Median super funds returned 14.7pc in 2019: Chant West

Median balanced super funds returned nearly 15pc in 2019, but one stood out, says Chant West.

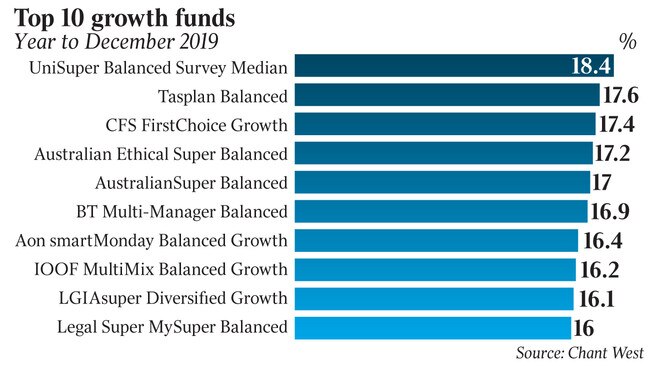

Surging equity markets lifted median balanced superannuation returns by nearly 15 per cent over 2019, but UniSuper stood out by matching the ASX200.

As the benchmark ASX200 clocked its best year in a decade with a gain of 18.4 per cent, UniSuper Balanced – a fund investing in Australian and international shares as well as cash and fixed interest among others – matched the index’s gain to be the best performing growth fund.

The median growth fund – with 61 per cent to 80 per cent in growth assets, in which most Australians are invested – returned 14.7 per cent, according to data from super tracker Chant West.

Earlier this week research house SuperRatings reported that median balanced superannuation funds returned 13.8 per cent over calendar 2019, the best gains in five years.

According to Chant West, even the worst growth fund returned a health 10.5 per cent, nearly 9 per cent above the rate of inflation.

Over the year conservative funds returned a more moderate 8.3 per cent, while all growth funds returned 20.8 per cent.

Shares were the main contributor to the broad strength in growth fund performance, with about a 53 per cent allocation on average, but all asset sectors delivered positive returns as record low rates pushed investors higher up the risk curve.

Global listed infrastructure returned 24.2 per cent, global listed property returned 21.2 per cent and Australian listed property returned 19.6 per cent.

“The better performing funds were generally those that maintained higher allocations to listed shares, which had a terrific year,” Chant West senior investment manager Mano Mohankumar said.

International shares surged 27.4 per cent in hedged terms and 28 per cent unhedged. Meanwhile the ASX200 Accumulation Index, which assumes reinvested dividends, rose an impressive 23.8 per cent.

In traditional defensive asset sectors however, bonds had a good year with Australian bonds up 7.3 per cent and global bonds not far behind with a 7.2 per cent return. As interest rates fall to record lows, it is not surprising that cash was the worst performing sector, with just 1.5 per cent.

Top performer UniSuper Balanced holds 38 per cent in Australian shares, with utilities Transurban and Sydney Airport two of its largest holdings, while Alphabet and Alibaba are key holdings in the international segment of its portfolio which is weighted at 22 per cent.

Cash and fixed income was its second largest asset class, making up 30 per cent of its portfolio.

Over a longer 10-year period, Hostplus and AustralianSuper edged above UniSuper to make up the top three funds, with returns of 9.2 per cent, 9 per cent and 8.9 per cent respectively.

“The 2019 result brings the average return over the past 10 years to 7.9 per cent per annum,” Mr Mohankumar said.

“That’s a tremendous run, but we should remember that it partly represents the recovery from the GFC when the median growth fund fell about 26 per cent.”

He cautioned that growth funds aren’t designed to yield such high returns over the long term and are typically built to return 3.5 per cent above inflation each year, or 5.5 per cent to 5 per cent per annum over the long term.

“It would be a mistake to assume that the level of returns over the past decade will continue,” he said.

“At some stage they’re going to revert to more ‘normal’ levels, and there will be more challenging times ahead.”

Chant West noted that since the start of compulsory super in July 1992, the average annualised return is 8.3 per cent, well above the 3 per cent to 4 per cent target of growth funds, even taking into account the tech wreck and GFC.

A similar note of caution came from SuperRatings, which earlier this week tipped “solid” super returns for the year ahead but urged investors to temper expectations of double-digit gains.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout