How the alert investor can ride the 2021 rollercoaster

It’s volatile and that’s not going to change but opportunities abound for the alert investor.

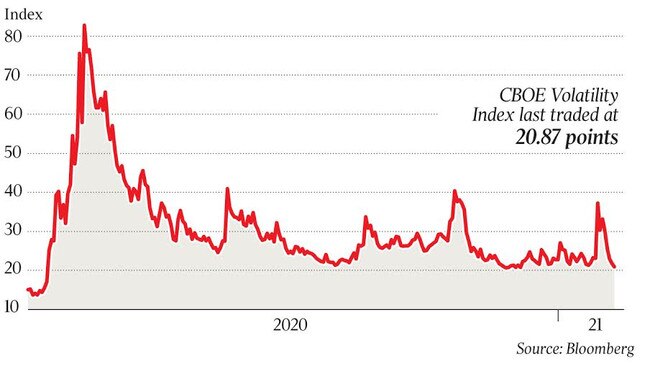

For the past 2½ years, volatility — the variance of returns in a market — has been a constant.

Now, higher volatility is seen by many as the new normal. I believe it’s here to stay, with events of the past few years tending to support this.

Let’s look back at the rollercoaster market performance of recent times.

● 2018: very strong third-quarter market returns, followed by a fourth-quarter correction of nearly 20 per cent.

● 2019: very strong for equity markets.

● 2020: onset of COVID-19 caused an extremely weak first quarter, an extremely strong second quarter and a strong fourth quarter.

How should investors respond to ongoing volatility?

To survive it and manage through, I have had to position portfolios for adaptability. That has meant many tactical adjustments to asset allocation over the last 12 months. These have generally been moderate, with the exception of an underweight position in fixed income and cash.

I have also largely been “style-neutral” with respect to our equity allocations. Or to put that another way, rather than getting caught up in the growth or value argument I favour a growth bias with quality always a priority.

Indeed, those investors who do swing between growth and value will only exacerbate the volatility they face in their own investing.

Though I see market volatility as being with us for a while, it has dominated so far in 2021. The headlines have focused on the devastating COVID-19 story with high northern hemisphere infection rates and deaths in Europe and the US. Nonetheless, markets have moved forward positively. The reason is the rollout of the vaccine. Markets are looking forward with confidence.

So are we in the late stages of a bubble?

I don’t believe so. As long as the vaccine rollout takes hold, there will eventually be an easing of restrictions globally — and an acceleration in growth.

However, I remain somewhat concerned about valuations in the US market. My concerns are tempered somewhat by the continuing favourable monetary and fiscal policy combined with the eventual reopening of their economy from COVID-19. Upward revisions to earnings expectations will also support equity markets in the medium term.

Further fiscal stimulus under President Joe Biden will be a continuing theme, with at least an additional $US1.9 trillion ($2.45 trillion) in support payments in the short term and additional long-term support to be announced shortly.

Meanwhile, my call of conviction for 2021 is emerging market (EM) equities. The valuations of Asian equities, led by Chinese equities, has seen this asset class produce solid returns. On a tactical asset allocation (TAA) position, I am overweight this asset class.

The recent strong performance has accentuated this overweight position. We have started to take some of this performance off the table to move back to the appropriate but overweight TAA position.

Despite the strong performance, Chinese equity valuations look less stretched than US equities. The global economic recovery, combined with strong domestic Chinese consumption, will underpin these valuations.

Having said that, it would not surprise me to see shares correct by up to 10 per cent in the near term but remain on a medium-term upward trajectory.

Where I am most concerned is the return of complacency that has crept back into risk-based assets, seen, for example in the recent headlines about cryptocurrencies.

I have repeatedly said that negative real interest rates support equity valuations. However, in a handful of sectors such as technology it does appear there are imbalances and pockets of elevated valuations.

What concerns me in these sectors is the leverage that has reappeared.

The Financial Industry Regulatory Authority in the US recently announced that leverage or borrowings against shares rose by $US56bn in December. This follows $US63bn in November to $US778bn, representing the two largest month-to-month increases on record. Since March 2020 alone, leverage has increased by about $US300bn, or 62 per cent.

Leverage can accelerate gains on the upside, but it accelerates losses on the downside. The degree of leverage that has reappeared in markets supports my concern around complacency.

In considering whether there is a bubble, investors need to ask whether real interest rates will remain low, and what will be the continued policy accommodation and pace of global recovery supported during the vaccine rollout.

London analysts Capital Economics see risk to markets in the immediate term linked to the progress of the vaccine. That would happen if it “is slower than we anticipate, held back by bottlenecks in production or, more likely, distribution and administration. Markets have anticipated the vaccine opening up economies, therefore failure to do so will lead to greater than expected downside volatility.”

While markets are anticipating a positive impact from the vaccine rollout, my concern is there may be impatience as this upside will not become evident until the second half of 2021.

Capital Economics notes: “The history of the pandemic has so far been one of hope trumping experience, with governments anticipating that lockdowns will be short-lived.”

Overall, I believe 2021 will be a strong year for sharemarkets but we should expect the new normal of volatility to continue.

Will Hamilton is the managing partner of Hamilton Wealth Partners

will.hamilton@hamiltonwealth.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout