How Richard White’s WiseTech became the new millionaires’ factory – or even billionaires’ factory

Move over Macquarie Group: Richard White’s global logistics software business is surging in value and accounts for more members of the Richest 250 than any other company. Here’s how he did it.

Move over Macquarie Group: Richard White’s WiseTech Global is the new millionaires’ factory. Or even billionaires’ factory.

Shares in the ASX-listed global logistics software company have surged by 67 per cent in the last six months and 75 per cent since January 1 as it rides the e-commerce boom.

It means White now has a paper fortune of about $6.46bn alone from his WiseTech shares, which on its own is enough to have him closing in on the ranks of the top 10 wealthiest people in the country on The List – Australia’s Richest 250.

White, a one-time guitar technician and wannabe rock star, holds about 44 per cent of WiseTech, which he founded in 1994, and has been gradually selling relatively small parcels of shares to both diversify his assets and the shareholder base of his company.

He has offloaded about $120m million worth of shares – including $6.5m last Friday – since April alone, and before then sold about another $150m in regular on-market transactions in the previous year.

WiseTech has been one of the most successful ASX floats of the past decade, having increased in value more than 10 times in only five years since its listing in 2016.

At that growth rate, it means White is not the only one benefiting from the WiseTech boom.

Take Charles Gibbon, a long-time WiseTech director who would now just about be considered a billionaire thanks to WiseTech’s stunning rise in value.

Gibbon has a stake in the company now worth about $930m.

Having first become a WiseTech shareholder in 2005 when it still was a private company and after a long career in institutional funds management, Gibbon served as WiseTech’s chairman from 2006 to 2018, and is offering himself for re-election to the board at WiseTech’s annual general meeting next month.

Gibbon is already a member of The List along with another board member in Michael Gregg, who also became a shareholder in 2005 and then joined the board the following year. Gregg sold almost $38m of shares on the market in August and has a stake worth about $670m.

He and Gibbon have their own investment firm Shearwater Capital, which focuses on business to business software-as-a-service start-ups. Shearwater’s portfolio ranges from wind turbine business Diffuse Energy to enterprise sales platform LivePreso, dog food delivery firm Lyka and biotechnology company GPN Vaccines.

Gregg and Gibbon met at Health Communications Network, which listed on the ASX before being eventually acquired by Primary Healthcare for $111m. On Gregg’s last day at HCN he met White, and then went on to invest in WiseTech along with Gibbon.

–

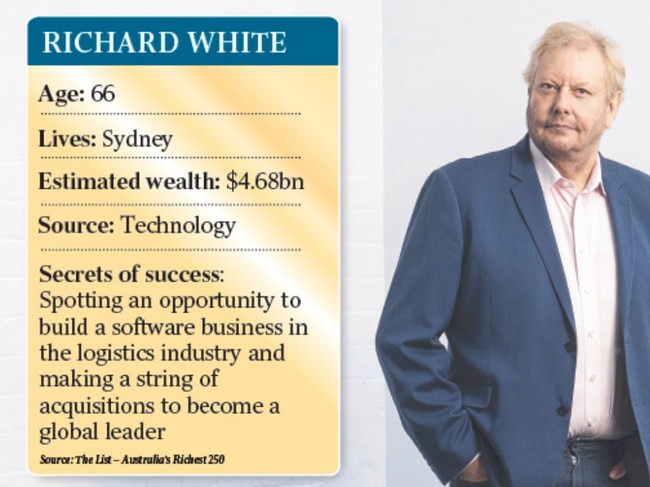

Richard White

- Age: 66

- Lives: Sydney

- Estimated wealth: $4.68bn

- Industry: Technology

- Secrets of success: Spotting an opportunity to build a software business in the logistics industry and making a string of acquisitions to become a global leader

Source: The List – Australia’s Richest 250

–

Another WiseTech executive in Maree Isaacs, who helped White found the company and remains on its board and as head of licence management, is also headed towards The List.

Isaacs’ shareholding in the company is worth almost $600m.

WiseTech provides cloud-based software for the logistics industry, giving freight forwarders a single platform to manage the movement of goods from start to finish.

The company, which has previously come under attack from short-sellers, is riding a wave of support for Australian technology stocks, with the likes of Afterpay locally and Atlassian in the US becoming market darlings.

White’s shareholding in WiseTech accounts for the vast majority of his fortune, though he has some other investments and assets.

He has a stake of about 20 per cent in ASX-listed business register firm Kyckr, but the stock is down 35 per cent since January 1.

White also owns the family home he grew up in Bexley in Sydney’s south, though the value of that property is dwarfed by the industrial holdings White has in Sydney’s inner-city suburb of Mascot and near WiseTech’s Alexandria head office.

He owns a stake in private sound and lighting company Jands, where he started working in 1981 and later invested in and bought the headquarters. White has since reportedly spent about $150m on commercial property in the same precinct.

Then there is a collection of guitars that includes a famous Cloud guitar used by pop legend Prince in his Purple Rain tour, said to be worth about $500,000. White was formerly a guitar technician for Australian bands such as AC/DC and The Angels.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout