Costs hike looms as war sparks oil shock

Motorists could soon pay $2.15 a litre for unleaded petrol, pushing up costs on items ranging ‘from Weet-Bix to caviar’ as the Ukraine conflict forces a rise in global oil prices.

Australian motorists could soon pay $2.15 a litre for unleaded petrol, pushing up costs on items ranging “from Weet-Bix to caviar” as the Ukraine conflict forces a rise in global oil prices.

US Secretary of State Antony Blinken’s moves to ban imports of Russian oil caused a surge in global oil prices on Monday, taking the price in Australian dollars to a record.

“We are now talking to our European partners and allies to look, in a co-ordinated way, at the prospect of banning the import of Russian oil,” Mr Blinken said.

Business groups warned that the higher oil prices would force transport companies to pass on higher costs, which in turn would drive higher prices for consumers and lift inflation.

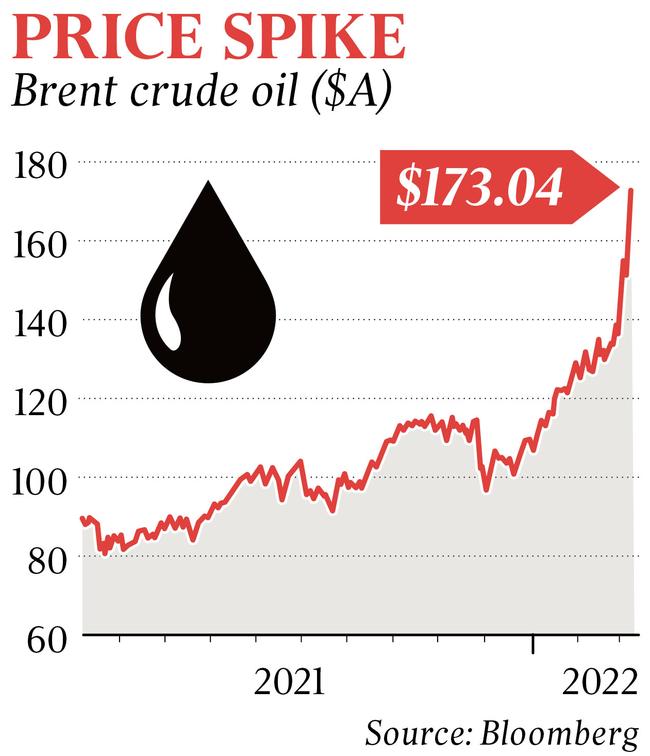

Over the past two weeks, Brent crude oil in Australian dollar terms has surged by $40 a barrel to a record $173 a barrel – an increase of 30 per cent. CBA commodity analyst Vivek Dhar said that suggested motorists should be prepared to pay at least $2.15 a litre in the near future.

The spike in oil prices sparked a sell off in Asian markets and a 1 per cent fall in the ASX S&P200. Travel stocks fell sharply, with Qantas down 7.9 per cent and Flight Centre dropping 4.2 per cent, while Woodside Petroleum rose 11 per cent.

Reserve Bank governor Philip Lowe last week warned that soaring energy costs as a result of the Ukraine war would cause inflation to “spike higher” than forecast.

Damage to farms and infrastructure in northern NSW and southeast Queensland as a result of the massive floods could also add to fresh food prices.

Dr Lowe is expected to speak more on the central bank’s view of climbing price pressures in a speech on Wednesday morning.

Economists said spending on petrol represented about 3 per cent of the average household budget, suggesting the impact of unprecedented petrol prices would have a more psychological, than financial, impact – particularly in the context of the more than $200bn in additional savings accumulated during the pandemic. However, lower-income families, who typically spend a larger proportion of their salaries on essentials, would be harder hit.

RBC Capital chief economist Su-Lin Ong said: “Petrol prices are particularly visible for consumers and will add to already rising inflationary expectations.”

AMP Capital chief economist Shane Oliver said: “The problem the central bank faces is the longer it (high inflation) goes on for, the harder it will be to get under control. The risk is it gets into expectations, and then leads to a wage-price spiral.”

Australian Logistics Council chief executive Brad Williams said higher global oil prices were having an impact on freight and logistics costs across the supply chain. Most businesses in his industry operated with low margins and had limited ability to absorb significant price increases.

“Unless market conditions change, it is likely these higher fuel prices will start to be reflected in the cost of transporting goods,” Mr Williams said.

Changes in international prices can take about two weeks to work their way through the supply chain in Australian cities, and longer in regional areas, according to the Australian Competition and Consumer Commission.

Ai Group chief executive Innes Willox said higher fuel costs had added to the cost pressures being experienced by large parts of the economy. Mr Willox said businesses operating in the mining, logistics, agriculture and construction sectors would be particularly affected.

South Australian Road Transport Association executive officer Steve Shearer said truckies faced a severe cash crunch as diesel costs ballooned. Mr Shearer, a 28-year industry veteran, said suppliers were already warning their customers that diesel petrol prices would be increasing by 20-40c a litre.

With trucks only getting about 1km for every litre of fuel, operators were facing major hits to their bottom line from a 2500km trip from Adelaide to Perth, Mr Shearer said.

“The trucking industry cannot absorb those increases,” he said. “Our very tight margins are already well and truly stretched because of the recent (fuel price) increases.”

A medium-sized business operating 30 trucks had already seen diesel prices jumping from $1.32 per litre in August, to $1.68 now, Mr Shearer said.

“The cost will have to be passed on, and we need everybody from the end customer to the companies to the prime contractors to be reasonable and just accept that reality and ensure people get paid adequately to cover the cost of that fuel increase,” he said.

“That way, at the end of the day, it gets spread out to a much smaller increase across the board, from Weet-Bix to caviar.”

Mr Dhar said that based on international developments, a litre of unleaded petrol would “definitely be north of two dollars” soon.

“We’re finally getting to the gritty end of all this now, talking about a potential embargo on Russian oil,” Mr Dhar said.

He said the oil price had quickly blown past overly conservative forecasts over the past two weeks and it was “plausible” that a barrel of Brent crude could reach $US150, based on a precedent of the previous peak of $US146 around 2007-08.

In Aussie dollar terms, that pointed to a price of more than $200 a barrel, which could push petrol towards $2.40 a litre.