Infratil manager Morrison & Co eyes investments in healthcare and digital assets after rebuffing AustralianSuper

Morrison & Co, the manager of Infratil, says it’s looking for ‘ideas that matter’, in sectors including healthcare and digital.

The chief executive of Australasian infrastructure fund manager Morrison & Co, which manages Infratil, says AustralianSuper’s $5.1bn play for the latter group reflects its high-quality assets and premium returns, as Morrison pursues new opportunities in healthcare and digital infrastructure.

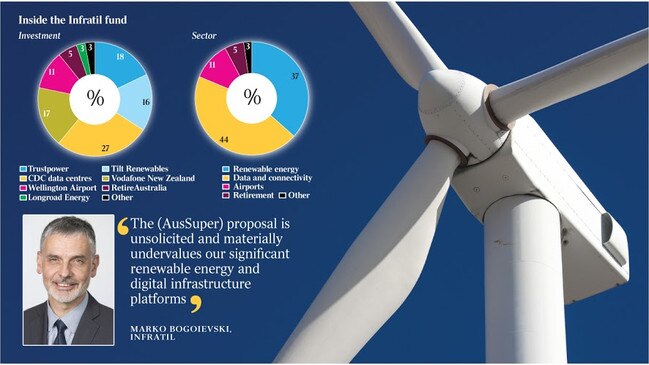

Morrison & Co chief executive Marko Bogoievski, who is also the CEO of Infratil, said the offer by Australia’s biggest super fund was “a reflection of the high-quality assets our team has built and the premium returns we have achieved for investors, across all the capital we manage”.

His comments came as Infratil’s board knocked back the unsolicited AustralianSuper offer saying the proposal “materially” undervalues the infrastructure manager’s renewable energy and digital infrastructure holdings.

In a wide-ranging interview with The Australian, he said Morrison had “no qualms going head to head with any of the global players” in the infrastructure space after its management of Infratil’s assets had consistently delivered annual returns of 17-18 per cent for investors.

In addition to Infratil, Morrison manages multiple client mandates with total funds under management of around $17bn. Half are New Zealand-owned and the remainder by Australian and international investors.

Its clients include The Future Fund, for which it manages manage Perth Airport and CVC Data centres, as well as Sunsuper and the Commonwealth Super Fund.

Morrison takes a high conviction, thematic approach to investment, with a guiding purpose “to invest wisely in ideas that matter,” according to Mr Bogoievski, who was speaking before AustralianSuper’s revelation on Tuesday of its approach to Infratil.

At the end of October a consortium of Morrison & Co and Infratil offered to take a controlling interest in the 70-plus-clinic Australian diagnostic imaging businesses Qscan Group, valuing the company at $735m.

The deal marked the first major push by Morrison, which is better known for owning wind farms, data centres and telecommunication networks, into the healthcare sector.

Morrison also has an investment in RetireAustralia, a retirement village business.

“It is a pretty interesting space. I think you will see more infrastructure investors turning up in healthcare because it is an essential service.

We are largely focused on diagnostics — helping communities deliver diagnostic services in the suburbs — and using technology appropriately to get better clinical outcomes,” Mr Bogoievski said.

“It is as much a data business as it is an infrastructure business. Maybe COVID has given us a little push to think about things differently.”

He also said he expected more traditional infrastructure investors would “get set” in digital infrastructure opportunities, especially in the wake of Telstra’s recent move to attract more revenue by selling its infrastructure services separately.

“I do think it is important for national economies as to what future models are going to emerge in this space,’’ he said.

“The future for us is going to be more greenfield … more about what community and national outcomes do we want from real assets.

“The pressure is going to come on super managers, politicians and regulators to come up with the right models.”

Three of Morrison’s major funds, including Infratil, raised additional capital during COVID to take advantage of new opportunities.

Morrison manages seven airports in Australasia which had their issues during the pandemic as airlines were grounded, and Mr Bogoievski acknowledged the group was revisiting its assumptions around business travel.

“What you are seeing with airport valuations is some adjustments of 10-15 per cent versus pre-COVID. But that is being reasonably conservative. It is not 30-40 per cent. The longer term trends around leisure and essential travel makes these incredibly valuable assets if they are managed well,’’ he said.

In October, Morrison & Co’s board committed to becoming climate positive to offset carbon emissions by 120 per cent, which has driven AustralianSuper’s interest in the company.

“Because of our New Zealand-based starting point, the country had a history of investing in renewable energy. A significant proportion of our energy comes from hydro and we saw the commercial benefits of non-subsidised investments in renewables very early. It is the right thing to do,” Mr Bogoievski said.

“Energy efficiency drives our initiation activity. Our clients demand not only direct investments in climate positive assets, but they will require full ESG principals in our investments — it turns up as the core of your investment principals. Fortunately, we think there are very attractive commercial returns if you get on with it.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout