Property outlook ‘pretty grim’, says Harry Triguboff

The property market is improving but won’t return to previous heights until migration numbers improve, the billionaire says.

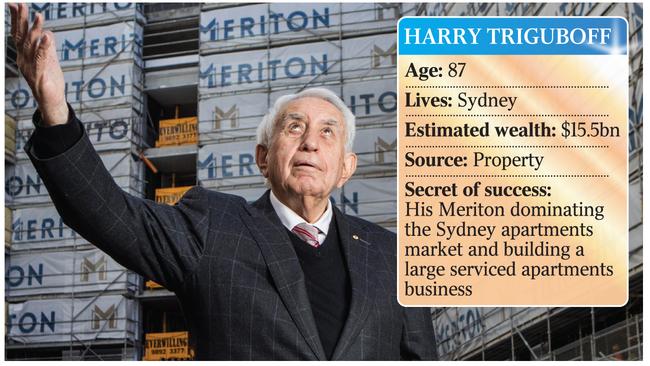

Even at 87, billionaire Harry Triguboff says he has not missed a single day of work during the COVID-19 pandemic.

Neither have staff members at the Sydney CBD office of his apartment giant Meriton, though Triguboff has been as hands-on with the business as ever during its more than six-decade history.

But Triguboff, who has steered his business through recessions and economic downturns, and survived the early to mid-1970s credit crunch that almost forced him to sell Meriton, admits the coronavirus has been his biggest challenge yet as borders close and workers lose their jobs.

“The future is very grim. We cannot survive without people — the migrants — coming to this country,” Triguboff says. “It is rubbish. We have never had these types of problems before.

“The other problem will be unemployment. It will be very hard for people. So we have to adjust as a country. We have to look at migration again, the (international) students must come again, too.”

As revealed by The Australian this month, Triguboff — the owner of 20 serviced apartment towers in the eastern states — stopped construction of a new complex he was building in the Melbourne CBD as the city entered stage-four lockdown.

The member of The List — Australia’s Richest 250 also ditched plans for serviced apartment projects in Canberra and Liverpool in Sydney’s southwest, saying it was too risky to pursue hotel projects and that he would convert them to residential buildings instead.

The Canberra and Liverpool projects are worth a combined $260m, and while Triguboff has been steadily, if slowly, reopening his serviced apartment hotel buildings, he says he has been focusing more on the portfolio of apartments he owns that he makes available to rent.

It is this part of the residential market that he admits has shown some weakness, even if some of it is by choice.

“I’m leasing out 200 units per week at the moment, but the prices have been down,” Triguboff says. “I used to say (earlier this year) that they were down 20 per cent, but I would say they are down between 5 and 20 per cent now. But I have no patience so I have been leasing them very quickly.”

The prices of apartments that Meriton is selling have increased slightly in recent months, Triguboff says, as first-home owner sales increase helped by a low interest rate environment and the stamp duty relief package the NSW government recently introduced. “Prices were previously back (up) about 2 per cent but I would say it is about 5 per cent now.”

He has apartment developments for sale in suburbs such as Sydney’s Zetland, Pagewood, Lidcombe, Dee Why, Alexandria, Mascot, Parramatta, North Ryde and Rhodes, as well as the Gold Coast in Queensland. But in overall terms Triguboff says he has wider fears for the residential market if overseas buyers don’t return to the market, even if supply dwindles because of a lack of projects.

Triguboff is not forging ahead with building thousands of apartments or buying vacant sites around Sydney at the same rate as he has in previous downturns.

He has built mostly in Sydney and southeast Queensland across his career, including the Gold Coast and Brisbane, choosing for Meriton to make recent forays to Canberra and Melbourne in only the past couple of years.

The last financial result Meriton lodged with the corporate regulator earlier this year, for the 2019 financial year, showed the business having an operating profit of about $356m.

Revenue last year was almost $1.75bn, down from $1.83bn for the previous year, but the pre-tax profit of $505m was about $20m up from 2018.

There was $3.5bn worth of land and buildings on the company’s balance sheet, up from $2.97bn the year before.

As for this year, Triguboff dismisses any concerns he may have about Meriton suffering a big fall in earnings: “I’m not too worried about the profit. It will be OK.”

He also insists it is no time for him to slow down from daily responsibilities at the Meriton office, arguing his experience is needed and that his employees are working harder than ever.

“Of course I am going to the office,” Triguboff says.

“So are all of my people here. They are happy, they are not bludgers. We have not missed one day here.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout