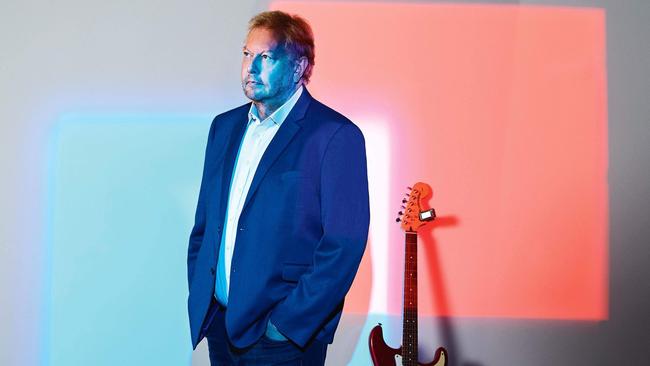

A long way to the top for former AC/DC guitar tech Richard White, CEO of WiseTech

Richard White is close to being among the top 10 wealthiest Australians after a surge by shares in his logistics software firm WiseTech.

WiseTech Global chief executive and former AC/DC guitar tech Richard White is close to being among the top 10 wealthiest Australians after shares in his logistics software company surged by almost 60 per cent as it rides the boom in e-commerce.

Mr White’s stake in WiseTech is worth about $5.5bn, but rose as high as more than $6.4bn on a wild day of trading for his company on Wednesday making his paper wealth higher than notable business identities such as John Gandel and James Packer on The List – Australia’s Richest 250.

White’s fortune was up as much as $2.4bn on paper during the morning trade on Wednesday, while non-executive director and long-time shareholder Charles Gibbon was closing in on billionaire status.

By the end of the day, White’s fortune had risen by a still spectacular $1.2bn as WiseTech shares surged 28 per cent to $46.50. The shares are up more than 70 per cent in the past six months and have increased ten-fold since White took WiseTech public with an ASX float in April 2016 at just $4 per share.

WiseTech provides cloud-based software for the logistics industry, giving freight forwarders a single platform to manage the movement of goods from start to finish.

The company, which has previously come under attack among short sellers, is also riding a wave of support for technology stocks, spurred on in recent weeks by the $39bn acquisition of Afterpay by Jack Dorsey’s payments company Square.

Mr White declared a “goods-led” recovery is bolstering his software company’s prospects and helping drive accelerated revenues.

In its financial 2021 results released Wednesday, WiseTech posted total revenue up 18 per cent year-on-year to $507.5m, and exceeded guidance reporting earnings before interest, taxation, depreciation and amortisation (EBITDA) of $206.7m, up 63 per cent year-on-year.

It expects growth of between 18 per cent to 25 per cent for financial year 2022.

“The best thing about the numbers is all of them,” Mr White said in an interview Wednesday.

“I think it’s great that investors love the result, I’m very happy for our shareholders and I’m very happy for Australian technology particularly,” he said.

Mr White said he wasn’t distracted by the share price swings.

“I try really hard not to get excited about prices, but to focus on doing great things for our business. We’re moving inexorably towards becoming the operating system for global logistics, that’s the thing that really turns me on and makes me want to strive for success.”

Such is the share price boom for WiseTech this year alone though that it would have at least four executives and shareholders on The List if its valuation holds.

WiseTech co-founder Maree Isaacs would also join The List with a fortune worth more than $500m. Ms Isaacs is now the firm’s head of invoicing and licensing.

Mr Gibbon, who first became a WiseTech shareholder in 2005 when it was a private company, is already a member of The List along with another board member in Michael Gregg.

Mr Gregg’s stake is now worth more than $600m.

Mr White sold more than $60m shares in WiseTech between April and June earlier this year.

WiseTech posted a net profit after tax of $160.8m, down 33 per cent, which it said was hit by writedowns from several acqusitions. Its underlying net profit after tax was up 101 per cent to $105.8m, while revenues for its CargoWise software were up 26 per cent on financial year 2020 to $331.6m.

He said that WiseTech had secured six new global rollouts in financial 2021, and had signed up FedEx as a partner since the end of the financial year.

“Importantly, we have a strong pipeline of potential new global customers, which we are actively pursuing,” he said.

Mr White started the software company in 1994 after running a successful guitar repair business and short stints in various bands. After deciding he wanted to ditch the music industry, he navigated through a list of ventures from lighting design to computer wholesaling.

All of these proved profitable, but he was convinced he needed to tackle something bigger and commit to it.

“I decided that I had to choose something and stick with it for a very long time to create real value. I had done things but had always exited before the big bang,” Mr White told The Australian.

“I was doing network and integration consulting and a couple of customers were freight forwarders. Their systems were just terrible. I started working within these businesses as a consultant, writing software, and realised that there was this huge complex problem that no one was addressing.”

As for his wealth, the executive said 100 per cent of his responsibility lies with WiseTech, which he started two and a half decades ago.

“I have a few very small, relatively speaking, investments in founder-led tech companies. But they really run themselves and I’m just providing a little bit of fuel.”

WiseTech declared a fully franked dividend of 3.85 cents per share, up 141 per cent year-on-year, payable on October 8.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout