Speculation is mounting that another block trade by Kogan’s founders could be imminent.

It comes after the online marketplace posted a 55.l9 per cent lift in its full year net profit to $26.8m due to booming online sales.

While shares were down more than 5 per cent in Monday’s trade, Kogan’s market value has soared since the COVID-19 pandemic and is now about $2.3bn.

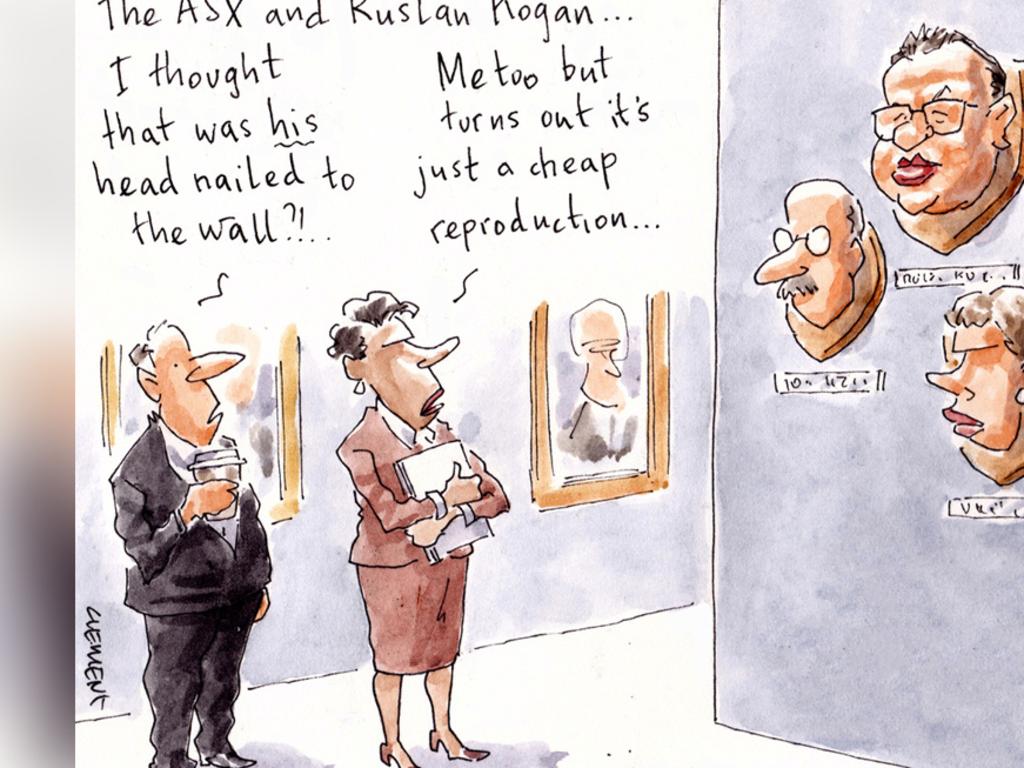

Its founders, Ruslan Kogan and David Shafer, sold shares in 2018 through investment bank Citi.

The pair had about 42 per cent of the listed business and that sale of just under 7 per cent of the stock took their interest down to about 35 per cent at the time.

Then, shares were sold at $6.41 each.

Some suspect that Canaccord and UBS could be on the ticket this time around.

Kogan said its full-year revenue increased by 13.5 per cent to $497.9m was driven by growth in its exclusive brands products.

Before Monday’s trading session, shares closed at an all-time high of $21.84.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout