Beijing raises tariffs on US to 125 per cent but declares no further hikes

China has hiked tariffs on America to 125 per cent but declared it would not lift them further, ending Beijing’s tit-for-tat response with Washington even as the world’s two biggest economies look for fresh ways to harm each other.

China has increased tariffs on US imports to 125 per cent and declared it would not lift them further, ending Beijing’s tit-for-tat response with Washington even as the world’s two biggest economies look for fresh ways to harm each other.

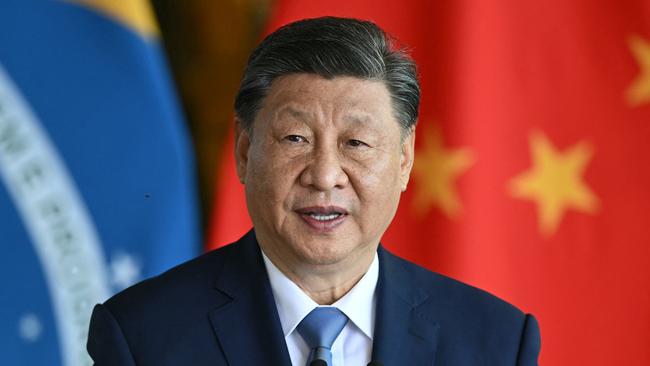

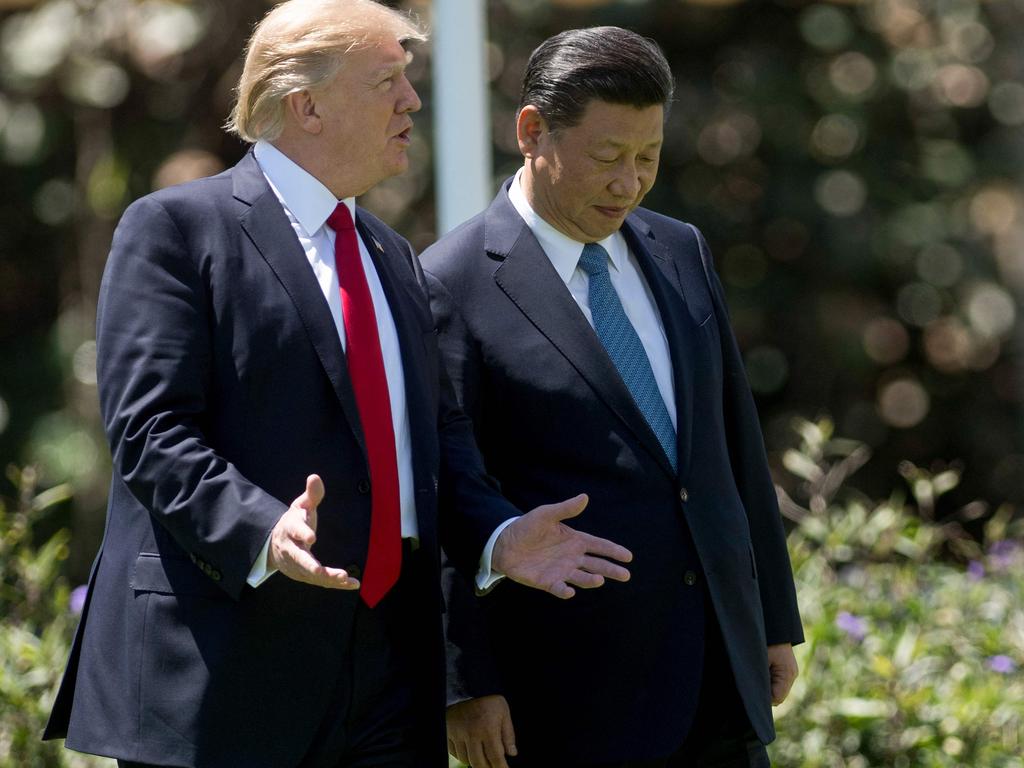

Late on Friday, Beijing raised tariffs on US goods from 84 per cent to 125 cent starting on April 12, while saying it would ignore any further increases announced by Washington. The new level remains slightly below the 145 per cent the US set on China after days of counterpunches between Xi Jinping and Donald Trump.

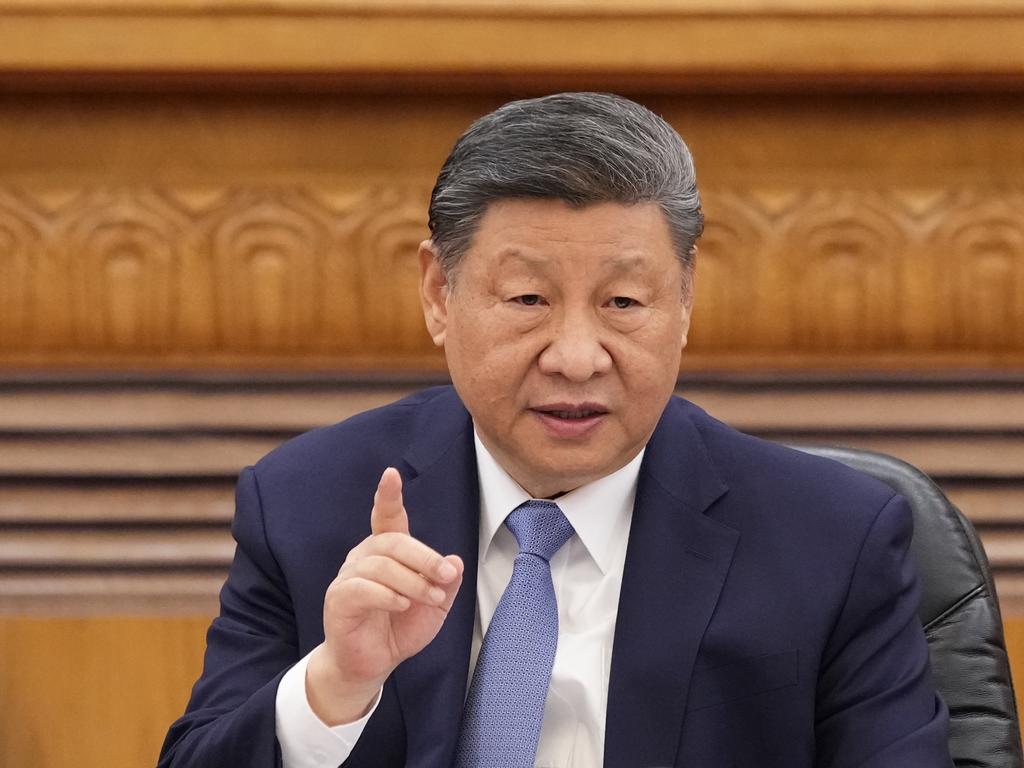

“Given that there is no longer any possibility of market acceptance for US goods exported to China under the current tariff levels, if the US side subsequently continues to impose tariffs on Chinese goods exported to the US, the Chinese side will pay no attention to it,” China’s Ministry of Finance said in a statement.

In a separate statement following the announcement, China’s Commerce Ministry said the Trump administration’s tariff escalations had “become a joke”.

The pause in tariff hikes at levels economists say will end almost all trade between the two economies came amid fresh modelling that forecast a $6bn economic hit for Australia this year.

Despite the tariff halt, both Beijing and Washington threatened that more non-tariff strikes were to come.

US Treasury Secretary Scott Bessent said Washington may next move to delist Chinese stocks from American exchanges. “I think everything’s on the table,” he said after Beijing slashed the number of Hollywood films it will allow to be screened in China.

Chinese scholars flagged months of further economic attacks from Beijing. “It is no longer a game about tariffs themselves, but a game of strategic resolve,” said Zhao Minghao, deputy director at the Centre for American Studies at Fudan University, in Shanghai.

“China has adopted an attitude of being prepared to go the distance and pay any price,” he said, predicting it would take months for the two sides to return to rational negotiations.

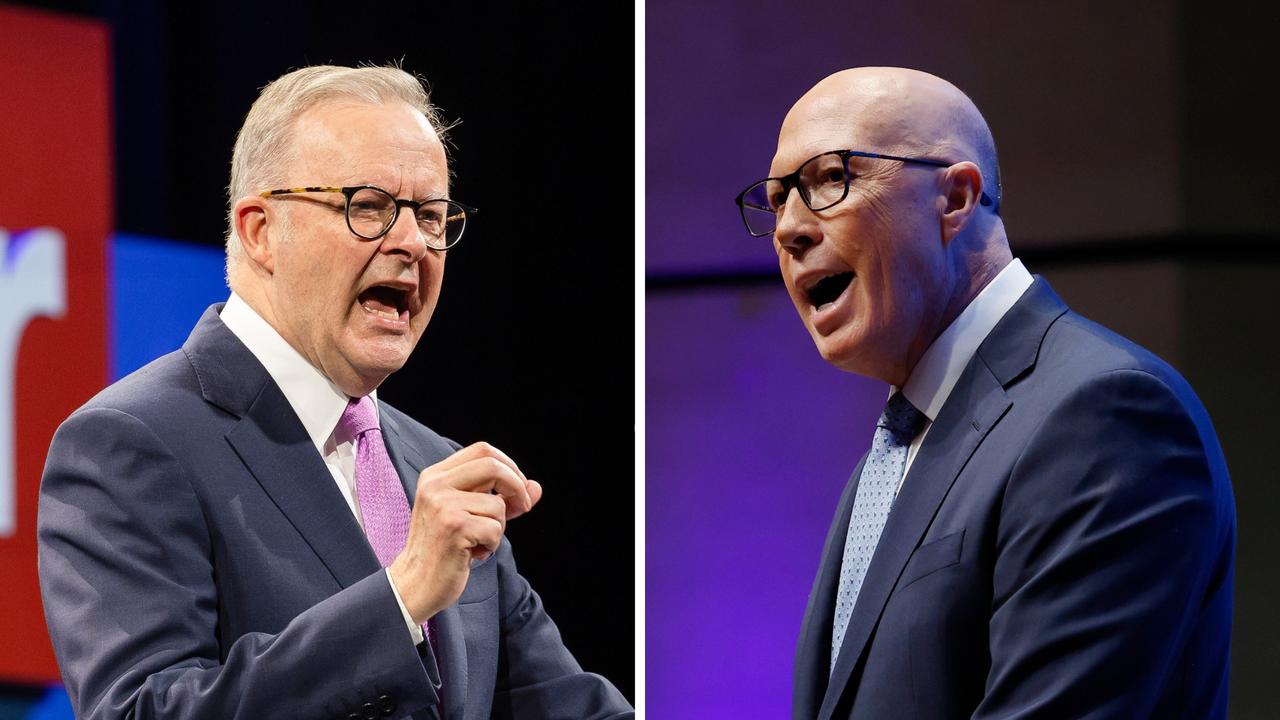

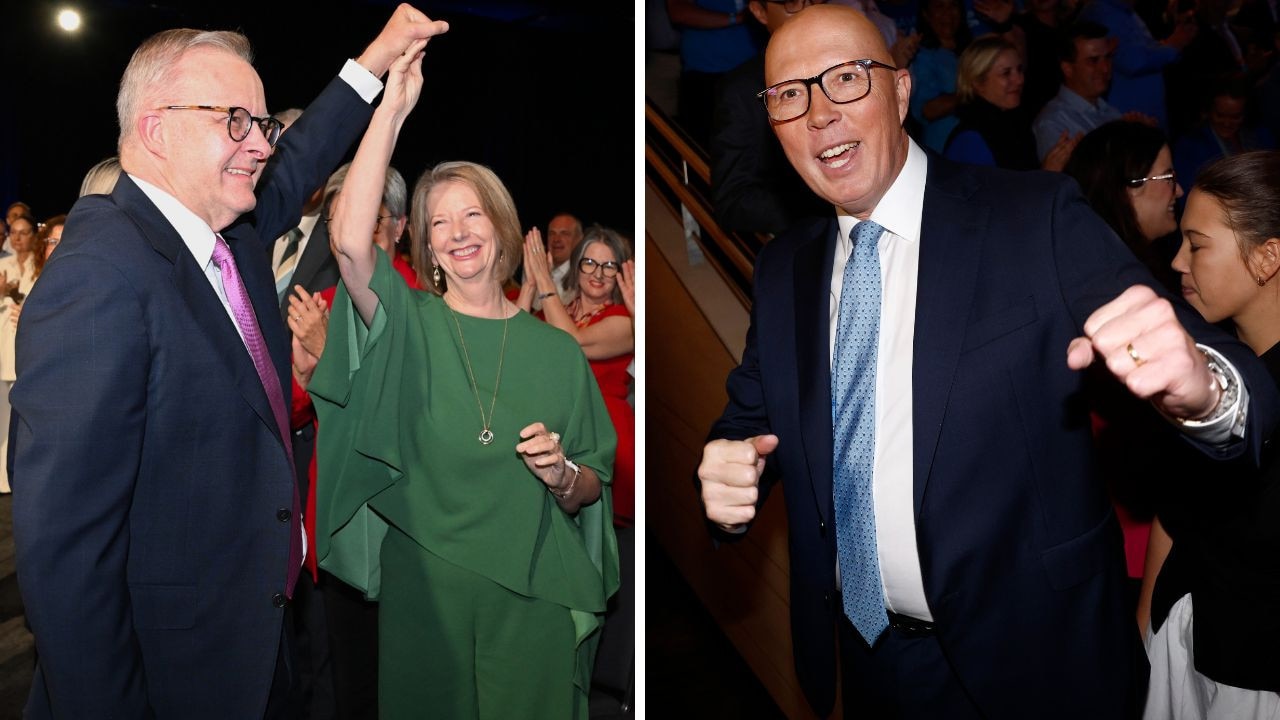

As the world’s two biggest economies continued their bruising trade war, the Albanese government said Australia was better placed to ride out the carnage than most countries.

US sharemarkets slumped on Thursday following huge gains the day before after Mr Trump unwound most of his international tariff regime, reducing levels to all countries except China to 10 per cent. The S&P 500 closed down 3.5 per cent, while the Nasdaq fell 4.3 per cent.

The ASX 200 closed down 0.8 per cent. The local bourse lost just 0.2 per cent for the week after diving as much as 6.5 per cent on Monday after a near collapse on Wall Street last Friday.

Jim Chalmers said it had been a “wild ride” for markets this week. “But the good news for Australia, and I think the Reserve Bank governor was making a point last night about the robustness of our systems, is Australia amid this new world of uncertainty is in quite good stead,” the Treasurer told the ABC.

New research from KPMG downgraded Australia’s economic growth in 2025 to 1.6 per cent from its previous 2.3 per cent forecast as a result of the trade war. The downgrade represents a $6bn fall in the GDP growth rate this year and assumes the 10 per cent tariff does take effect once the current 90-day pause ends.

While Australia will avoid a recession under KPMG’s modelling, a potential fall in China’s GDP growth rate of 2.5 per cent would flow through to the Australian economy. “We’re basically taking all the growth that we had anticipated to rebound as our economy was recovering and has basically wilted as a consequence of this trade war,” KPMG economist Brendan Rynne said.

“This trade war is incredibly unhelpful for the pathway that we anticipated was ahead of us for the short term for the recovery of economic activity in this country after a couple of years of economic malaise.”

KPMG expects 1.6 per cent GDP growth in 2026 from its previous 2 per cent estimate as the economic fallout bottoms through the middle of the year. In 2027, the forecast was revised down to 1.9 per cent from 2.1 per cent previously.

Reduced demand from China for Australian goods and currency fluctuations were the major drivers of the economic downgrade,” Mr Rynne added.

“We get some consumption loss because our exchange rate devalues and imported goods cost more. Our exports fall a little, domestic consumption falls a bit, as does investment. Then we start to recover from that, recognising our economy is permanently lower.”

Using a justification it employed at the start of its 2020 trade assault on Australia, Beijing claimed its heightened restrictions on American movies was a response to Chinese public sentiment. “The US government’s abuse of tariffs against China will inevitably lead to a further decline in the favourable perception of US films among the Chinese audience,” the China Film Administration said in a statement.

The new restriction came as state media amplified Beijing’s warnings about safety concerns for Chinese citizens considering travel or study in America, another reprise of measures used on Australia in 2020.

The Trump administration announced a further hike to 120 per cent on a tariff on shipments priced up to $US800. The parcel loophole had previously allowed goods from Chinese e-commerce retail firms Temu and Shein to evade American tariffs entirely and is forecast to decimate what had been a booming trade to the US for the popular Chinese firms.

Mr Xi has shown no sign of accepting the US President’s offer to “do a deal” and mend the rupture between the world’s two biggest economies.

China’s foreign ministry continued to quote defiant words from Mao Zedong. “China never bluffs – and we see through those who do,” said a foreign ministry spokeswoman on Friday.

Mr Trump on Thursday conceded there were “transition problems” with his tariff plan and flagged some products might get exceptions to relieve pressure on US businesses and consumers.

He repeated his optimism that China would eventually come to the table to do a deal. But simultaneously his administration clarified that American tariffs on China added up to 145 per cent, not the 125 per cent that had been widely reported.

“There will be a transition cost, and transition problems, but in the end it’s going to be a beautiful thing,” Mr Trump said. “We are doing, again, what we should have done many years ago … we allowed some countries to get very big and very rich at our expense.”

China’s commerce ministry said pressure, threats and extortion were no way to deal with the country. “Our position is consistent and clear – the door to dialogue is open, but any discussions must be conducted on the basis of mutual respect and equality,” said spokeswoman He Yongqian.

China’s leadership team reportedly met on Thursday for an ad hoc meeting to discuss “support measures for housing, consumer spending and technological innovation”, according to Bloomberg, citing sources not allowed to be identified discussing the matter. China’s financial regulators also met to discuss measures to boost the economy and stabilise the markets.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout