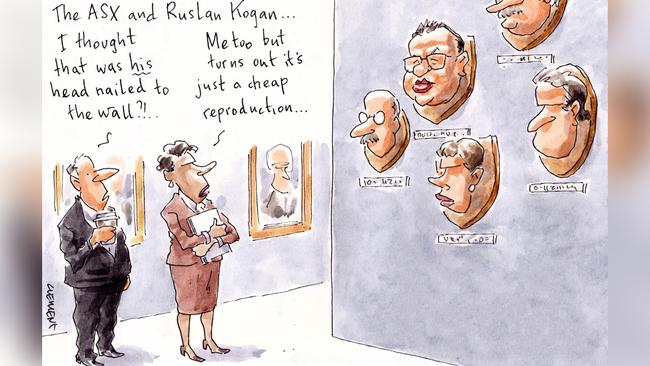

Who needs the formal channels of the ASX to update shareholders in this social media-driven day and age?

Certainly not Ruslan Kogan.

The boss of the online retailer was happy to tweet on the quick success of their recently acquired furniture house Matt Blatt through Twitter.

“Yesterday was a record day of online sales in the entire history of Matt Blatt”, Kogan tweeted to his 11,600 followers on Monday morning.

“Over $100,000 and 450 per cent up on the first full day in May. So proud of our team for this incredible turnaround and execution.”

Forget the long-held practice of having updates issued by notification on the ASX under the signature of the company secretary or listings compliance officer.

The shares were up 2 per cent, so perhaps not having a material effect on the share price, but Margin Call wonders: were all shareholders equally aware of the news?

Kogan has form, too, tweeting following the Black Friday sales last year.

“What a huge 24 hours Black Friday was,” Kogan noted. “Sales nearly double from $5.4m to $9.8m”, showing the difference between 2018 and 2019.

Last week Kogan raised $20m through a share purchase plan, with around half its shareholders electing to participate.

Hands are clean

It was hapless hand sanitiser company Holista CollTech that was updating shareholders on Monday, after an ASX query. It came after it had downgraded its $3.8m expected sales from its hand-sanitiser product, Natshield, to just $500,000.

Following last week’s shock announcement by Rajen Manick, the company’s share price plummeted from 14c to 7c.

The downgrade in sales was blamed on COVID-19 lockdown restrictions, as well as the race-related unrest in the US, as both issues disrupted its supply chain, including being pulled from Amazon’s inventory.

Of course, Holista recently had to issue two corrections regarding the sanitiser.

For just a few minutes there was hope in April in the Twittersphere of a miracle COVID-19 hand sanitiser. Holista quickly advised the ASX that a key word had been missing from its PR’s misleading tweet. Holista had announced that a plant-based ingredient in its hand sanitiser had been “tested by a UK biosafety laboratory to be more than 99.99 per cent effective against the feline coronavirus, a surrogate of the COVID-19 novel coronavirus”.

But their newly appointed media and investor relations consultant, Julia Maguire at Sydney-based The Capital Network, had tweeted with the key word “surrogate” missing, which resulted in a misleading statement.

Manicka was back a couple of days later to advise the ASX that Holista had pulled its YouTube video as it had also contained the same “misleading and incorrect statements”.

Gyngell out of picture

Former Nine boss David Gyngell, now recovering at his Byron hinterland home from a heart attack, seems even more unlikely than ever of returning to the television industry.

There was a recent, probably pesky, suggestion Gyngell was rated an outside chance of emerging at Channel 9 for a third time to lift plummeting morale borne of what internal sources called Hugh Marks’s “remote and spreadsheet-obsessed management style”.

A few years ago there was an even sillier suggestion that Oaktree Capital Management was hopeful that it could get Gyngell to take the reins at struggling broadcaster Network Ten.

Gyngell, who felt a shortness of breathe after training last week with laid-back tennis legend and Byron local Pat Rafter, now has a couple of stents in his heart.

“But I feel like I’ve got a new lease of life.” he told Philip “Buzz” Rothfield at The Daily Telegraph.

Ever since Gyngell stepped well away from Nine in 2015, he’s mostly spent his time on his burgeoning property empire in the NSW northern rivers district.

He also enjoyed a payday when Balter, the beer business co-founded by surfers Mick Fanning, Joel Parkinson, Bebe Durbridge and Josh Kerr, was sold to Carlton and United Breweries last year.

It was for about $200m, with Gyngell one of the bigger backers, bringing him full circle on his more youthful interests of surfing and beer.

He first bought commercial property in the Byron area, south in Brunswick Heads, in 2013, when he acquired the Hotel Brunswick, with his mate John “Strop” Cornell, for $5.25m.

They’ve invested in the 1940 building overlooking the Brunswick River, renovating during their seven-year ownership and just launching new office space.

The business partners have recently settled on the neighbouring property, costing $3m.

It’s their third investment in the tourism town as in 2016, they spent $3m on a property across the road. Last year Gyngell and wife Lelia McKinnon sold their Dover Heights home in Sydney’s east for $8.4m, but retain an investment apartment at Bondi Beach that cost $1.675m in 2017.

PM still on the job

So much for Scott Morrison taking holidays. Monday 8am saw him taking departmental briefings on the pandemic. And he remains “very connected” to national coronavirus operations despite the much-deserved short break.

“Just because I’m not in front of a camera doesn’t mean I’m not on task,” the Prime Minister told Nine Radio broadcaster Ray Hadley mid-morning.

But then his mobile phone call dropped out.

“Prime Minister we have a very, very significant problem with the line there, and you are starting to break up,” Hadley advised, then adding: “Don’t get me going on the poor coverage.”

“I’m within an hour of the CBD, so anyway … there we go,” a slightly frustrated Morrison advised when he dialled in again.

No clue there as to any glamorous holiday location.

The Prime Minister had advised the gallery press conference on Friday that he would be taking a short break this week with wife Jenny and daughters Abbey and Lily outside Sydney, but he would remain in charge during his “down time”.

“I will not be joining them for that full-time. I will also not be standing aside from the tasks I have all day,” Morrison said.

New board relations

There’s been change at The Australia-China Relations Institute (ACRI) at the University of Technology Sydney advisory board. Berkeley Cox, the chief executive partner at King & Wood Mallesons, is the chair of the organisation that was established after a $1.8m donation in December 2013 from the exiled chairman of the Yuhu Group, Huang Xiangmo.

UTS now fully funds ACRI, which was chaired by Philip Ruddock for the past three years.

The board’s renewal sees Clinton Dines, the former president of BHP China, at the table, along with former Blackmores managing director in Asia Peter Osborne. There’s a few professors including Garry Willinge and KPMG’s director of geopolitics and tax, Merriden Varrall.

Our own double Walkley Award-winning columnist Rowan Callick sits on the board, too.

Former NSW premier Bob Carr was its foundation director, but it is now James Laurenceson, who had been deputy director for five years.

Its 2020 research grant recipients include Lai-Ha Chan, at the UTS Faculty of Arts and Social Sciences, whose researched paper is advised as looking at “Australia’s half-hearted engagement with the Free and Open Indo-Pacific strategy (FOIP) and the Belt and Road Initiative (BRI)”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout