AustralianSuper eyes $300bn milestone

AustralianSuper plans to become a $300bn super fund, a move that would consolidate its position as the nation’s biggest investor.

AustralianSuper plans to become a $300bn super fund, a move that would consolidate its position as the nation’s biggest investor.

At the same time the fund giant says it is likely to launch more full-scale takeover bids of companies as an investment strategy, after this week launching a $5.1bn on-market takeover of New Zealand-based clean energy infrastructure investor Infratil.

“There will be more, but it is not going to be the main form of investment,” AusSuper chief executive Ian Silk told The Australian.

“We are not going to be doing them every day of the week.”

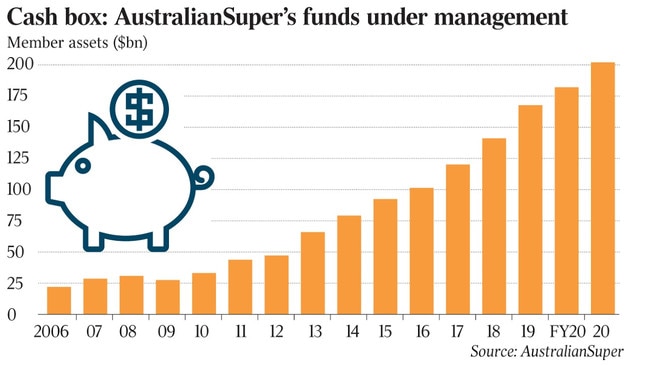

AusSuper on Thursday passed $200bn in assets, making it by far the largest super fund in the country after a decade of continuous growth. This compares with the $163bn Future Fund.

AusSuper, which was only established 14 years ago, now has more than 2.3 million members or 10 per cent of the Australian workforce.

Chief executive Ian Silk told The Australian that he expected AusSuper would become at least a $300bn fund but would not say when he expected this to happen.

“We are planning with that in mind,” he said. “We are not saying ‘how do we get to $300bn?’ That is not the intention.

“But when we look at the trajectory of the fund, we are thinking about what it should be when we become a $300bn fund.”

The fund has grown from an initial $21bn in 2006 with 1.2 million members when Silk became chief executive, to $40bn in 2010.

Mr Silk said AusSuper added another 410,000 members in the financial year to the end of June 2020.

He said the fund would continue to bring more of its investment management in-house.

“Over the last 10 years we have halved our investment costs and we have been the No 1 performing super fund over five, 10 and 15 years in the SuperRatings survey,” he said.

The fund currently has some 43 per cent of its assets managed in-house, a move which has saved it $200m in investment fees in the last financial year.

“We are looking to increase that (the percentage of assets managed in-house) to 50-60 per cent,” he said.

“And that per cent will come off a higher level of assets.”

As the fund has grown it has become more aggressive in its investment strategy, moving from investing in shares to launching direct takeovers of companies.

Mr Silk said AusSuper’s high cashflows meant it had the funds to make bids like this week’s $5.1bn takeover bid for Infratil.

The bid, which was rejected by Infratil on Wednesday for being too low, involves a $4bn cash component.

Mr Silk, who did not comment on the future of the transaction, said AusSuper could be expected to be doing more of these transactions.

“But a modest amount more,” he said.

“We have more than 50 per cent of our assets in equities and that will continue to be the biggest share of assets.”

Australian Super was attracted by Infratil’s unique portfolio of assets, which include stakes in Vodafone New Zealand, RetireAustralia and Wellington International Airport as well as renewable energy companies including wind farm Tilt Renewables, Galileo Green Energy, Trustpower and Longroad.

It is also interested in its links with Wellington-based fund manager Morrison & Co, which launched Infratil in 1994 as an infrastructure investment fund.

Morrison has stakes in funds worth a total of $15bn and has a mandate to handle the global infrastructure investments of the New Zealand superannuation fund.

The bid is another sign of AusSuper’s desire to play a more active role in its own investment destiny, including making direct “take private” investments.

This week’s bid follows AustralianSuper’s unsuccessful $4bn bid for ASX-listed private hospital operator Healthscope in 2018 in conjunction with private equity player BGH, which was ultimately outbid by Canada’s Brookfield Asset Management, and its successful involvement in a consortium which bid $2.1bn for ASX-listed education group Navitas last year.

AusSuper has total investments in Australian shares worth more than $43bn with half its total assets in Australia.

Mr Silk said he expected that there would be an increasing proportion of its funds invested offshore because of the limited size of the Australian market.

The fund has seen an outflow of more than $5bn this year as a result of the federal government’s superannuation early release scheme, which was paid to 450,000 members.

Mr Silk said he hoped that the early release scheme, which has seen some $40bn flow out of the Australian superannuation system, was a once-in-a-century emergency move for early access to super that would not be repeated in the near future.

AusSuper has a staff of 900 people, most of whom are in its Melbourne head office.

It has about 40 people in London and a small research team in Beijing, with plans to open an office in New York once travel restrictions to the US ease.

Mr Silk said he expected AusSuper’s growth to be largely organic.

He said the fund had recently ended merger talks with a mid-sized super fund.

“We declined the opportunity,” he said.

“We are not interested in growth for the sake of it.”

But he said the fund was “open to discussions” with other super funds about mergers.

“We are having preliminary (merger) discussions with two other organisation at the moment,” he said, but declined to be specific.

“We will only doing it if it is in the interests of our members.”

Mr Silk said that he expected the planned increase in the superannuation guarantee — from 9.5 per cent to 10 per cent in July and to 12 per cent in 2025 — to go ahead. He said he would be concerned if there were any move moves to offer early release of superannuation.

“The early release was appropriate for a once-in-a-century release but extending it in the future for other purposes is going to destroy the superannuation element of the national retirement income system.”

Mr Silk said the $200bn asset milestone reflected “Australian Super’s ability to use its size and scale to provide strong long-term returns while also driving down costs for members.”

He said the fund had supported 20 Australian companies which had raised funds this year, investing $380m in new capital to stabilise their businesses.