IPO doubts well placed as Prospa misses forecasts

Anyone who had doubts about non-bank lender Prospa when it pulled its first IPO attempt last year can now feel vindicated.

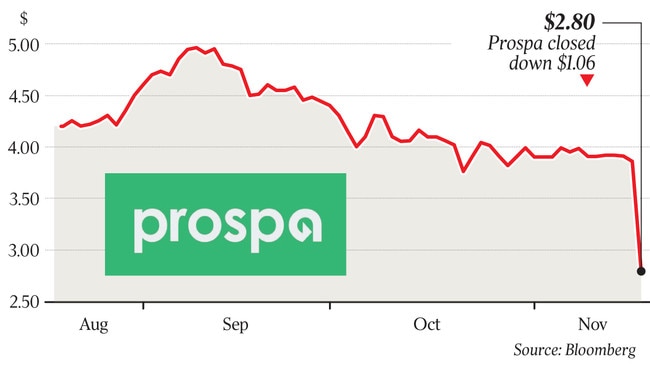

The financial services company that can charge up to 30 per cent to business borrowers has failed to match its prospectus forecasts and traders took to its share price with an axe on Monday, slicing almost a third off its price at one stage.

Remarkably, though Prospa can charge business borrowers more than a credit card provider — the average interest rate is 19 per cent — it has struggled to make money from charging rates that look exorbitant when we have a cash rate at less than 1 per cent.

Yet many small businesses now scramble beyond the borders of the traditional banking system to try anything to lift their own revenue. This non-bank demand goes some way in explaining the success of operators such as PayPal and, in a narrower vein, the string of “buy now pay later” operators led by Afterpay.

Prospa’s ability to fuel powerful compound annual growth rates of more than 100 per cent before it finally got its float away at the second attempt had brought in key investors such as Daniel Petre’s Airtree Capital and Paul Bassat’s Squarepeg group. But that underlying momentum of the group is now in question.

Moreover, the company’s attempt to explain the earnings “miss” as the unexpected outcome of success in converting higher-quality borrowers to the business model had the immediate effect of convincing very few observers.

After all, if a company is lucky enough to get a float away just months after a dramatic cancellation, common sense would suggest you make sure you deliver on IPO forecasts.

Prospa now expects earnings of only $4m for the year, which is a long way down from the $10.6m it was forecasting not that long ago.

Meanwhile, revenue is expected to come in at $143.8m, against original forecasts of $156.3m. After floating at $3.78, Prospa had a closing price on Monday of just $2.80.

Keep in mind, too, that Prospa has disappointed at a time when interest rates are dropping. How would this group, and its customer base of small business borrowers looking for loans with little security, perform if rates were rising?

Curiously, Prospa serves the same client base that has caught the attention of Scott Morrison with the Prime Minister’s novel concept of an Australian Business Growth Fund, which is close to launch — this is a fund that would allow small business to access equity as an alternative to debt.

The Australian Business Growth Fund is a politically driven concept where the major banks have been obliged to cough up $100m each in the formation of a $500m fund designed to bankroll up to 50 firms that might be lucky enough to get a slice of the action.

The fund will have its critics, but any business that can manage to avoid further debt and gain equity from the scheme will count itself lucky indeed, compared to being exposed to non-bank lenders that cannot offer convincing earnings even with the wind behind them.

Anyone who had their doubts about non-bank business lender Prospa when it pulled its first attempt at an ASX float last year can now feel vindicated: those doubts were well placed.