Australia’s jobless rate holds at 3.5pc amid high inflation, RBA rate hike pause

The latest evidence of a still red-hot labour market lifts the chances of a Reserve Bank rate hike at its next board meeting.

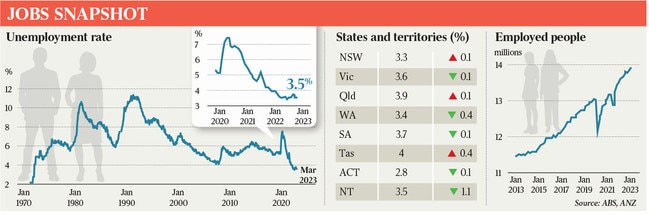

The unemployment rate has held at a near 50-year low of 3.5 per cent in March after the economy added a bumper 53,000 jobs in the month, with the latest evidence of a still red-hot labour market lifting the chances of a Reserve Bank rate hike at its next board meeting.

The number of full-time workers jumped by 72,200 in the month, offset by a 19,200 fall in part-time employed, seasonally adjusted data from the Australian Bureau of Statistics showed.

Women drove the month’s jobs gains, with a 55,600 increase in female employment in March against a 3300 drop in the number of male jobs. It was a month of labour market records for women, as the female unemployment rate fell to an all-time low of 3.4 per cent, versus 3.7 per cent for men, the ABS figures showed.

ABS head of labour force statistics Lauren Ford said the share of working-age Australians with a job inched up by 0.1 percentage point to 64.4 per cent, while the workforce participation rate was unchanged at 66.7 per cent.

“Both indicators were close to their historical highs in November 2022, reflecting a tight labour market and explaining why employers are finding it hard to fill the high number of job vacancies,” Ms Ford said.

Jim Chalmers hailed Thursday’s “remarkable” jobs figures, even as he emphasised growing fears around a global economic “hard landing” ahead of the May budget.

Speaking from Washington DC, where he was taking part in a series of meetings with his G20 counterparts and representatives from the International Monetary Fund and World Bank, the Treasurer said the upcoming budget “will be defined in so many ways by the economic pressures that we’re seeing from around the world, but which are being felt around the kitchen tables of Australia”.

“And when we confront uncertain times in the global economy, the best possible response is responsible economic management at home, and that’s what we’ll see in the May budget,” Dr Chalmers said.

The Treasurer also said he did not expect a recession in Australia, but predicted “a pretty substantial slowdown in our economy”.

“We’ve got a lot coming at us from around the world but we’ve got a lot going for us as well at home: low unemployment, the beginnings of wages growth, and very good prices for our exports on global markets,” he said.

“We enter this new period of global economic uncertainty from a position of relative strength.

“We are confident but not complacent about how this will play out.”

A rare soft spot in the jobs data was the underemployment rate, which measures those with jobs who can’t find the extra hours they would like and which lifted from 5.8 per cent in February to 6.2 per cent, according to the latest figures.

Still, the jobs numbers came in far hotter than anticipated.

The consensus among economists had been for a 20,000 rise in the number of employed Australians and for the jobs rate to tick higher to 3.6 per cent.

Capital Economics head of Asia-Pacific Marcel Thieliant said “the strong set of labour market figures probably tilt the odds towards another 25bp (0.25 percentage point) rate hike at the RBA’s May meeting”.

With just over one unemployed person to every job vacancy, EY chief economist Cherelle Murphy said “more Australians are working than ever before to meet the hot demand for employees”.

“The Reserve Bank will be pleased that the gains in the labour market are continuing, but concerned that it provides an upside risk to inflation over the remainder of the year, given the upside risks to wages,” Ms Murphy said.

“If this were to occur, and if inflation remains stubbornly high, a further rate rise would be warranted,” she said.

The ABS has estimated that the population over the past six months grew at its fastest pace in records stretching back to 1978.

Judo Bank economic adviser Warren Hogan said: “What’s really spectacular about that 3.5 per cent unemployment rate is that we’re having a surge in population, and we’re providing jobs for everyone.”

Economists believe that the RBA’s aggressive series of rate hikes will drive a sharp slowdown in spending and economic growth from the second half of this year, and this will push unemployment higher to approach 4 per cent or above by December.

The next major test for the RBA’s monetary policy path is consumer price index data on April 26, which the ANZ predicts will show headline annual inflation having dropped from 7.8 per cent in the December quarter to 6.9 per cent in March.

After two months of falling employment in December and January, jobs growth surged back by about 65,000 in February, more than offsetting the summer holiday slump, which economists blamed on unusually powerful seasonal factors. The Reserve Bank board at this month’s meeting held rates steady at 3.6 per cent following its 10 back-to-back hikes, citing weakening spending, a gloomier global backdrop and clear signs of a retreat in inflation.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout