Matt Comyn, the chief executive of Commonwealth Bank, is openly calling for moves to cool the same market in which the bank makes most of its money … what on earth is happening?

It’s a measure of just how stretched the gap between the real world and the residential property market has become that Comyn is doing this.

What he fears is crucial to understanding where house prices are likely to go from here for homeowners and investors alike.

It’s also highly relevant in getting a picture of how banking stocks may perform in the months ahead.

There are two issues here.

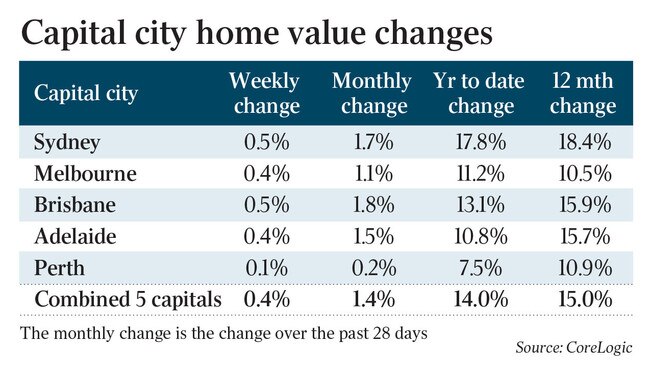

The first is the prospect of a further upward swing in residential prices once lockdowns fade away across the metropolitan capitals. That would mean an upswing on top of the 20 per cent that is already clocked up over the last year.

The second is the extraordinary situation where no single government agency has explicit responsibility for house prices – even though we are in what is surely the most unlikely house price boom in a century.

Comyn is worried that even though his bank benefits from strong house prices, any further escalation of prices against an economy where the GDP is going backwards may mean deep trouble in the longer term for an economy where housing debts are already very high.

Stressed homebuyers could ultimately flatten the housing market and take the steam from recently revived bank stocks, too.

-

Post-lockdown pop

It comes as the International Monetary Fund has warned that surging house prices have raised concerns about affordability and financial stability in Australia, recommending tougher lending standards and supply side reforms to take heat out of the market.

Comyn will be across not just local data but international housing data as well, and the picture overseas is that once lockdowns end property hunters burst back into action, stoking residential markets that are already very buoyant.

There are a string of driving factors:

● Activity accelerates after a period where it had been temporarily suppressed.

● The need to find more space in a new world where at least one member of a household will be working from home.

● The search by investors for residential property income that is superior to cash trust income.

● An uptick in demand for second properties such as holiday homes as wealthier homeowners put international travel in the “too hard basket”.

In the likely event that our market follows overseas patterns, then house prices are going to “pop” in the months after lockdown, eventually reaching a peak perhaps next year as the price growth begins to slow and the exceptional circumstances of the pandemic market begin to fade.

In the US, which is considerably ahead of the Australian economic recovery, house prices charged ahead post lockdown but are starting to cool now.

The median house price in the US was rising 18 per cent a year in August. This month the annual growth rate slowed to 14 per cent.

The issue for investors is that residential property has already been artificially pumped higher by the equally artificial low settings of interest rates.

As Comyn said this week: “In terms of increasing housing debt and increasing housing prices, we are increasingly concerned, we think it will be important to take modest steps sooner or later to take some of the heat out of the housing market.”

-

Where’s the regulator?

What Comyn did not spell out in his presentation to the Senate’s Standing Committee on Economics is that despite the extraordinary situation where he is openly saying he is worried about the market – and the bank is willing to take short-term pain to have it fixed – there is a blaring regulatory gap in this crucial area.

The Reserve Bank does not have a role in setting house prices. Maybe it should, as is the case in New Zealand, but just now it is removed from the picture.

Worse still, the RBA’s mission to stimulate employment means it is holding rates lower. This is the opposite of what an overheating residential market needs.

We do have a bank regulator – the Australian Prudential Regulatory Authority – and it is there to make sure the banks are operating well and there is no deterioration in lending standards.

The problem is that on paper the banking industry is humming away nicely – after all, interest rates have never been so low so bad debts are within a normal range.

But they are looking the wrong way – the banks are fine, it’s the customers that are facing trouble.

When something finally triggers government action, it may be much too late.

Comyn raised the idea of tightening “serviceability floor rates” across the industry – that’s a test on how much you can borrow based on an assumption that rates are higher than they are today. Such a tightening of home-loan serviceability assessments would have some impact, but there is no way the banks are going to volunteer en bloc to tighten their rules.

At the same time, the RBA does not want to know and APRA does not have enough evidence to make a move.

As the regulators stall, more than one in five households are borrowing more than six times income to invest in a market that looks like it will have even higher prices after lockdowns end.

Something is going to have to be done to cool the situation. It’s an urgent issue – if it wasn’t, the head of the nation’s biggest bank would not have brought it up.

Something very unusual is happening at the very top of the property sector – the head of the nation’s biggest mortgage lender wants the government to step in and cool the market.