That is a fair bit of value leakage to put to one side before the argument starts on the asset valuations.

The external management model has largely gone out of favour and is not necessarily bad if performance measures stack up.

On this basis with Infratil earning 18 per cent a year against stated hurdles of 11-15 per cent, you have to say it passes muster, but it’s safe to assume if AS wins control Morrison will lose its lifeblood.

Infratil’s returns are good enough to justify the use of an external manager, but by definition the model opens the door to value leakage with listed company shareholders handing money across to the privately owned Morrison run by the same person, Bogoievski.

The board is using an independent group on the board to assess the bid, but its rejection must raise questions about whose money the board is trying to protect.

The deal highlights AustralianSuper’s intent to own more of its assets long-term in house.

After first approaching the Infratil board in October and being rejected twice, it has gone public in an attempt to take the fight directly to shareholders.

This is a hostile move for a fund that had previously joined with private equity in making such public to private takeovers.

At last count AustralianSuper had more than $180bn in assets under management so has plenty of firepower in the hunt for high-yielding long-term assets.

Chief investment officer Mark Delaney a couple of years ago plotted life running a $300bn fund manager by 2024 and the way things are going with $19bn in net inflows alone last year that is no pipe dream.

It also tends to put context into the debate around the superannuation guarantee and what it means for the funds, although the issue is more around member funds and what chance they have of getting a pay rise next year without the 0.5 per cent increase in superannuation guarantees to 10 per cent.

It is better for the fund to own the assets in house enjoying its cashflow than suffer the rollercoaster of the public market, which is why the fund has sold itself to listed companies as a trusted long-term partner and buyer of unwanted assets.

It is basing its bid for Infratil on the basis of premium to net asset value because the disparate assets all trade on different models.

If you take last Friday’s Infratil stock price at $5.80 and deduct the value of TrustPower shares that will be distributed among Infratil shareholders, that works out at $1.64 a share, which leaves a balance of $4.16 a share against the bid price of $5.79 a share.

That looks like a premium of 39 per cent, which should be enough to get into the due diligence room.

Morrison & Co is a long-running infrastructure manager of the highest repute and earns a base fee of $38m a year from Infratil on top of a host of add-on fees depending on performance.

Most of the Infratil assets are in Australia and hence classified as international, and it just so happens that Morrison collects a 20 per cent outperformance fee on any returns of assets above 12 per cent a year.

The listed vehicle is what is known in the trade as a Christmas tree with fee lights shining all over the place.

AustralianSuper infrastructure boss Nik Kemp would fancy his chances of running the assets in house, and saving $150m or so a year in fees is not a bad head start.

Australia’s largest fund manager is not about to make a big noise about the conflict because it is still trying to win board approval to conduct due diligence on the assets.

Already the deal is being opposed in New Zealand in part as a defence against an Aussie raider from across the ditch, which is a stretch given 65 per cent of the assets are in Australia.

But when your chief executive’s team is making $150m in fees from your assets, a distorted narrative is not exactly new news.

AustralianSuper was one of the pioneers in the Australian industry of running money in house to save costs and with the expectation of $4bn in passive funds in its $33bn in Australian equities.

Infratil and New Zealand Super paid $420m for Shell New Zealand in 2010, changed its name to Z Energy, and floated the assets five years later for $2bn, which was the start of a happy friendship.

Its assets now include a joint ownership of Vodafone New Zealand, 51 per cent of TrustPower, 60 per cent of diagnostics provider QScan, 51 per cent of Tilt Renewables (which runs 322 windmills in eight wind farms in Australia), 48 per cent of the Canberra Data Centre with the Future Fund (a former combatant in the fight over Perth Airport) and nursing home assets in Australia.

In all, an eclectic set of highly prized assets, for which AustralianSuper will clearly have to pay more to get into the diligence room, but the battle is now on.

In awe over iron price

Forget the China trade squabble. Iron ore is now selling at a record of more than $200 a tonne, topping the last record in May 2010.

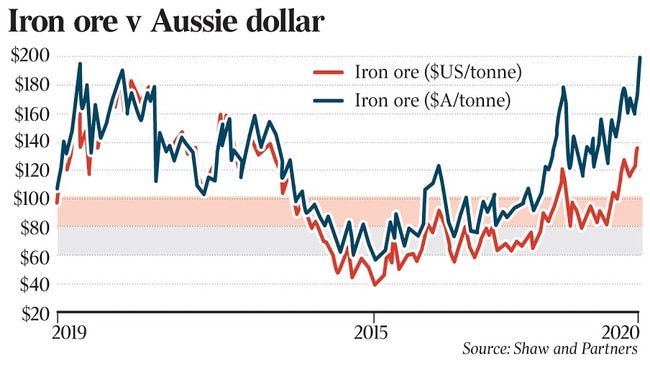

At the time the US-dollar price was $191.70 but as the accompanying graph from Shaw & Partners shows the iron ore price and Australian dollar have split a touch, in part because Vale’s problems have sent the iron ore price higher.

Fortescue sells ore into China at about $US55 a tonne when you throw in cash costs of $US13, royalties, freight and the like, which still leaves a handy margin on the price of $US148 a tonne. Analysts are looking at Fortescue reporting a profit of $2.70 a share.

AustralianSuper’s $5.1bn bid for Infratil faces a massive conflict of interest with its chief executive Marko Bogoievski also running external manager Morrison & Co, which earns about $155m a year in fees from the company.