The bulls have been charging but how much energy do they have?

Shares are running hot but the excitement, especially around US markets, has yet to reach the level of euphoria which sparks a major sell-off.

As we know, the current sharemarket rally could pause or retreat on the back of a shift in sentiment in late 2025 or in 2026.

Massive demands on liquidity from the refinancing of about $US70 trillion of global debt taken up when interest rates were zero would leave less liquidity to sustain the rally in shares, bitcoin and everything else.

Even if the refinancing event did not strain liquidity, fears that it might could be enough to reverse prices, which might indeed be stretched by then.

In this, my final column for 2024, I want to share what I think happens between now and that possible scenario. In any case liquidity strains aren’t an event; they develop over time.

Value investing legend John Templeton famously observed: “Bull markets are born on pessimism, grow on scepticism, mature on optimism and die on euphoria.”

As we close out 2024, there are already plenty of investors worried this insight foreshadows danger in 2025.

With the S&P 500 poised to post two consecutive years of 20 per cent-plus gains – a rare achievement over the past 150 years – the question that needs to be explored is whether the rally is nearing its twilight, or whether 2025 could be the market’s brightest year yet.

To understand where we might be in the current bull market, it helps to revisit how bull markets evolve. Booms often begin with rallies in lower-risk assets like bonds before enthusiasm spreads to shares, real estate and eventually speculative ventures.

As these rallies progress, they gain momentum, drawing in increasingly broader participation. The latecomers, often chasing gains with little due diligence, can fuel the final phase of the rally. This stage, marked by a fear of missing out, is where booms morph into bubbles.

The present environment exhibits many of these characteristics. Sharemarkets are buoyant, property markets are resilient and speculative assets like bitcoin and NFTs are regaining favour.

Yet, as history has shown, stretched valuations or speculative fervour do not themselves precipitate a crash; they merely signal the possibility of one.

But are prices stretched? The rally in the S&P 500 has been driven disproportionately by the “Magnificent 7” mega-cap technology stocks. These have contributed more than 60 per cent of the index’s gain.

When these outliers are excluded, the broader market’s growth of about 10 per cent is far more modest, suggesting the rally may not be as overstretched as headline figures suggest.

This nuance is critical when assessing whether we are in a bubble or in the middle stages of a boom.

Meanwhile, many analysts and commentators say the CAPE Shiller Ratio, a widely followed valuation metric, suggests the S&P 500 is expensive by historical standards. This metric compares current prices to a 10-year average of inflation-adjusted earnings – a period which includes the pandemic-induced earnings slump.

Adjusting for this anomaly paints a less alarming picture. Moreover, the US economy is robust, with strong corporate profit margins and resilient growth.

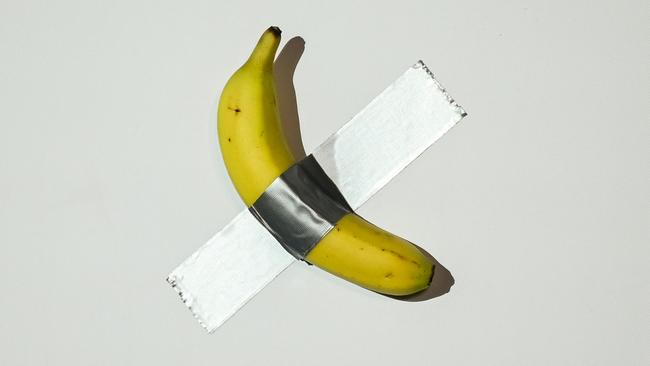

It is the case, however, that speculative excesses – often a hallmark of late-stage booms – are increasingly visible. Consider the recent $US6.2m sale of a banana duct-taped to a wall. Maurizio Cattelan’s art piece is reminiscent of the Bored Ape NFT frenzy of 2022. Back then, digital examples of cartoon apes fetched millions of dollars before their market values plummeted, and partially rebounded in 2024.

As an aside, those who claim that “regional” assets like bitcoin and NFTs could bring on a financial crisis fail to acknowledge that a financial crisis requires the collapse of an asset held on the balance sheets of systemically important banks.

The 2008 financial crisis, for instance, stemmed from the implosion of a bubble in subprime mortgages in the US – a sector deeply integrated into the balance sheets of systemically important banks. By contrast, today’s speculative mania in collectibles and cryptocurrencies lacks the scale or ownership to destabilise major financial institutions.

So the rally could plausibly go on for another year or more, even if euphoria is rising or has already reached historic extremes. Indeed, 2025 could be the best year of the current rally.

One reason for the rally explains why the US sharemarket now accounts for 75 per cent of the MSCI World Index, up from 30 per cent in the 1980s. Investors are buying into America’s unique advantages: a large and resilient economy, world-class innovation and a financial system that attracts global capital. US tech giants, in particular, have rewritten the rules of business economics, demonstrating the ability to compound returns even as they grow larger – an anomaly in traditional microeconomic theory.

However, the rationale for investing in the US – compelling as it may be – is nothing new. When such arguments are embraced by latecomers to the rally, they often signal that a good idea has gone too far. Overexposure to a single market, no matter how exceptional, can amplify risks.

But I don’t think we are anywhere near euphoria yet. That vertical run-up in the index, the one that reflects unbridled rapture, hasn’t transpired and there is little to suggest it cannot.

The rally could continue well into 2025, buoyed by strong fundamentals and the momentum of an “everything rally”.

However, investors should remain vigilant. Late-stage booms often feel irresistible but they carry heightened risks. As we move through 2025, the market’s trajectory will hinge on how well liquidity is managed and whether speculative excesses spill into broader instability.

Templeton reminds us that market cycles are as much about psychology as fundamentals. For what it’s worth, I reckon the band is still playing and the lights are still on. But as the year progresses, investors would do well to listen out for fading volume.

Roger Montgomery is founder and chief investment officer at Montgomery Investment Management.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout