Formula One season can’t come soon enough for stockpicker Will Vicars, as Caledonia keeps losing value

Netflix helped rejuvenate the global motor racing series, and boost the share price of its Liberty Media owner — a good investment for Will Vicars.

It is getting harder to find a good performing stock in Will Vicars’ portfolio, which is why the start of the Formula One season this week is timely.

Vicars manages about $10bn of investor funds for the Darling family and other wealthy individuals and families at Sydney private funds manager house Caledonia.

Most of Caledonia’s holdings are listed in the US, though it has a smattering of European stocks and last year sold a $720m stake in ASX-listed Challenger after being a long-term holder in the investor and wealth manager.

Its biggest positions are in online real estate marketplace Zillow and global betting giant Flutter, which has a local angle via its ownership of digital betting giant Sportsbet, but those two stocks have fallen from record highs in the past year.

Vicars has had better luck with Liberty Media, the majority owner of the global Formula One circuit.

It is now about five years since Liberty bought the motor racing giant, which has been transformed from a popular though seemingly ageing competition past its glory days into one that has captured a new, younger viewership and fanbase via the Netflix hit series Drive to Survive.

Netflix released the most recent series late last week, ahead of the opening round of the 2022 Formula One season this weekend in Bahrain.

Caledonia holds a large stake in the Nasdaq-listed Liberty Media Formula One Series stock, which has almost tripled in value in the past three years and is up about 22 per cent in 12 months.

Vicars himself holds a stake in Caledonia, the basis of his estimated wealth. Caledonia recorded a whopping $526m profit for the year to June 30 last year as fees for successful investments in Zillow, Liberty Media, Flutter and Scientific Games flowed in.

Vicars and his shareholders received about $33m in dividends for the performance, and another $25m for the 2020 financial year, with Caledonia’s revenue jumping from $112m in 2020 to a massive $603m.

But Zillow struck trouble as 2021 went on, eventually closing its algorithm-based home-flipping outfit called Zillow Offers. Zillow shares plunged, hurting Caledonia’s subsequent performance.

Zillow Offers was going to be a big part of the company’s future and the main reason why Vicars once said Zillow would soon be worth $US1000 per share.

The Nasdaq-listed shares are more like $US47 now, and are down about 25 per cent since January 1. They have fallen almost 70 per cent in the past 12 months.

Zillow’s performance was a big part of the reason that Caledonia had about $US1.5bn ($2.05bn) wiped from the value of its US stock holdings in the December quarter, according to documents lodged with the Securities and Exchange Commission. Its portfolio also reportedly fell by more than 10 per cent in January.

Much of Caledonia’s holdings are centred around digital stocks, including gambling firms and home delivery food services, healthcare and education.

Flutter shares have fallen 21 per cent this year and 45 per cent in the past 12 months on the London Stock Exchange. Flutter’s Sportsbet has a 50 per cent share of the local online betting market though, and recently posted an adjusted operating profit of about $750m for 2021 in Australia.

Caledonia’s investment in Scientific Games is down about 28 per cent in 12 months, but its holding in fitness group F45 is up 27 per cent since January 1. F45 is headed by Australian CEO Adam Gilchrist.

Caledonia also has a large stake in telehealth group American Well, which has fallen 47 per cent this year.

Closer to home in Australia, Vicars’ private investment in luxury fashion brand Oroton is showing some signs of progress – though it has still been costly for the billionaire.

Vicars bought Oroton for about $25m in July 2018, rescuing the 80-year-old business from administration. He had previously held a stake of almost 20 per cent in the business.

Documents lodged recently with the Australian Securities and Investments Commission show Oroton’s revenue rose by about 16 per cent to almost $80m in the year to July 31, but it made a loss of $1.24m after posting a $2m profit in the previous 12 months.

The loss was mostly due to an $1.9m investment in new technology and a point of sales system though.

Oroton also received government JobKeeper payments of about $1.7m during the year.

The company’s accounts do include a going concern note from the auditors that includes details of Oroton having access to a cash advance facility of more than $25m provided by Vicars and Westpac. The company’s unused borrowing facilities also include a $15.4m loan from Vicars.

-

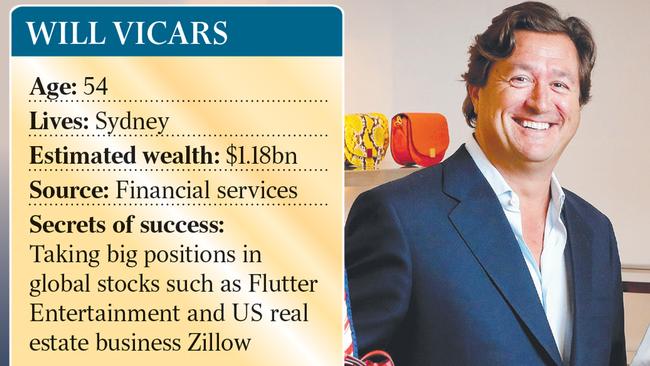

Will Vicars

Age: 54

Lives: Sydney

Estimated wealth: $1.18bn

Sector: Financial services

Secrets of success: Taking big positions in global stocks such as Flutter Entertainment and US real estate business Zillow