Launched in January 2020 when inflation was nowhere to be seen, house price increases are now eating into a range of homebuyer assistance initiatives.

Mostly used by the under 30s, the guaranteed home loans allow the purchase of a property with as little as a 5 per cent deposit and without the need to take out expensive mortgage insurance. The government guarantees the difference between what the first-home buyer has saved and the 20 per cent deposit threshold lenders require.

Mortgage brokers working in the scheme suggest that applicants typically have around 10 per cent of the deposit, with the government stepping in to guarantee the rest.

But the bad news is that applicants using the scheme will now generally need up to a quarter more than they did a year ago. In Sydney a 10 per cent deposit now sits around $110,000 after prices jumped to a median of $1.1m inside a year.

Michael Baumann, executive general manager of home buying at CBA, says: “House prices have certainly gone up but we are also hoping that people have saved more during the lockdowns — the statistics would suggest this is the case.”

CBA, NAB, and Bendigo Bank are among a panel of lenders administering the scheme which is due to take on more lenders later this year.

The variation between regional house prices has also thrown up distortions in the scheme, where an applicant in Perth with a median home value of $531,00 can get a much better deal from the guarantee scheme than one in a higher priced city such as Canberra where the median is now $906,000.

A report into the effectiveness of the scheme, released last year, found the majority of First Home Loan Deposit Scheme guarantees went to women applicants. It also discovered that homebuyers were able to bring their home purchases forward by an average of four years.

This week’s release of around 5000 new loans under the scheme is not strictly an extension of the government program but the “reissue of unused guarantees for first-home buyers” from the last financial year.

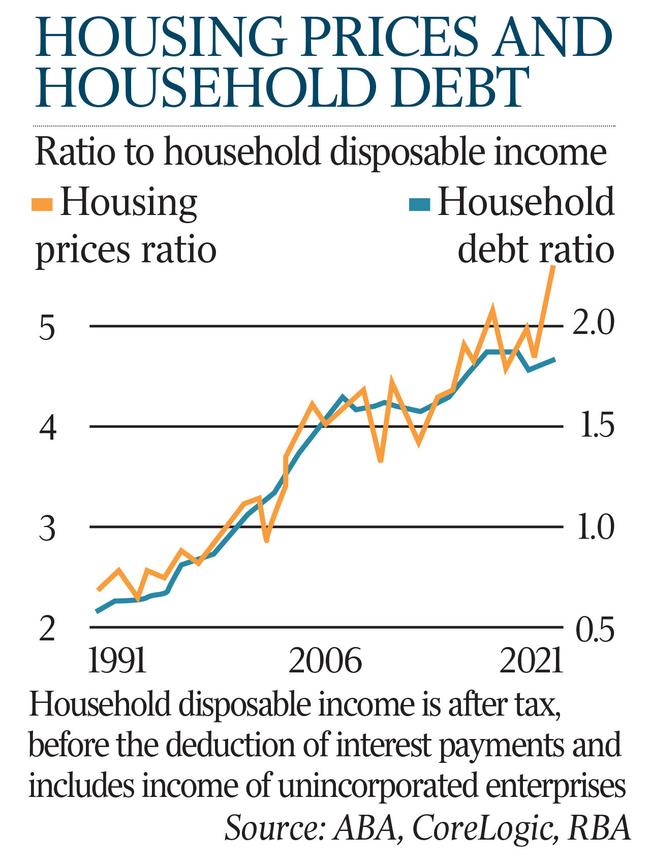

The trouble for the scheme – and a range of related schemes that are stuck on a fixed percentage of assistance – is that house prices continue to rise relentlessly on a monthly basis.

Research group CoreLogic tagged the most recent figures for January as “a surprise to the upside” – the median price rose by 1.1 per cent over the month.

The latest report, for the month to January 31, found that even Melbourne, which had posted a decline in values during December, had reversed course.

More generally, the January uptick means the 12-month increase in house prices was now at 22.4 per cent, the highest annual growth rate since 1989.

The declining impact of the first home grants is also clear from the fall in owner-occupier share of the residential market, as investors return to control more than a third of the market.

The release this week of a further batch of government-guaranteed home loans – the most successful of Canberra’s first homebuyer schemes – highlights the fading power of the schemes as a 20 per cent lift in house prices undermines their promise.