-occupier borrowing recording its largest monthly increase in data stretching back to 2002.

New home lending gathered momentum in July, with owner-occupier borrowing recording its largest monthly increase in data stretching back to 2002, even as economists warned the rise would prove a “last hurrah” before the impact of the Victorian lockdowns took effect.

Housing loan commitments, excluding refinancing, jumped by 8.9 per cent to $18.9bn, seasonally adjusted figures from the Australian Bureau of Statistics show, after rebounding by 6.4 per cent in June amid the initial phases of the national reopening.

Despite the recovery in borrowing levels over the two months, new lending levels are yet to recuperate from the 16 per cent plunge through April and May, although they are just 3 per cent below the $19.5bn in March.

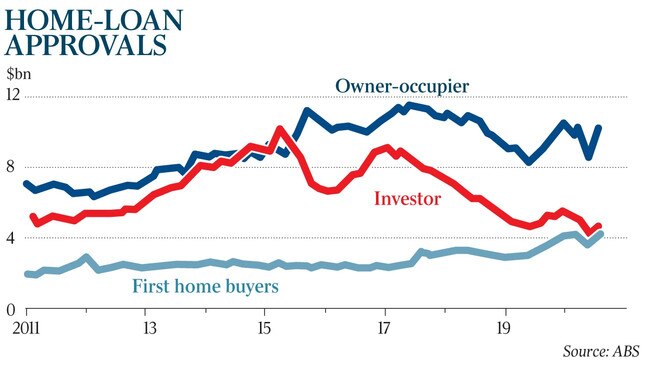

The value of new loan commitments for owner-occupier housing soared by 10.7 per cent to $14.3bn — the biggest increase on record — while investor housing rose 3.5 per cent to $4.6bn, the ABS report shows

The number — rather than value — of owner-occupier first homebuyer loan commitments jumped 14.4 per cent.

The value of owner-occupier new lending commitments in July was only 0.7 per cent below pre-COVID-19 levels, while investor lending — already trending lower leading into the pandemic — remained closer to 10 per cent below its February level.

New loan commitments for owner-occupiers — those who intended to live in the property — rose across all states and territories, except the ACT. The biggest increases were recorded in NSW (up 12.1 per cent), Queensland (up 11.3 per cent) and Victoria (an increase of 8.9 per cent).

But ANZ economist Adelaide Timbrell warned that the record growth was “by no means the start of a trend”.

“Rather, it is more likely a last hurrah before stage four lockdowns in Melbourne hit households’ ability and confidence to borrow,” Ms Timbrell said.

Westpac economist Matthew Hassan agreed Victoria’s hard lockdown would “clearly see a renewed hit in coming months”, but said he expected “activity in other states is likely to hold up well”.

The ABS data shows personal loan commitments increased by 6.9 per cent to $1.6bn, to remain about 10 per cent below their pre-COVID-19 levels.

Lending to small and medium-sized businesses fell in original terms, after rising in June as tradies took advantage of end-of-financial-year tax incentives.

With the jobless rate tipped to push towards 10 per cent by the end of this year, the pandemic and associated recession are expected to weigh on house prices in coming months, which could further weigh on borrowing activity.

New forecasts from CBA suggest house prices across the eight capital cities will drop by 5.1 per cent over the year to June 2021, led by a 10 per cent drop in Melbourne. Sydney property values are tipped to fall by 4.9 per cent, with a 2.5 per cent loss in Brisbane house prices the next biggest expected fall. In contrast, CBA predicts Canberra house prices will rise by 2.3 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout