Coronavirus: Superannuation funds ‘liquid’ as assets switched

Australia’s smaller superannuation funds have knocked back concerns of a liquidity crisis.

Australia’s smaller superannuation funds have knocked back concerns of a liquidity crisis in retirement savings vehicles despite a rise in customers switching their assets into cash and defensive options.

But a new plan by Scott Morrison to allow workers experiencing hardship to cash out up to $20,000 worth of savings over the coming two years could exacerbate the stress faced by smaller super funds beset by shrinking membership and ageing demographics.

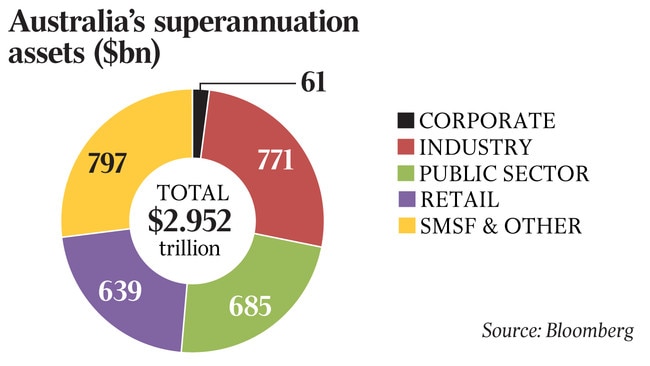

The prudential regulator is expected to issue new pandemic guidance to the $3 trillion savings sector amid the flux in government policy as the industry takes a battering, triggered by steep sharemarket falls as governments attempt to limit the spread of COVID-19.

Panicked savers have staged a rush on their super funds amid the steepest bear market on record, pressuring trustees to ensure savings can be switched out of illiquid holdings in property, infrastructure and private equity investment options and into safer assets such as cash.

The Australian Prudential Regulation Authority has for years been warning smaller funds to seek out mergers with larger funds if they have an ageing cohort, are bleeding members or have negative cash outflow, in order to help them avoid a liquidity trap.

The Australian Institute of Superannuation Trustees yesterday said the not-for-profit super fund sector industry group would be working with its member funds, the government and regulators to address “a number of administrative challenges and risks that will need to be overcome and mitigated” for the new income support measures that were announced by Scott Morrison and Josh Frydenberg on Sunday.

Graeme Russell, chief executive of $6.5bn MediaSuper, told The Australian the fund had already cashed in on some of its put options and spreads — hedged bets against market falls — to moderate the negative impact from plunging sharemarkets over the last few weeks.

“While the value of the fund’s equities portfolio has obviously fallen significantly, the fund also has significant cash and fixed-interest holdings, and has not experienced any significant increase in member switches to cash or in drawdowns,” Mr Russell said.

“There’s been some, but not significantly increased switching into cash and other defensive investment options.”

Mr Russell said MediaSuper, which manages the savings of journalists, artists and entertainment industry workers and is due to close its infrastructure investment option at the end of the month due to a lack of scale, was “regularly” talking to other industry funds about sharing resources.

The $5bn truckies super fund, TWUSuper, was warning members of long wait times on the phone due to “call volumes increasing due to recent market volatility” after many of the fund’s savers phoned to check on their nest eggs.

“These are volatile times for the superannuation industry,” said TWUSuper chief executive Frank Sandy, noting the super fund had cash holdings to meet its liquidity requirements.

“So far, we have seen a small increase in our members switching into the Cash Plus option, but nothing extreme,” Mr Sandy said. “It is worth noting that even during the GFC, movement into cash was muted,” he said.

APRA head of superannuation Helen Rowell was last week due to outline the regulator’s updated expectations of the $3 trillion super sector at the Conference of Major Super Funds in Adelaide on Thursday, an event that was cancelled.

Instead, super funds can expect APRA to outline in coming days any change to regulatory programs, how funds should be preparing their portfolios during the pandemic, potential liquidity problems and the impact of the health crisis.

One of Australia’s largest superannuation funds, the $85bn UniSuper fund, on Monday pulled the pin on lending its stock to short sellers in a bid to protect its hammered portfolio. Fellow $10bn industry fund MTAA super joined the ban, withdrawing its own stock lending program.

The $60bn REST Super fund confirmed its securities lending program was under “constant review”, while AMP superannuation also said its share lending arrangements were under review, while AustralianSuper and Cbus did not respond to inquiries.

KPMG national wealth management leader Linda Elkins, a former Colonial First State executive, said it would be some time before the impact of customer switching on super funds became clear.

“We don’t have any visibility of the level of switching yet,” Ms Elkins said. “But people will likely be looking at drawing down on savings through hardship claims,” she said.

“The GFC gave us a blueprint for that. What’s different this time is how quickly things like caterers and event organisers have gone out of business almost immediately. They have no cash flow. People will need to think about accessing super, but that will take some time to play out.”

Ms Elkins said super funds had to be mindful when customers called to check on their savings. While most would be seeking answers about the state of their own affairs, super funds were mostly barred from providing personal advice under the “general advice” model.

“They will either have to give you personal advice, taking all your factors into consideration, or they will have to stick to factual information. It could be quite awkward to give succinct answers to the questions,” she said.

Ms Elkins said parts of the sector that had taken less liquidity risk, by not investing in infrastructure and property, had been punished for underperforming over the last decade. “The league tables are going to flip around,” she said.

Statewide Super chief investment officer Con Michalakis said the $10bn fund had a positive cash flow and the recent market movements were “all within our stress test scenarios”.

“Statewide Super correctly classifies all infrastructure and property growth assets, unlike some other funds. This is why there appears to be a higher growth allocation (in its asset mix),” Mr Michalakis said.

Paul Cahill, chief executive of the $800m electrical trades nest egg, NESS Super, said the fund was not experiencing any liquidity issues and that the volume of calls from members was “tiny”.

“This is the GFC all over again,” Mr Cahill said.

“We seem to have one of these every 10 years.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout