Mirrabooka: Investors ready to turn savage

Sky-high equity valuations mean companies that disappoint in the coming profit season will be ‘savaged’, according to Mirrabooka.

Sky-high equity valuations mean companies that disappoint in the upcoming profit season will be “savaged”, according to establishment fund manager Mirrabooka.

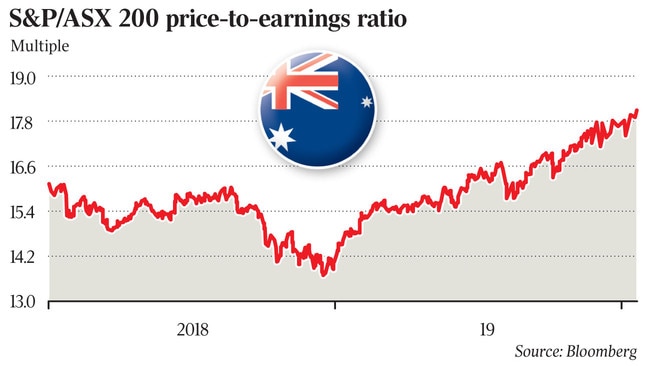

Ultra-low interest rates have helped drive the equity surge here and around the world, which has stretched the price-to-earnings ratio of many high-profile companies. But the expensive valuations in the face of subdued economic growth means there will be little room for error when earnings results are delivered from next month.

As the Australian sharemarket set a fresh all-time high of 6962.8 points on Tuesday, this pushed the price-to-earnings multiple of the S&P/ASX 200 to a record of 18 times.

Mirrabooka managing director Mark Freeman warned that companies — especially those in the mid-tier space — now had to justify their lofty valuations.

“This part of the market is notorious for savage share price reaction to any disappointment. A lot of companies will be threatened in this environment,” he told The Australian.

“The higher the PE ratio goes, the higher the share price risk if they don’t deliver good results. Regardless of the lower interest rate environment, investors are expecting earnings to support those valuations.

“Volatility will be high going into the earnings season.”

He said current share valuations were betting on significant growth, with little allowance for execution missteps that often hit the smaller end of the market.

His comments come as the US earnings season kicked off on Tuesday night, with results from JPMorgan, Citi Group and Wells Fargo, before the local season starts with Evolution Mining later this month.

Reflecting on the current market strength, Mr Freeman noted no sector had been spared, admitting there was a “struggle to find legitimate value”.

As at the end of December Mirrabooka, which oversees a $400m portfolio, had $18.6m in cash — boosted by takeovers in two of its key holdings, Dulux and Wellcom. Mr Freeman said the fund was content to hold under the expensive conditions.

“We are sticking with what we have but not rushing to put that into the market. We are on the cautious side as valuations are looking quite robust and the market is starting to look like money chasing assets,” Mr Freeman said.

“The challenge at the moment is we want to be sticking with quality, but quality has been pushed to high valuations.”

He described Dulux as an “irreplaceable asset”, lamenting its $3.8bn takeover by Nippon Paints in August as falling short of its valuation. “Given the market rally, Dulux would have been trading at the takeover level now,” he said. “Markets are too short-term-thinking on high quality and we were unhappy to be selling that stock.”

Mr Freeman’s comments came as the fund released its first-half results, posting a December half-year profit of $4.4m, down marginally from the $4.6m in the same period a year earlier.

Across its portfolio of medium to long-term investments, James Hardie was a standout in terms of returns, along with Xero and Carsales — each of which hit record trading highs on Tuesday.

The fund said it had consolidated its portfolio and had sold completely stocks it felt were less certain, including Boral, Iluka Resources, Sims Metal Management and WorleyParsons. Holdings in Lifestyle Communities was also trimmed after “overly strong” performance.

“Importantly, the 10-year return for Mirrabooka, including the benefit of franking credits, is positive 13.1 per cent per annum, well ahead of the benchmark over the same period, which is up 7.6 per cent per annum including franking,” the fund said.

Mirrabooka maintained a first-half dividend at 3.5c a share, fully franked. In the corresponding period last year a special dividend of 10c a share fully franked was paid, given the uncertainty surrounding franking credits in the lead-up to the May federal election.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout