Reserve Bank has room for interest rate cuts before QE

I believe the answer is no.

Reserve Bank governor Philip Lowe’s landmark speech this week, titled Unconventional monetary policy: Some lessons from overseas, gave markets more clarity on the implications for Australian monetary policy.

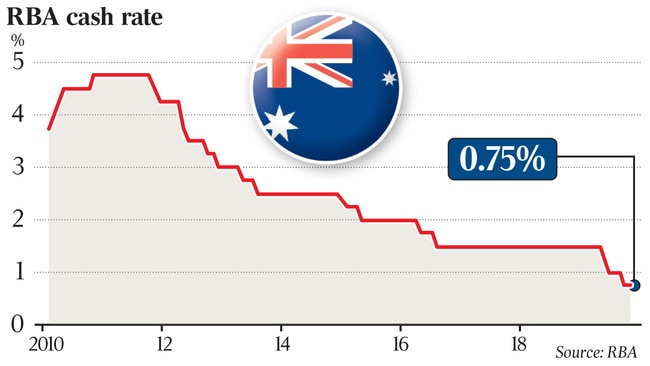

His statement that the RBA’s “current thinking is that quantitative easing becomes an option to be considered at a cash rate of 0.25 per cent, but not before that”, supports my long-held view that the effective lower bound for the cash rate is 0.25 per cent. This is below the (prior) consensus view of about 0.5 per cent.

So how and when will more cash rates cuts come?

I believe the RBA will use “conventional” cash rate cuts, before implementing QE. Indeed, Dr Lowe clarified that the “0.25 per cent effective lower bound equals the threshold for delivering on QE or thinking about it”. Dr Lowe’s logic is quite technical. At a 0.25 per cent cash rate “the interest rate paid on surplus balances at the RBA would already be at zero given the corridor system” and “in most other countries you’d call that zero interest rates”.

So will interest rates hit zero or turn negative?

I don’t believe so. Dr Lowe has said this more than once, calling it “extremely unlikely” and said the RBA’s “appetite for a zero cash rate and hence, negative interest rates on … reserves is very, very limited and I don’t think we’re going to go there” Hence I place a low probability on zero or negative rates.

High probability of 0.25 per cent cash rate by mid-2020

To achieve my base case outlook of 0.25 per cent, I anticipate a 25 basis point rate cut in February 2020, and then another 25 basis points to 0.25 per cent by mid-2020, albeit “conditional” on further global central bank easing and no material fiscal stimulus.

This latter view is now more supported by the federal government’s commitment to surplus. Rating agency S&P this week said that if “fiscal stimulus involves substantial spending initiatives and changes the trajectory of the budget, then doing so could increase downward pressure on (Australia’s AAA) rating and outlook”.

What’s next?

There is a high probability that the most likely unconventional policy option the RBA is considering is forward guidance. The RBA has already said that it is “reasonable to expect the cash rate will remain low for an extended period”, which is arguably a form of forward guidance, albeit Dr Lowe has previously downplayed his comments as “transparency”.

I will be keeping an eye open for stronger forward guidance ahead, probably at their February meeting where I expect a 25 basis point rate cut, but with a non-trivial chance of a dovish shift at its December meeting. This is supported by Dr Lowe saying that globally the forward guidance “experience has mainly been positive”. Dr Lowe implied that calendar-based forward guidance seems less preferred. More probable is conditional/state-based forward guidance akin to a “commitment that rates will remain at the current or lower level until more significant progress is made in achieving inflation and full employment targets”. Further, when the RBA next guides to further easing, it could also change or drop the “if needed” condition.

I still don’t have a base case for RBA’s quantitative easing of government bond buying , but following Dr Lowe’s comments have upgraded the probability to medium from a low risk previously.

Dr Lowe said the RBA’s “threshold for undertaking QE … has not been reached, and I don’t expect it to be reached in the near future”.

Dr Lowe also noted “there is not a smooth continuum running from interest rate reductions to QE. It is a bigger step to engage in money-financed asset purchases by the central bank than … cut interest rates”.

However, he specified that “QE would be considered if there were an accumulation of evidence that, over the medium term, we were unlikely to achieve our objectives. In particular, if we were moving away from, rather than towards, our goals for both full employment and inflation”.

To QE or not QE?

Importantly, our economic outlook is close to breaching the RBA’s QE threshold, and hence I attribute a medium probability to QE. Specifically, we remain below consensus on GDP growth in 2020 at 2.1 per cent year on year versus the market at 2.4 per cent. We expect unemployment to rise to 5.5 per cent next year, in contrast to the consensus and RBA which expect a fall.

That said, we all see 2 per cent inflation ahead, which continues to fail to reach the RBA’s target band mid-point of 2.5 per cent year on year. However, we assume a material fiscal stimulus in the May 2020 budget to avoid QE. This was reinforced by Dr Lowe, arguing central bank’s “willingness … to use its full range of policy instruments might create an inaction bias by… fiscal authorities”.

George Tharenou is Australian chief economist at UBS.

Following the Reserve Bank cutting the cash rate to a record low of 0.75 per cent, markets are asking: “Has monetary policy reached its limit?”