Will Vicar’s Caledonia clocks hefty profit; Max Beck heralds in 80 with high-flying guests

It turns out that billionaire Will Vicars is like the rest of us – in some ways, at least.

The star stockpicker at Caledonia had a terrific first half of the year, but it’s all gone a bit pear-shaped in the last six months.

The financial report for Vicars’ Caledonia, where he and Mike Messara manage a good $10bn or so for the Darling family and a smattering of other rich-lister investors, shows the firm had a huge 2021 financial year.

For the year to June 30, Caledonia made a whopping $529m profit!

Fees for its success in investments in Zillow, Liberty Media, Flutter and Scientific Games were absolutely flowing in, with Caledonia’s revenue jumping from $112m in 2020 to a massive $603m.

They were heady days. US real estate online marketplace Zillow was a market darling and Vicars and Messara were looking like geniuses.

Zillow – Caledonia’s biggest position – struck trouble as the year wore on, however, and it closed its algorithm-based home-flipping outfit called Zillow Offers – which was going to be a big part of its future and the reason why Vicars said Zillow would soon be worth $US1000 per share.

Those same Nasdaq-listed shares are more like $US60 now, and Caledonia is said to have lost about 10 per cent from its funds since January.

Vicars and his shareholders can content themselves with about $33m in dividends though, and another $25m it declared for the 2020 financial year.

All the better for his still ongoing, years-long quest to turn a block of eight flats in Bondi, bought for $11.6m in 2017, into his new ultimate three-bedroom family home overlooking the Pacific Ocean.

Plans first lodged in 2018 estimated the cost of the build in the ballpark of $1.2m, though with works continuing and no signs yet of any real structural progress you’d have to think the money pit was growing at a fair rate still.

Best just file it under another Zillow Offers miscalculation.

–

Rich and famous

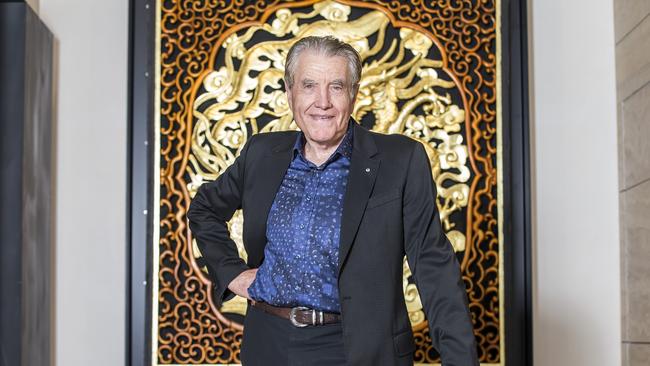

It sure is hard to find a better-connected person than veteran Melbourne property doyen Max Beck, who well and truly proved that point on Friday and saved the best for last in 2021.

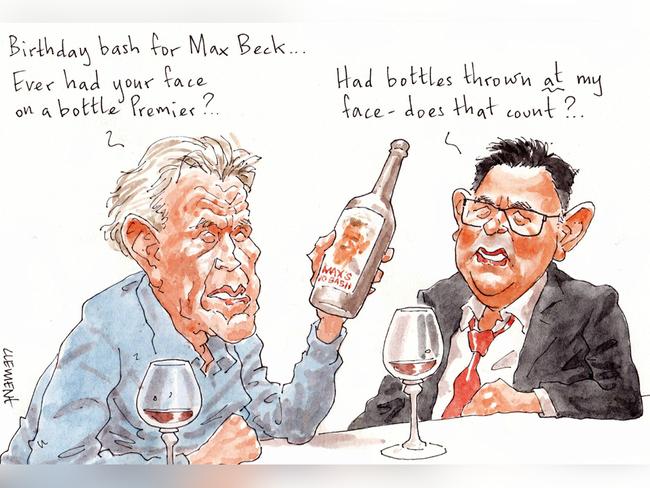

Beck celebrated his 80th birthday on Friday with a lazy $10bn or so in the room – half of The Australian’s Richest 250, basically – plus assorted political figures and other identities down at Sorrento’s hottest new restaurant, Italico, on the foreshore on the Mornington Peninsula.

As befits a bloke who still rides hundreds of kilometres a week, a special vino for the birthday was created by Mitchelton Wines (owned by Jayco caravan magnate Gerry Ryan) called Max’s 80th Shiraz (the one-off label has Beck emerging from the Arc de Triomphe – Tour de France style – on his bike), sourced from 25-year-old vines planted in the deep red Cambrian soil of Heathcote (in other words, the vines are 55 years younger than Beck).

Suffice to say the wine flowed throughout the afternoon.

Italico owner Marco Di Pietrantonio, who first met Beck at the Melbourne institution Pinocchio’s Pizza in South Yarra he and his family ran for 40 years, ensured that the guests had an abundance of food and drink to enjoy the lunch.

The menu consisted of an entree of fresh crumbed calamari and some of Marco’s famous pizzas, including the Bunga Bunga named in honour of former Italian PM Silvio Berlusconi – with caramelised onion, pork sausage and broccolini.

Main course was followed by fresh barramundi or filletto di manzo (eye fillet) and capped with a special birthday cake for dessert, featuring Beck’s smiling face.

Beck had a who’s who of Melbourne along, including long-time mate and truckie billionaire Lindsay Fox and his sons Peter and Andrew, alongside Beck’s trio of boys Ben, Nick and Sam.

There were unconfirmed rumours of a sighting of Victorian Premier Dan Andrews too, with the state’s boss currently holidaying down at the Peninsula (at a house without stairs, we hope).

Retail guru Solly Lew was definitely there, as was pokies king Bruce Mathieson, corporate undertaker to the stars Mark Mentha, rich list painter John Higgins and surfwear pioneer Brian Singer.

Former Labor leader Simon Crean also put in an appearance, as did real estate agent Joe Bongiorno, Hotel Sorrento owner Rob Pitt, Terry Campbell of Mirrabooka and ex-Tabcorp boss Ross Wilson.

The food and booze flowed well into the afternoon, and Beck is likely to have to work lunch off by riding up the steep Arthur’s Seat over the weekend. He’ll need it.

–

The house always wins

Could this be the real reason bookmaker Tom Waterhouse and wife Hoda relocated overseas?

The couple and their three young children recently swapped Sydney’s north shore for winter in the UK, reportedly in a bid to drum up support for the 39-year-old’s digital bookmaking investment fund.

Margin Call hears there might be other reasons too, the family in recent days lodging plans to upgrade the beachfront block they bought for $13m in 2015, demolishing the current home and building a schmick two storey, six-bedroom replacement.

Surely it would have been just as easy to bunk in with mum Gai Waterhouse down in the Southern Highlands than make the shift abroad.

Architect Luigi Roselli described plans as upgrading the “dated existing building to suit the needs of a young family”, with the plans including a new swimming pool and beach terrace for easy access to Edwards Beach out back, as well as a new grand spiral staircase and master suite.

All up, the ambitious reno is set to cost the Waterhouses in the realm of $4m.

His Waterhouse VC boasted gross one-year returns of 120.63 per cent to the end of November.

Here’s hoping the bookie turned venture capitalist can keep up his current streak.

–

Early exit

Administrative Appeals Tribunal registrar Sian Leathem has brought forward her exit from the review board to January, and we can’t say we’re surprised.

Only weeks ago this column’s colleague Strewth reported AAT president David Thomas had been asking his deputy presidents to write letters of support for the besieged registrar following her disastrous performance at Senate estimates in October.

Leathem’s term in the role, which commands a $415,000 annual pay cheque, had been slated to expire in April, but Margin Call hears staff were informed on Friday that the registrar had resigned, with her last day in mid-January.

In an email to colleagues, Leathem noted that she had “decided to take up a new professional challenge” after almost seven years in the role.

“I am very proud of what we have achieved as an organisation, particularly the way in which we responded to the Covid-19 pandemic, and know that there are hundreds of talented and dedicated members and staff who will continue to deliver and support high-quality merits reviews to our users,” she wrote.

Nothing at all then to do with being labelled “argumentative” by Liberal senator Sarah Henderson and the warning by Labor’s Kim Carr not to mislead the Senate during her appearance for the tribunal in October.

We’re eager to know where she ends up.

–

Guess who

And with that we mark our final column for 2021. Thanks to our readers and anonymous tipsters for support during the year.

Along with new Covid variants, 2022 will also feature a new face on the column, as Mel moves on to a new challenge.

While we’d like to reveal said new identity, where would the fun be in that? Watch this space.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout