Shelved Prospa float hits finance listings

The shelving of online lender Prospa’s $146m stockmarket listing has put a shadow over other financial floats.

The shelving of online lender Prospa’s $146 million stockmarket listing has put a shadow over other financial floats, with consumer credit business Latitude expected to revisit its compliance with the securities regulator on lending rules before it pushes ahead with its own monster float later this year.

Latitude, which has more than 2.6 million customers, is slated to list during the second half of the year, after testing fund manager support for a float in recent months.

Latitude has been shaping as a $5 billion float in what would be the biggest ASX listing since Medibank Private in 2014.

Sources close to Latitude yesterday said the business was expected to get on the front foot to confirm its compliance with the Australian Securities & Investments Commission’s consumer credit rules. Latitude has a share of just under 8 per cent of the $100bn unsecured consumer lending market.

Meanwhile Prospa’s co-founders Greg Moshal and Beau Bertoli said they were confident the online lender’s plans to list on the ASX had not been terminally damaged despite its much-hyped $146m IPO being put on ice for the foreseeable future.

Speaking to The Weekend Australian, Mr Moshal said the last-minute decision to halt the listing had been a difficult one for the company, but one it had to make.

“As a financial services company we saw that as a prudent step to take and I think investors will ultimately reward us for that decision,” Mr Moshal said.

However, there are no immediate plans to resurrect the IPO. “We are not putting a timeline on it. We will now regroup and while the IPO option is still available to us we will look at when we can come back to it,” he said.

Prospa’s IPO was seen as an important step for the entire local fintech industry and the botched process has made many in the sector nervous.

One industry player told The Weekend Australian a number of Prospa’s peers have had to reassure their investors that the fintech’s last-minute hiccups did not affect the health of the entire online small business lending market.

Prospa maintains that its decision to defer the IPO just 15 minutes before it was scheduled to go live was based on its interaction with ASIC 24 hours before its originally slated day of listing.

According to Prospa, it received a letter from ASIC on Tuesday requesting information. However, The Weekend Australian understands the letter did not contain any specific requests that would warrant the postponement of the IPO. The corporate regulator had asked for a copy of Prospa’s contractual loan documents to get a clearer understanding of how a typical loan is processed by the lender.

ASIC has been conducting a broader review of the small business lending space for the past six weeks, with a focus on compliance, especially around the issue of unfair contract terms.

Mr Bertoli said Prospa had consistently reviewed its loan contract in relation to unfair contract terms laws, with the last examination carried out in September last year.

“With regards to UCT we take our guidance from ASIC and we continue to review our position,” Mr Bertoli said.

However, Prospa has not definitively clarified whether it is fully compliant with unfair contract rules, which were extended to protect small businesses in November 2016.

Given the heightened sensitivity around compliance in the wake of the banking royal commission and separate concerns raised about the disclosure practices and interest rates charged by online lenders, it is unclear why Prospa did not take the steps to become fully compliant prior to listing.

Prospa, along with several other fintechs, has been involved in building an industry code of conduct that would be enforced by ASIC. While some in the fintech industry have questioned why Prospa decided to go ahead with listing before the code of conduct comes into play in June 30, both Mr Moshal and Mr Bertoli said the decision to list was driven by the relatively robust health of the business.

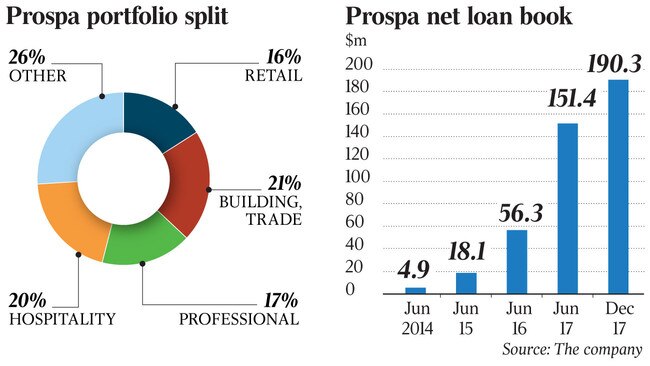

“We didn’t need to list, we chose to list. Our business is growing and in really strong shape,” Mr Moshal said.

Mr Bertoli added that while the issues discussed with ASIC were not material to the IPO and no additional disclosure was required in the prospectus, the listing had lost it momentum.

“The postponement did impact our momentum but when ASIC contacted us we had to pause and engage with them and consider the information presented to us,” Mr Bertoli said.

Despite the setback, Prospa said it had the full support of the board and its shareholders.

“Major shareholders, including Entree Capital, Square Peg Capital and AirTree Venture Capital committed over $47m to the IPO,” it said in a statement.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout