So-called “trimmed-mean” inflation, which removes volatile items, has fallen from a peak of 6.8 per cent at the end of 2022 to 4.2 per cent in December.

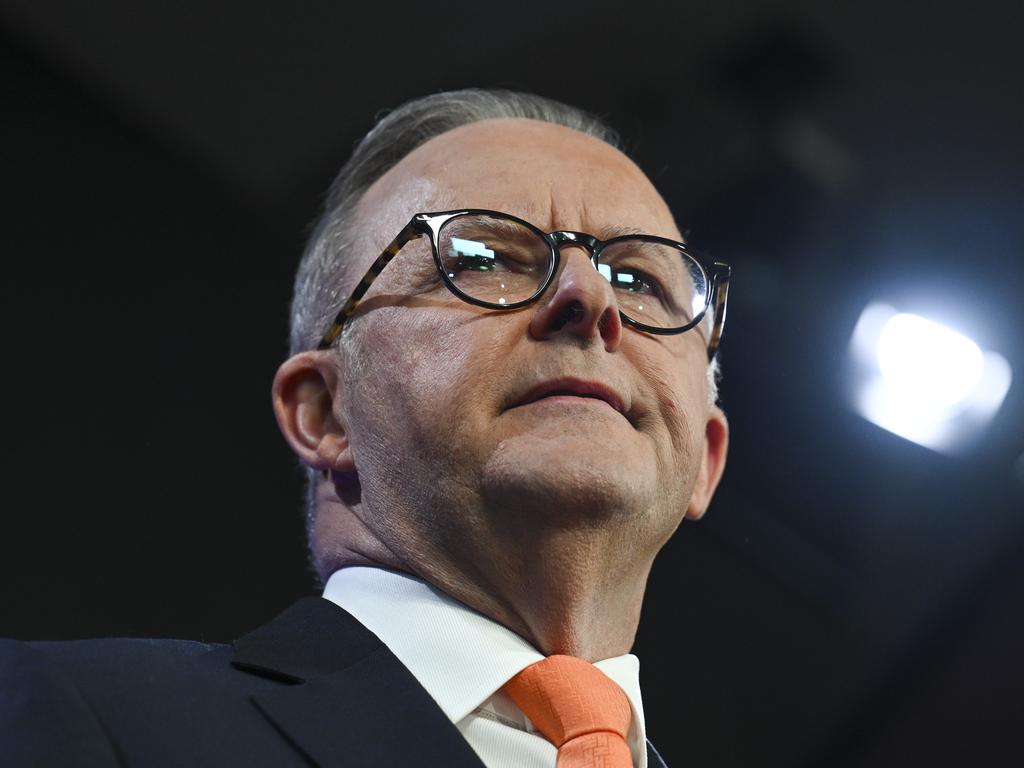

With the record-high rate of tax paid by households and disposable incomes going backwards, the Albanese government’s cost-of-living challenges remain – clear, present and electorally dangerous.

According to Deloitte Access Economics senior partner Stephen Smith, real household disposable income per capita, a proxy for living standards, is expected to remain below the trend seen between the 2008 financial crisis and the pandemic for at least the next five years.

Easing cost pressures on families will be voters’ top concern for the rest of Labor’s term and the stage three tax switch will soften the politics, as long as the RBA nails the landing.

Younger homeowners who are also raising children are facing the sharpest rise in living costs, which is about double the headline figure for both the consumer price index and wages.

In the year to September, the living cost index for employee households, which includes mortgage interest, rose by 9 per cent, while wage inflation across the economy was 4 per cent.

Still, RBA governor Michele Bullock is worried about “homegrown” inflation, code for services inflation, which is driven by wages, rents and power costs.

The central bank enters a new era, with a two-day meeting from Monday and a press conference after the board’s monetary policy decision on Tuesday.

After Wednesday’s inflation news, economists doubled down on views that the RBA would be holding its cash rate target steady at 4.35 per cent, which will likely be the peak in this cycle.

More market players are now pencilling in interest rate cuts in the second half of this year.

Let’s wait for a clear signal in the jumble of numbers over the year, because they won’t be in the same direction: migration will keep things running in consumer land, while inflation is sticky.

The disruption to shipping supply routes in the Middle East may push up the cost of imported goods, although retailers may be forced to take a hit on margins.

The last part of getting consumer inflation to within the RBA’s 2-3 per cent target band – and of course in the new monetary deal, aiming for the 2.5 per cent middle ground – could be a struggle.

In its world economic outlook update, the International Monetary Fund estimates about 80 per cent of the world’s economies are expected to see lower annual average headline and core inflation this year.

But IMF chief economist Pierre-Olivier Gourinchas said financial markets “appear excessively optimistic about the prospects for early rate cuts”.

“Should investors reassess their view, long-term interest rates would increase, putting renewed pressure on governments to implement more rapid fiscal consolidation that could weigh on economic growth,” he said.

That could be delayed, the IMF fears, because of the likely cash-splashing by politicians in what it calls “the biggest global election year in history”, causing a sugar-hit to growth but fuelling inflation and leading to budget problems down the track.

On average, inflation is falling more rapidly in countries with an inflation target (like Australia, although only one in five people know what it is).

In several major economies, the IMF said success in reducing inflation and modest upgrades to economic activity “implies a softer-than-expected landing”.

A soft landing for us means the jobless rate, now 3.9 per cent, not rising above 4.5 per cent, which is still below its pre-pandemic level.

But it’s going to be a long year in the trenches for central bankers, political aspirants and working families with a mortgage.

What Australia gains on the inflation downswing, we could lose on the unemployment roundabout.

The drop in headline and core inflation is welcome news for the economy, and expected, given the Reserve Bank’s aggressive tilt over the past year and a half to slow consumer spending.