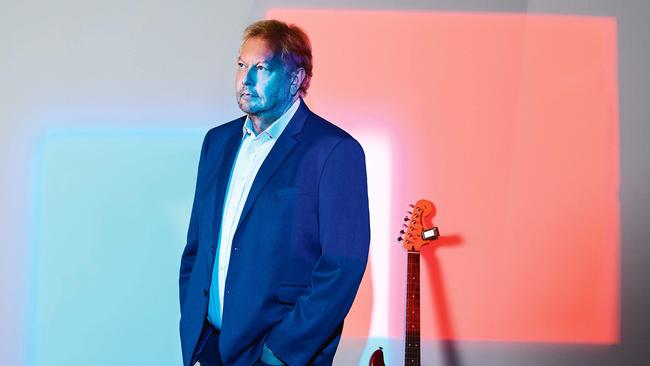

Australia’s Richest 250: Richard White is off the charts, on the money

Richard White may have left behind his rock-star dream but the founder of Wisetech is not short of passion and drive.

Legendary Australian band The Angels are ripping through their well-honed brand of sweaty pub rock, and the middle-aged crowd is swigging beer and singing along to every song. But this isn’t your normal rock show. The billionaire founder of WiseTech Global, Richard White, is onstage with The Angels, just hours after ringing the bell that took his logistics software company public. It’s April 11, 2016, and WiseTech has just surged 16 per cent on its first day of trading on the ASX, to $3.89 per share.

Today those shares are worth more than $15, but in 2013, White – who owned more than half the company – was just enjoying the moment, belting out a couple of classics.

“We’d borrowed the bell from the stock exchange, and brought it onstage with us,” he tells The List. “I played one of The Angels’ hit songs with them – Who Rings The Bell. It’s this great anti-establishment song. And I broke the rope [attached to the bell].”

That night in 2016 was symbolic of the gritty, hard-working ethos that White says is embedded in the DNA of his software business. But before he ever dreamed of shaking up the global logistics industry, he had a different plan.

“In the middle of high school, I started playing guitar, and that quickly became an enormous passion and overtook everything else,” he says. “I wanted to be a rock star. It might have just been to meet girls, but in any case I was quite good at it and by the end of high school we’d formed a band.”

White’s first band, a glam rock outfit called Jade, didn’t find the same success as The Angels, Hush or AC/DC, but grew up around them and toured with them. And White’s subsequent impact on Australia has arguably been just as mighty as that of those bands.

“It was the golden age of Australian rock,” he says. “It was great

except for one problem – there was absolutely no money in it. None of us had any, even all these famous bands. I had some near misses; I really scraped along the bottom for a while.”

Fed up with being broke, the guitarist decided to put his musical talents towards something more lucrative. He set up a guitar repair shop in Sydney, doing work for Angus and Malcolm Young of AC/DC, Rick Brewster and Carlos Santana. As fun and as profitable as it was, the business had a problem of its own – it couldn’t scale; it relied on White’s two hands to work. So he sold it to a co-worker and started a lighting equipment business. That then merged with Australian outfit Jands, where White started working with computers.

Something clicked for the one-time aspiring rock god.

“I realised that programming is like electronic poetry,” he says. “To me it felt like, and still feels like, a beautiful piece of art that you do. And I liked the whole structure of playing with technology to solve problems.”

White started consulting for freight-forwarding companies, and says he noticed a lot of people running between computers with pieces of paper. He programmed the first version of what would eventually become WiseTech in 1992, with Brett Shearer, the company’s current chief technology officer, joining in 1993 alongside fellow co-founder Marie Isaacs.

“It was tiny compared with what we have today, but it was a full forwarding system, customs system and accounting system all in one,” White says. “You didn’t have to leave the software at all, and that just roared through the Australian economy and chewed up our competitors. We ended up buying most of them, or the shells of them, and we became very dominant in Australia.”

He adds that the Y2K bug washed out enormous amounts of legacy software across Australian businesses, and given WiseTech’s software had been certified as compliant in 1997, companies made the switch en masse. The firm quickly outgrew the Australian market, and White decided to turn WiseTech into WiseTech Global.

“I told my marketing manager, ‘You run the company – go to that side of the room, leave me alone and I’m going to build a global system’,” White says. “I hired a new team, and I said to them, ‘That’s the old company, and this is the new company; we’ll invite them in once we’re ready’.

“That new business was aimed at targeting the world, and I can’t tell you how many times people told me that we’re crazy.”

Today, WiseTech claims to service 19 of the top 20 logistics companies globally. White is now worth more than $3 billion, but he says his wealth has not affected his relationship with money.

“I was always very frugal,” he says. “A couple of those early businesses ran out of cash, and you say, ‘How am I going to pay the wages on Friday?’ So by the time I go to WiseTech I had certainty it would be a cash-positive business.

“Wealth is not something that motivates me, it just allows me to do things.” He adds that he doesn’t know what retirement is and that he’s committed to running WiseTech for the long-term. He has given up the rock-star dream, however.

“As you mature you realise that childhood fantasies drive you, and they create passion, but you need to replace them with something more fundamental,” he says.

“For me, playing a guitar now is like playing golf is for other people. I’m a good player, I can make the instrument do things, but it’s not what I want to do with my life.”

Like any rock band that goes through ups and downs, WiseTech has been hit with turbulence, both internal and external. The company is still worth many multiples of its valuation when it listed in 2016 but is enduring a rough patch –not unlike a difficult second album.

Short-seller J Capital Research savaged its core software, CargoWiseOne, in reports that claimed WiseTech had been making acquisitions to artificially inflate its growth.

“WiseTech’s acquisition spree looks like a frantic effort to maintain the narrative that this is a fast-growing technology business,” J Capital said in its report.

The twin attacks, in late 2019, wiped off more than $2 billion of WiseTech’s value in just one week. The company also saw almost 30 per cent of its valuation evaporate in February 2020 as the impacts of the coronavirus epidemic triggered a downgrade.

“Every road has potholes,” White says. “When something like this happens you have to be very resilient, and be surrounded by other people who are very resilient.

“We had to stop for a couple of days and dig deep; many people around us had two sleepless nights on both occasions. And we went hard at it.”

Following the J Capital short attacks, the executives hunkered down in the company’s Alexandria offices to plot their response to an assault that White says would have taken J Capital six months to concoct.

“It does gel the team,” he says. “And the report didn’t make any sense, let alone logic, so it was about forming a coherent answer that answered enough of the questions so it didn’t seem trite but still didn’t take a month to figure out their crazy logic.

“It was character building, it was formative, and we came out of it a much better team. And at the end we just got back to work, and since then we’ve largely ignored it. What matters is what happens in three to five years’ time – our big vision.”

The executive wants to see more protections against short sellers, arguing that J Capital’s attack was a form of market manipulation. White says that, on a deeper level, Australia has to change how it treats technology. He says the country boasts some world-class companies, his own included, but the economy needs to undergo more of a structural overhaul.

“We have to build a technology future because the jobs of the future won’t be anything at all like the jobs of the past,” he says. “Every sector of the economy will be affected. We’re a country that’s run on resources, but there’s a finite limit to them, and some of them create huge problems, like coal.

“Technology creates wealth, value, and massive improvements to the world we live in. That’s the future for us and we have to be there; China, the US, Israel and Ireland are all going to be there.”

White describes Australia as a smart country with good laws, a strong society and a “challenger” culture.

“We have a gritty self determination to make things happen,” he says. “We need to be Australia-first, and technology-first.”