Energy opportunities to charge your portfolio

The time to buy is not when everything is going hunky-dory, but when current difficulties obscure future profit growth.

This is what’s happening in the energy sector, where many of the companies are mired in current difficulties obscuring the future profit growth from higher spot gas prices.

Liquefied natural gas prices collapsed early last year due to the COVID-19 pandemic, but factors such as an Asian cold snap, northern hemisphere winter demand, shipping constraints, China recovery post-COVID-19, and higher Korean demand due to nuclear generation outages led to severe supply tightness resulting in a surge in the LNG netback price from historical lows of around $2.30 a gigajoule to around $10 at present.

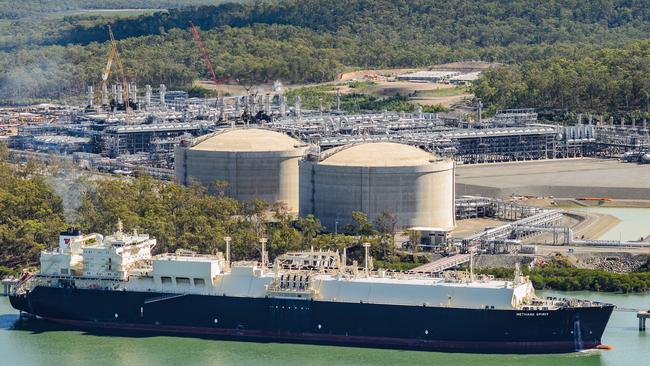

A classic example at the small end of town is Cooper Energy, which will benefit from the severe shortage in gas eastern Australia is set to experience from 2026 due to the vast LNG exports from Gladstone through the likes of Origin Energy and Santos.

Cooper is in the box seat to be a key supplier to southeast Australia, where it believes the market opportunity is 70 petajoules a year by 2023 and more than 100PJ by 2024. One petajoule is the equivalent of powering about 19,000 homes for a year. Utility customers include AGL Energy, Energy Australia and Alinta Energy.

Cooper is now at the beginning of contracted gas sales, which is no mean feat considering the major problems management has had to deal with. These centre around the APA-owned and operated Orbost Processing plant for Cooper’s flagship offshore Sole gas field in the Gippsland Basin in Victoria.

At the big end of town I like Origin Energy, which has the ability to ramp up LNG production to take advantage of higher prices with gas production techniques supported by artificial intelligence: this is through its 37.5 per cent interest in Asia Pacific LNG. In November 2020 it achieved record operated asset production of 1614 terajoules a day, but Origin is under pressure on earnings, an announcement this week highlighting that its retail business is generating lower profits, driving a 13 per cent downgrade in FY21 earnings (EBITDA) guidance.

Then there is energy contractor Worley, whose stock was hit hard recently in the wake of a profit downgrade due to ongoing COVID-19-related project deferrals. The company expects these projects to return as global economic conditions improve. There have been negligible project cancellations, but the announcement underlines how volatile the contractors’ earnings are and also how there are opportunities for investors who like value.

Worley has broadened out its offering to beyond oil and gas and says it is seeing profit potential accelerate across all its sectors.

Last, if you’re looking to reduce your portfolio risk, arguably you can’t go past pipeline owner/operator APA Group. The company has a strong defensive asset base and balance sheet, which gives it the ability to fund more infrastructure investment. Late last year the company announced it would invest up to $460m to construct a 580km pipeline in Western Australia connecting the emerging gas fields in the Perth Basin to the resource-rich Goldfields region, forming an interconnected WA Gas Grid, expected to be operational mid-2022.

APA has growth potential and offers a dividend yield of more than 5 per cent. With all this uncertainty, here’s a stock with a monopolistic position to consider, in part because it allows you to take more risk in the smaller end of the market.

Disclosure: interests associated with the author owns shares in Cooper Energy and APA.

Richard Hemming is an independent analyst who edits undertheradarreport.com.au