Super funds ordered to review liquidity to ensure they can meet rush of demands

Regulators have warned super funds to review health of investments in the wake of virus crisis.

Financial regulators have told the nation’s superannuation funds to come clean over the health of their investments as unlisted assets such as toll roads, airports and infrastructure take a beating amid an expanding government shutdown of the global economy.

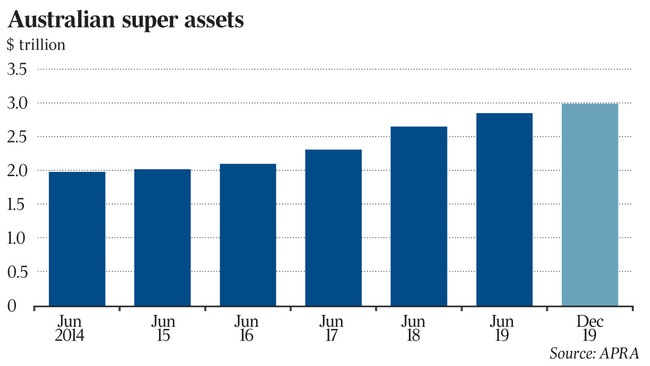

In a move to force large retirement savings managers to ensure there are no unwanted surprises amid an intense liquidity squeeze on the super sector, the prudential regulator and the corporate watchdog on Wednesday warned the $3 trillion superannuation sector to revalue their “unlisted and illiquid” assets and to launch “regular and detailed liquidity stress testing” to ensure funds can remain solvent during the coronavirus crisis.

In a joint letter sent to the nation’s 200 superannuation fund trustees on Wednesday, Australian Prudential Regulation Authority member Helen Rowell and Australian Securities and Investments Commission commissioner Danielle Press told the retirement savings sector to overhaul short-term strategies and priorities to ensure they could “fulfil their payment obligations” to members, including for the government’s plan to allow savers to access up to $20,000 from their retirement funds over the next two years.

The watchdogs also turned the blowtorch on super fund directors, warning that in some cases difficult decisions will be required” and boards and chief executives will need to display strong leadership or face consequences.

“The ongoing stability and proper functioning of the superannuation sector, which safeguards trillions of dollars on behalf of members, is critical to the overall stability of the financial system and the economic prosperity of all Australians,” the regulators said.

The letter was posted in the wake of a series of public statements from some of the country’s largest fund managers — AustralianSuper, SunSuper, UniSuper and IFM Investors — which alerted savers to billions of dollars worth of write downs in unlisted assets across the globe.

While equities and fixed income markets have clearly registered steep falls, unlisted assets, which can include private equity investments in firms, are more opaque and require an independent valuation to reflect the fair carrying value of the asset.

Unlisted assets and infrastructure holdings in particular have put a rocket under investment returns over the last decade, as super funds are paid a premium to lock away money for long periods of time in assets that can’t be sold quickly.

However, a shutdown of logistics industries and commercial and private travel has sparked a sharp reassessment of the book value of the assets.

On Wednesday listed toll-road operator Transurban, which is widely considered to have resilience to economic downturns withdrew its second-half dividend guidance following steep falls in traffic across Australian and US toll roads over recent weeks.

Ms Rowell and Ms Press told super funds that maintaining liquidity must be “a top priority” for trustees “who bear ultimate responsibility for maintaining sufficient levels of liquidity to sustain the operation of their funds”.

The regulators said super funds must be undertaking regular and detailed liquidity stress testing to ensure they could cope with member drawdowns and switching, make sure their investment portfolio was able to cope with the current liquidity strains, and to assess “the impact on liquidity of their liabilities and contractual commitments, such as currency hedging programs” and review securities lending arrangements.

“Trustees should also ensure that the valuation of unlisted and illiquid assets remains appropriate and consider whether any assets need to be revalued,” the letter said.

One of Australia’s biggest infrastructure companies, toll road operator Transurban, on Wednesday scrapped its dividend guidance for the second half of the year after traffic plunges across the globe, and with lower traffic comes lower toll revenue. North American toll traffic has fallen 65 per cent over the final week of March, and traffic across all assets fell 36 per cent.

The hit to infrastructure investments will likely be more heavily weighted to union-and-employer-backed industry funds, which have over the last decade outperformed the rival retail super sector thanks to the willingness to lock funds away for long periods in unlisted assets.

Rest Super, which manages the savings of retail and hospitality workers, said last week it had lowered the value of its property asset class by 8.6 per cent and that it was “well placed” to support the government’s early drawdown plan.

“This decrease in value will be factored into the overall value of all our investment options that include property assets. We have been communicating this to our members who have chosen to invest their super in our property option,” a Rest spokesman said.

“Rest has extensive fund assets including cash, and other liquid assets, and we are comfortable about managing our illiquid assets such as property and infrastructure.”

Construction sector workers’ fund Cbus Super said it conducted an “out-of-cycle” revaluation of its unlisted assets and this was already passed onto its members.

A spokesman for Cbus said the fund would be able to “pay all member hardship claims” and was in a strong liquidity position.

“Cbus paid close attention to the lessons of the GFC. We have a very robust approach to liquidity and stress testing. We are comfortable in meeting the regulators requirements,” Cbus said.

TWUSuper chief executive Frank Sandy said the fund’s investments are managed externally “and have been revalued where appropriate” and was “confident of sufficient liquidity to meet current and potential needs”.

“Stress testing remains in place to test liquidity and our processes for this are reviewed regularly,” Mr Sandy said.

Parts of the superannuation sector have baulked at the plan to allow members to drawdown cash at the same time investment markets have crumbled and as a significant chunk of their cohorts switch out of diversified investment strategies and into safer cash investments.

The moves have put a strain on super funds, which are now facing the prospect of liquidating positions out of longer-term investments in unlisted assets such as infrastructure and private equity.

In a letter sent to Treasury last week, the Association of Superannuation Funds of Australia, Industry Super Australia and the Australian Institute of Superannuation Trustees said expected drawdowns of up to $65bn could exceed the industry fund-dominated MySuper sector’s cash reserves of about $45bn, forcing funds to engage in a fire sale of assets to cover payouts, which would harm the investments of remaining members’ assets.

First State Super chief investment officer Damian Graham said liquidity across many different markets had changed significantly over the past month.

“However, the foreign currency market has not been as impacted as other markets, so we believe we can maintain our current approach,” Mr Graham said.

Chris West, the chief Investment officer at WA Super, said the fund regularly undertook liquidity stress testing “regarding a range of both foreseeable and more severe liquidity shocks”.

“Market liquidity across markets has changed significantly. The foreign currency market has not been as impacted at the same levels as some other markets. We continue to monitor the situation carefully. We continue to be able to effectively impact our currency hedging policy without material impacts,” Mr West said.

A number of smaller industry funds also attain a cohort of savers through industry-specific enterprise bargaining agreements, meaning membership can be concentrated in sectors that have been hammered by the government shutdown aimed at arresting the spread of COVID-19, such as the retail, hospitality, clubs and tourism sectors.

Some funds are also heavily weighted towards younger super members, who may be more willing to dip into meagre retirement savings.

Ms Rowell and Ms Press the impact of COVID-19 was likely to be short term, but that superannuation was a “long term proposition”.

“Australia’s 16 million members of APRA-regulated superannuation funds are relying on trustees’ nous, dedication and preparedness to appropriately safeguard their savings through this difficult time. In some cases, difficult decisions will be required, and trustee boards and CEOs will need to display strong leadership,” the watchdogs said.

“ASIC and APRA are available to provide guidance and assistance on issues arising under the regulatory framework, however, ultimate responsibility for the outcomes superannuation members experience lies with boards and trustees.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout