MySuper ‘heatmap’ cutting fees for superannuation fund members says APRA

APRA says its public naming of poorly performing super funds is cutting fees for more than 40 per cent of MySuper fund members.

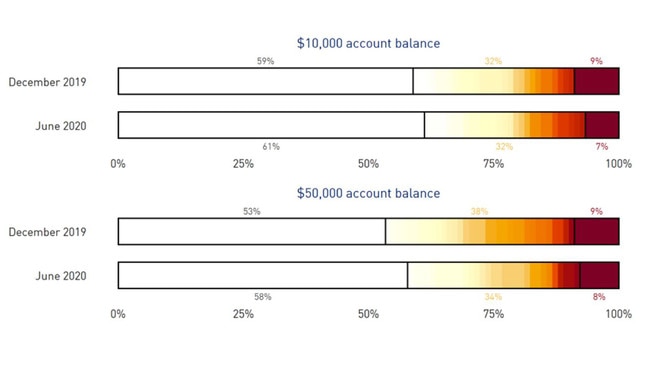

The prudential regulator says its public naming of poor performing super funds in 2019 has prompted more than a 40 per cent decline in fees incurred by members.

The Australian Prudential Regulation Authority said its MySuper Heatmap was saving account holders an estimated $110m per year, thanks to a drop in fees for 42 per cent of MySuper account members across the industry.

APRA’s MySuper Heatmap was introduced six months ago in an attempt to put poorly-performing funds on notice that they were producing substandard outcomes for members.

The product gauge looks at the fees and costs associated with a specific fund, as well as its investment performance and sustainability of returns.

Despite an overall fee reduction across products, APRA did note fund administration fees still remain “static” and in some cases have increased over the six month period from December 2019.

APRA deputy chair Helen Rowell said recent the coronavirus pandemic had affected investment performance across the sector, but efforts to produce strong consumer outcomes needed to persist.

“It’s disappointing to see so many funds still displayed on the heatmap in shades of red and orange when it comes to fees and costs,” Ms Rowell said.

“Since publishing the Heatmap last December, APRA has intensified its supervision of underperformers.”

APRA said it was writing to more than a dozen funds which continued to underperform with regard to high fees and costs attributed to members.

Ms Rowell said funds had a legal duty to promote the financial interest of members and had no excuse for keeping fees above competitors’.

The MySuper public data set uses a graduated colour scheme to identify whether a MySuper product was providing less than desirable outcomes for members.

According to APRA, 6.1 million Australians hold MySuper accounts.

MySuper products were first introduced in 2011 and are the default funds used by an employer when a person decides not to bring an existing fund to a new job.

The products were initially designed to be a low cost single diversified investment product. APRA plans to extend its heatmap to cover the insurance sector and other products.

According to the map, products offered by Westpac’s wealth arm BT Super have a higher proportion of fees compared to its peers.

IOOF’s MySuper product increased total fees on $10,000 account balances by 2.2 per cent over the six month period, while total fees on $50,000 account balances rose by 1.26 per cent.

Administration fees incurred on MLC MySuper accounts are also higher compared to competitors.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout