Sensible proposals about increasing housing supply are seeing the light of day and leaders, such as NSW Premier Chris Minns, are finding courage to offer solutions beyond those that simply pump up demand, rents and home values. Following a housing statement last year setting out a decade-long plan to build 800,000 homes, Victorian Premier Jacinta Allan is on a roll.

In the past week, Allan has announced a 12-month cut to stamp duty for all off-the-plan units, townhouses and apartments; a 10-year greenfields land release plan to support greater housing supply across greater Melbourne; the introduction of the state’s Building and Plumbing Commission; and further consideration of making it easier, cheaper and faster to subdivide blocks of land for homes.

A senior Victorian Labor figure audaciously tells Inquirer the Suburban Rail Loop boondoggle, estimated to cost a gazillion dollars (no one really knows), is actually a housing play, putting thousands of homes above metro stations rather than adding to the city’s sprawl.

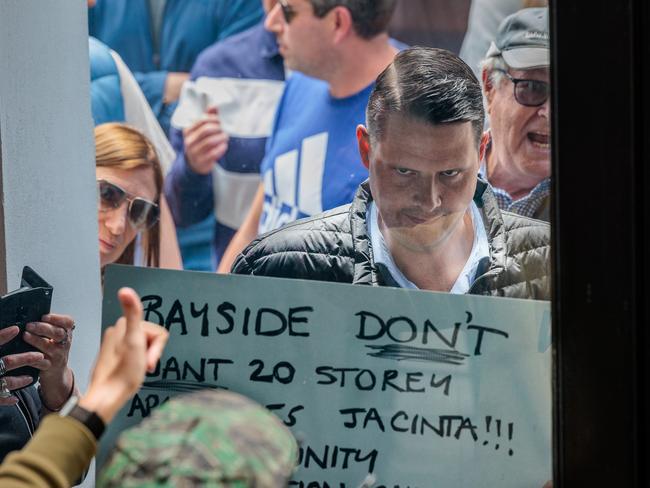

But Allan’s most controversial move to ease the housing crisis was to make public last Sunday the first 25 locations for 50 “train and tram zone activity centres” for new homes in developments reportedly up to 20 storeys near public transport across Melbourne, primarily located in inner-east and southeast suburbs.

High-vis federal Victorian teal MPs immediately flipped the lollipop sign to STOP for what they saw was the Premier’s lack of consultation. On Wednesday, their NSW crossbench colleague Allegra Spender was more welcoming about what planners call “densification”. “I support housing of all different shapes and sizes, but it has to work for the community,” she told the National Press Club.

It’s true we’re in the slippery realm of “announceables” and the wiles of messaging merchants for a government about to clock up 10 years in office. Builders, however, are cautiously welcoming the changes. The Housing Industry Association’s executive director (Victoria), Keith Ryan, said on Thursday the land release plan was an important step, “but not the full answer” to greater supply.

“Alongside this, industry needs all areas of policy working together to support greater housing supply and put downwards pressures on housing affordability,” Ryan said. “The industry continues to face a number of challenges in boosting housing supply, including the costs and time associated with delivering new housing, slow and restrictive planning approvals, and the continuing raft of cascading regulatory changes.”

Just over a week ago at the University of Sydney, opposition Treasury spokesman Angus Taylor sketched out the principles that would guide the Coalition’s economic policies; in truth, it was recital of “back to basics” platitudes, post-it notes and dot points, rather than fresh policies written in ink and cohering into a winning platform.

Nevertheless, Taylor declared housing the nation’s most important economic challenge. Like other politicians and commentators, he conceded “there is no silver bullet” in this area. “It requires every lever to be pulled,” he said.

Taylor said the Coalition’s focus would be to allow withdrawals from superannuation for the purchase of a first home; managing budgets to put downward pressure on inflation and interest rates; and ensuring there is enough supply (and aligning population growth with available housing).

Superannuation withdrawal, however, is an entry-level demand booster. Best let super be super. During the pandemic, the Morrison government’s oversubscribed HomeBuilder scheme added to the industry’s miseries, which include a lack of skilled trades workers, exorbitant wage and materials costs, difficulties in accessing sites, and company collapses.

In its latest Business Outlook, Deloitte Access Economics says HomeBuilder “distorted demand by inducing a ‘bring forward’ of activity that otherwise would have taken place later (or not at all), further straining a sector already under pressure”.

Although construction costs are no longer accelerating, they’re not declining either. According to the HIA, the median price of a residential lot reached an all-time high of $351,044 in the June quarter, due to acute shortages and rising tax imposts. Annual building block inflation is 6 per cent.

With very little capacity to begin new projects and permanently higher costs, Deloitte partner Stephen Smith says the sector will be both unwilling and unable to lift supply unless property prices also rise. “That is, housing affordability will get worse before it has a hope of getting better,” he says.

Deloitte has revised down its forecast of residential activity. Fewer than one million new dwellings are now expected to be built over the next five years, well below the federal government’s National Housing Accord target of 1.2 million homes by 2029.

Labor’s priority is social and affordable housing, through the Housing Australia Future Fund, but its supply initiatives go beyond industry incapacity. There’s been legislative delay on the Help to Buy plan, Greens grandstanding on loopy ideas like rent freezes, and a crowding out of activity from state “Big Builds” on roads and rail.

A week ago, Peter Dutton put theoretical cash down, announcing a Coalition government would set up a $5bn “use it or lose it” fund of grants and concessional loans to jump start infrastructure development, such as water, power, roads and sewerage, with the aim of building 500,000 homes in new greenfield locations. It was welcomed by the property lobby and economists as a supply booster, although there are qualms about a 10-year freeze on changes to the National Construction Code to reduce unnecessary “red tape”.

Labor, too, is throwing in incentives for housing infrastructure and to spur state governments to lift their work rates. But as Geoff Chambers revealed this week, its $1.5bn Housing Support Program is being funnelled into marginal and winnable seats ahead of a federal poll due next year.

This week the Business Council of Australia provided evidentiary ballast and corporate impetus through the It’s Time to Say Yes to Housing report. It’s the BCA’s major contribution in this area, seemingly driven by the promise of a productivity dividend, a desire for intergenerational equity and getting more homes built in areas where people want to live.

The key takeaway is a $10bn national reform fund, a variation on the landmark National Competition Policy. Those measures were a down payment on reforms a generation ago across three tiers of government and provided a boost to our material living standards. The Productivity Commission estimated a 2.5 per cent permanent increase in the size of our economy from the competition reforms, or around $5000 per household.

The BCA argues a reform fund could incentivise states to rezone land for housing in areas of demand and lead to faster and more efficient approval processes. As well, it calls for performance management of local councils to crack the whip on approvals, as well as new intervention and approvals powers for state governments.

Other measures are aimed at raising workers’ skills, better skilled migration visa settings and interstate mobility for tradies, lowering taxes and charges, and tackling criminal behaviour on building sites, as well as new ways to consult with communities and manage heritage issues.

BCA chief executive Bran Black backs many of the latest measures. Fixing the housing crisis “means putting hard but important policy changes on the table; the scale of the task before us remains immense, and so we need every good reform on the table if we’re to hit our targets,” he says. Black says stamp duty is “a horrible tax that stops Australians getting into a home” and is urging Canberra to help the states replace it with a land tax.

But in NSW, the Minns government reversed the Coalition’s policy that offered home buyers the choice of paying stamp duty or an annual property tax, while waiving stamp duty paid by first-home buyers on properties worth up to $800,000. The ACT has slowly weaned itself off stamp duty, while lifting land taxes; receipts for the former continued to climb and the move is often viewed as a tax grab.

Federal Housing Minister Clare O’Neil declares stamp duty is a bad tax and welcomed moves that states and territories have made to wind it back or to remove it altogether. Yet the property levies raise around $130bn a year and even skint state treasurers won’t switch to “forever” land taxes.

At the conclusion of an official mission to Australia this month, International Monetary Fund staff said addressing our housing affordability challenges “requires a holistic approach to tackle the continued supply shortfall”.

“A comprehensive strategy is essential, focusing on increasing construction worker supply, relaxing zoning and planning restrictions, supporting the built-to-rent sector, expanding public and affordable housing, and re-evaluating property taxes (including tax concessions to property investors) and stamp duty to promote efficient land use,” the IMF said.

Finally, some of those elements are falling into place; the NIMBYs may be in retreat and the Greens’ harebrained ideas exposed. Mainstream politicians and mature homeowners may soon realise that the supply science is in and accept that torturing young Australians on housing affordability can only come back to bite us all.

Amid the brutish financial waterboarding of young Australians with extortionist home-price inflation, the slow drip of independent research and advocacy has led to breakthroughs in the conversation about housing policy.