Coronavirus: Second wave of early super calls looming

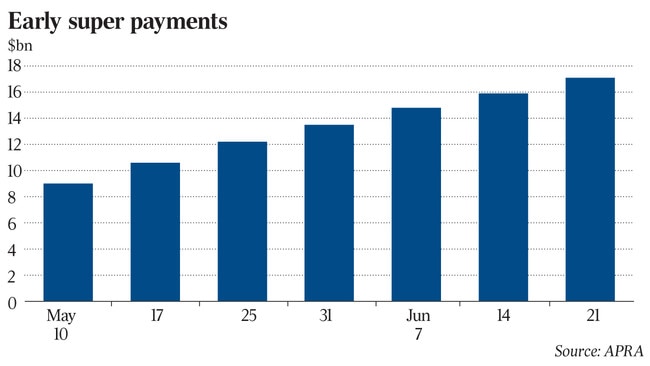

Super funds are preparing for a fresh wave of withdrawal requests due to hardship, with more than $17bn already pulled from the sector.

Superannuation funds are quietly preparing for a second wave of withdrawal requests as the new financial year is tipped to bring a fresh flood of hardship claims, with more than $17bn already pulled from the retirement savings sector.

Major funds have told The Australian that around 70 per cent of people who had requested payment in the first round are likely to apply for assistance in the second tranche — bringing total claims to more than $30bn.

Under the rules of the early release scheme introduced at the height of the coronavirus crisis, superannuation members can withdraw $20,000 over two financial years.

This means that $10,000 can be taken out in the 2020 financial year ended June 30, and another $10,000 from Wednesday.

Latest weekly figures provided by the Australian Prudential Regulation Authority show 2.4 million workers have lodged applications with the Australian Taxation Office to access their super early, totalling $17.1bn as of June 21.

The federal government implemented the support measure as a result of the economic downturn sparked by COVID-19, allowing workers to protect their income by dipping into their retirement savings.

A bulk of the payment requests have been made at five of the country’s largest industry funds, with AustralianSuper, Sunsuper, Hostplus, Rest and Cbus constituting $8.1bn of total funds paid out.

A report released Tuesday by The Association of Superannuation Funds of Australia shows that over half the applications lodged with the ATO have been from people under 35. The report also notes Queensland, Western Australia and the Northern Territory had experienced a higher proportion of withdrawals, as these economies rely more heavily on the tourism industry and discretionary spending activities.

ASFA chief executive Martin Fahy told The Australian that the biggest risk facing the sector during the second tranche of payment requests would be the number of account balances being wiped to zero.

“There is an increased danger that more people will drive their account balances to zero and will then end up losing their insurance cover,” Mr Fahy said.

“People need to be very shrewd in thinking carefully before withdrawing funds.”

Mr Fahy noted the majority of funds have already put provisions in place to cope with the new bout of expected payment requests, but the number of claims would depend on Australia’s ability to minimise the impacts of the pandemic.

“The amount that people withdraw, we suspect, will be a function of where we are with the overall health crisis and how that is likely to impact the economic trajectory,” Mr Fahy said.

There is growing concern within the sector as to whether a later surge in requests will occur when the JobKeeper wage subsidy scheme is scheduled to expire in September. Industry Super Australia chief executive Bernie Dean said the government needed to stick to its commitment of raising the super guarantee contributions to 12 per cent.

“To have Australians wiping their savings out midway through their life is a tragedy,” Mr Dean said.

“Those early contributions are like yeast: you pull them out and you end up with a far flatter result.”

AustralianSuper has paid out the most of any other fund by value, with nearly 330,000 members requesting a total of $2.3bn.

Sunsuper has lost $1.7bn in early redemptions from 239,882 members requesting an average payment of $7060.

Hospitality-based fund Hostplus has dished out $1.55bn, with 96.2 per cent of claims being paid within five business days.

REST has paid out about $1.56bn to more than 218,000 members.

A person is eligible for the scheme if they have become unemployed during the pandemic or experienced a reduction in working hours, but documentation is not required.

Federal Superannuation Minister Jane Hume said the scheme had been a “lifeline” to millions of Australians facing hardship during the shutdown. “We urge people to take the application process seriously,” Senator Hume said.

“I recommend that if you are considering withdrawing some of your super, you seek advice from a trusted financial adviser or your super fund.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout