Global markets nervous of Evergrande ripple effects

The woes of Chinese property developer Evergrande are rattling global markets with swathes of the Australian economy exposed to the fallout.

The woes of Chinese property developer Evergrande are rattling global markets as fears grow about the impact of a potential collapse of one of the Middle Kingdom’s largest companies, with swathes of the Australian economy exposed to the fallout.

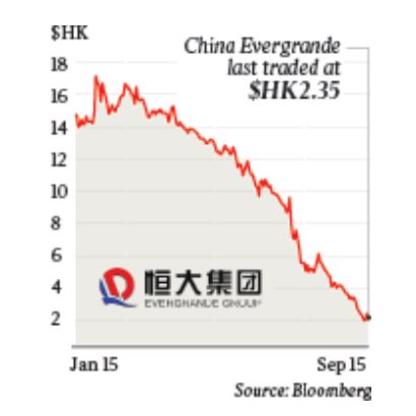

The Evergrande crisis was picking up steam on Friday with the Chinese developer’s near 12 per cent plunge in Hong Kong trading and its debt crashing, raising the spectre of broader contagion spreading deep into China’s murky financial system.

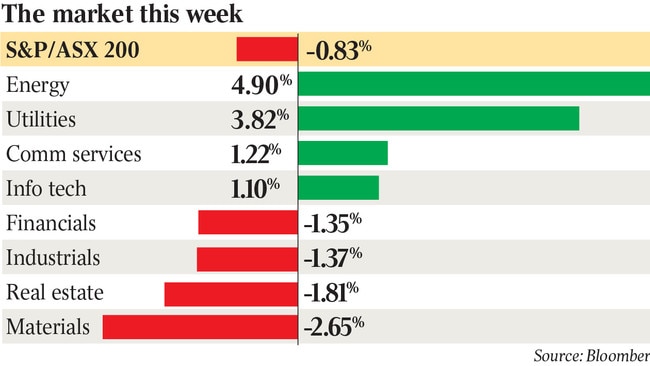

The developer was heavily sold off amid fears about the stalling Chinese property sector hitting global economic flows, with China’s least favourite trading partner, Australia, in the crosshairs if demand for resources dries up.

But markets are punting that Xi Jinping’s China will not let Evergrande’s failure become catastrophic even if the hot money invested speculatively in China’s property and debt markets are forced to take a haircut on their holdings.

While Evergrande’s problems show the Chinese property boom is well and truly over, global investors expect that the situation is headed towards a painful workout rather than an uncontrolled collapse, which would increase pressure on the country’s economic model.

Whichever course is taken, China’s deep links to the Australian economy mean that local ripples could be substantial even if there is not a deep hit to local share or property markets.

A plunge is not expected as ongoing tensions between Australia and China have already lessened ties and in property – a potential transmission mechanism after a period in which mainland buyers made a beeline for local apartments and Chinese developers poured in – the party is already over.

Resolution Capital chief investment officer Andrew Parsons dubs the consequences of Evergrande’s demise as significant and says much depends on how Beijing responds.

“While by itself Evergrande is not too big to fail, the broader consequences on the housing market, financial institutions and the economy are meaningful, particularly if it leads to the rapid collapse of many other highly leveraged players in the market,” Parsons says.

Parsons says equity investors and offshore bond holders should prepare for the worst, but they should not be shocked given Evergrande’s precarious position was evident for some time.

He says the Chinese Communist Party has warned in the past several years that it is seeking to address economic imbalances. Part of its motive is to curb the influence of large private enterprises and notable billionaires, but underlying these actions has been policies to rein in housing costs.

He argues this is a China problem, not a global one.

“We do not believe the challenges facing Chinese developers and their lenders is likely to be a crisis on the magnitude of Lehmans,” Parsons says.

“While there are ‘shadowy’ recesses in the financial system, there is limited evidence of low-doc NINJA-type (no income no job applicants) loans that riddled the US banking system in the lead-up to the GFC.”

Even if there is a liquidation or major restructure of Evergrande, he says this will be orderly with China’s deep-pocketed state-owned enterprises likely to be called on to help.

While foreign money will steer clear of China’s property market, Beijing will want the fallout to be limited. “Crucially, the CCP has no motive to undermine the housing market, the populace has most of its wealth invested in residential and … it is a significant driver of the economy. Hence, we expect the government will pull levers necessary to stabilise the market,” Parson says.

Global property stocks also carry much less debt than ahead of the GFC. “We therefore see limited risk of a repeat of the GFC liquidity crisis which impacted the REIT sector,” he says.

Macquarie Research has also played down the risk of Evergrande’s troubles hitting locally and prompting apartment defaults.

The last local downturn was marked by worries about defaults, but they were kept in check and this time there is even less exposure among big names. “Mirvac’s upcoming apartment exposure is relatively less reliant on offshore buyers compared to prior cycles (and) … Lendlease’s product is also more differentiated this cycle given the luxury nature of the key development at Barangaroo, which is more than 70 per cent pre-sold, of which 15 per cent is to offshore,” Macquarie says.

REA executive manager, economic research, Cameron Kusher is watching mainland developers. “For Australia, the concern is around Chinese developers that own sites in Australia as well as whether Chinese investors will sell up in Australia,” he says.

Some may go. And China’s policies are being blamed for Evergrande’s woes.

First Trust chief economist Brian Wesbury says much of China’s overbuilding and funnelling of money into real estate is a direct result of poor centrally planned policies, with the most notorious example being the country’s “ghost cities”. He says the real estate bubble seems to have burst but is not worried about international markets.

“Other private real estate companies, besides Evergrande, may default or go under. But will that bring contagion to the US? We don’t believe so,” he says. “Banks in the US have very little exposure to Chinese real estate. There may be some hedge funds that do, but not large banks.”