S&P/ASX 200 records its best year in a decade with 18pc lift

The local sharemarket has surged to its best annual gain in a decade, with the ASX 200 recording an 18.4 per cent rise.

The local sharemarket has surged to its best annual gain in a decade, as the benchmark S&P/ASX 200 Index recorded an 18.4 per cent rise on the back of an aggressive search for yield.

The gains came despite end-of-year profit-taking that triggered a fall of 1.8 per cent, or 120 points in the benchmark index on Tuesday, cutting about $40bn of market value.

But even as earnings estimates retreated across the year after the worst economic growth since the global financial crisis — following China’s deleveraging campaign, hostile US trade policy and Australia’s housing downturn and crippling drought — the benchmark index closed the year at 6684.1 points, a 1037.7-point annual gain.

It marked the local market’s best year since a 31 per cent rise in 2009.

The gain was spurred on by surging global markets, three interest rate cuts from the Reserve Bank and its guidance for an extended period of low interest rates — including possible further cuts and quantitative easing as it pursues full employment and higher inflation.

The combination of rising share prices and falling estimates for 12-month forward earnings per share saw the forward price-to-earnings valuation of the S&P/ASX 200 hit a record high near 17.5 times.

At the same time, the 12-month forward dividend yield of the sharemarket hit a decade low of 4.1 per cent. But interest rate cuts improved the value of shares relative to bonds, the yields of which hit record lows as central banks abandoned plans to tighten monetary policy as growth slowed.

Instead, central banks mostly cut interest rates and increased liquidity in what amounted to their biggest overall change of direction in monetary policy since the global financial crisis.

Helping the appetite for risk assets including shares last month, the US softened its trade policy towards China by halting new tariffs and planning to rescind some existing tariffs pending the signing of a “phase-one” trade deal early this month, and a resounding victory by Boris Johnson’s Conservative Party in the UK lessened some of the risks from UK politics and Brexit.

Including dividends, the S&P/ASX 200 returned 23.4 per cent.

A 19.4 per cent rise in the broader All Ordinaries index meant it was the 16th best year for the Australian sharemarket in records dating back to at least 1936.

The gains came as slow growth and interest rate cuts reignited a global hunt for defensive income and growth opportunities in the sharemarket at the expense of value stocks tied to the economy.

The healthcare, information technology, consumer discretionary, communications services, industrials and materials sectors outperformed, while financials were a notable laggard as banks were hit by regulatory pressure, slower loan growth and narrowing interest rate margins.

The health index led rises with a 41.23 per cent gain, on the back of CSL’s 48.93 per cent surge. The biotech finished the year with a market capitalisation of $125.2bn, making it the third-largest locally listed company.

Infotech surged 31.8 per cent, as WAAAX stocks followed the enthusiastic performance of their US peers to be among the local market’s best performers. WiseTech rose 38.3 per cent, Altium surged 60 per cent and Appen soared 76 per cent. Afterpay recorded a 136 per cent gain and Xero lifted 90.4 per cent. In contrast, financials sharply underperformed the broader market with a collective gain of just 7.3 per cent. The sector was weighed down by Westpac, which recorded a fall of 3.2 per cent for the year, while ANZ eked out a 0.7 per cent rise and NAB rose 2.3 per cent. Commonwealth Bank fared better, lifting 10.3 per cent for the year.

The MSCI Australia High Dividend Yield index rose 36.4 per cent and the Growth index added 28.31 per cent, while the Value Index underperformed with an 10.8 per cent rise.

It was also a year when the gains in the best-performing stocks were vastly bigger than the falls in the worst-performing stocks. Those lucky enough to have picked some of the top 10 — including Afterpay, Magellan Financial, Fortescue Metals, Nanosonics and Avita Medical — would have more than doubled their money.

But the average decline of the worst performers — including stocks such as Costa Group, Pilbara Minerals, Whitehaven Coal, G8 Education and AMP — was “only” about 40 per cent.

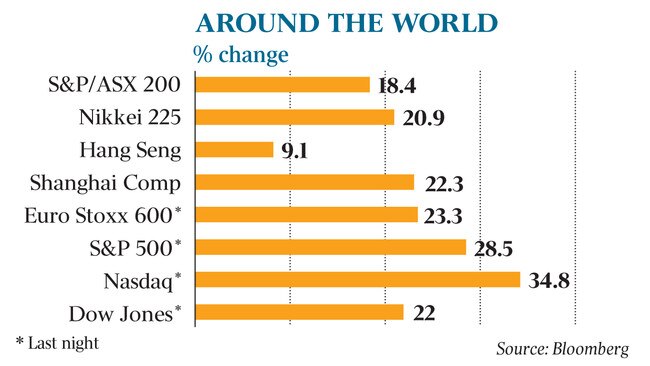

The flagship US S&P 500 index rose about 29 per cent after the Federal Reserve abandoned interest rate increases and balance sheet normalisation in favour of three interest rate cuts and balance sheet expansion.

The STOXX Europe 600 rose around 23 per cent as the European Central Bank cut rates to a record low of minus 0.5 per cent and restarted its quantitative easing program.

Meanwhile, China’s Shanghai Composite jumped 22.3 per cent.

Government bonds also surged and Australian residential property started to recover from a fall of roughly 10 per cent as the RBA cut the cash rate to a record low 0.75 per cent in response to sub-trend economic growth, stubbornly low inflation, rising unemployment and evidence that plunging property prices were affecting consumer and business confidence, as well as rate cuts overseas.

Australian capital city house prices have rebounded rapidly in recent months.

The median capital city house price rose at a double-digit annualised pace in November, following the RBA rate cuts as well as the passage of the federal government’s tax-cut legislation that began to be implemented in July, and the federal election outcome in May that effectively removed the risks of change to negative gearing proposed by the opposition Labor Party.

House prices have risen almost 7 per cent on average since the May election, the rebound led by Sydney and Melbourne, where prices have soared 10 per cent, according to CoreLogic.

Bloomberg’s AusBond Composite index rose 7.6 per cent as Australian bonds delivered their best total return since 2014. That was despite a rise in the 10-year bond yield to 1.3 per cent, from a record low of 0.85 per cent in August, amid an improving global growth outlook, a US-China trade deal and favourable UK election outcome.

A surging sharemarket combined with strong gains from bonds will provide superannuation funds with bumper returns for the year, according to industry research house Chant West.

After a relatively flat month for shares in December, the median growth fund with 61-80 per cent invested in growth assets such as shares was heading for an annual 14.4 per cent gain.

That’s a major turnaround from the December quarter of 2018, when the average super fund lost 4.6 per cent and sentiment was decidedly negative.

But because 2019 was a year when central banks responded to the late 2018 slowdown in economic growth and shares slump by mostly abandoning plans for interest rate rises and balance sheet normalisation in favour of interest rate cuts and balance sheet expansion, it sets up an interesting dynamic for 2020. Financial markets have already priced in additional monetary stimulus, yet central banks have put further rate cuts on hold as they wait for economic growth to respond.

Last month, investors received a taste of what may happen if economic data improves.

Stronger-than-expected Australian employment data reduced the chance of interest rate cuts, pushing the sharemarket down from a record high as the 10-year bond yield hit a five-month high.

Whereas bad news was good news for the sharemarket in 2019, the reverse may be true in 2020, because it could mean interest rates aren’t cut and the RBA doesn’t start quantitative easing.

Similarly, if bond yields were to rise sharply because of global factors such as lessening trade tensions, improving US growth prospects and a growing belief that Donald Trump will be returned to power, the sharemarket could face a valuation problem unless earnings estimates are revised up.

If the RBA does deliver more monetary policy stimulus, the question is how weak the economy needs to get before it does so. The market-implied chance of a February rate cut has fallen to 38.3 per cent, from 60 per cent before the November jobs data, and the chance of another rate cut any time next year has fallen back to 82 per cent, from well over 100 per cent last month.

Another question is whether the government moves to front-load its legislated fiscal stimulus in response to a weak economy, and whether that is enough to take pressure off monetary policy to provide stimulus, or whether the RBA sees that as a chance to launch quantitative easing.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout