That’s a chunky number, and if it keeps going we are heading for 20 per cent-plus in total returns this calendar year.

Better still, some of the heat over the last three months transferred from overpriced “tech-related” stocks back to value-based blue chips such as banks. This is just what we might have been hoping for this year. That’s why financials were the strongest performing sector in the quarter (up 11 per cent) and IT stocks were the worst (down 12 per cent).

In fact, rarely do we see the conditions so ideal for sharemarkets: we’ve got low rates, an improved profit outlook and pockets of speculative activity but not an engulfing wave of irrational exuberance.

The single most important issue threatening this picture is the steady rise in US bond yields: at 1.7 per cent, the US 10-year bond is now twice as high as a year ago. All money worldwide is ultimately priced off this benchmark and, if it continues to advance, sharemarkets ultimately will suffer as valuations come under pressure and, crucially, money has “somewhere else to go”.

And it’s easy to forecast a sharp correction somewhere down the line, so let’s just take that as a given and assess the market as it presents itself now.

Inside investment markets, shares still offer the best choice in mid-2021. The danger will lie in the degree to which the market is willing to indulge greed in the months ahead.

One way we are able to gauge this is the quality of new listings coming to the sharemarkets at home and abroad.

It is only a fortnight since gig economy services group Airtasker held its IPO and managed 150 per cent gains in two days.

Airtasker is a loss-making company pulling in $19m a year in revenue, with a market capitalisation of $440m. In other words, the market has ignored the lack of profit, instead putting a revenue multiple of more than 20 times on Airtasker.

Now, on the subject of unlikely sharemarket listings, what do the Australian-based Latitude consumer finance group and WeWork, the US flexible office space company, have in common?

They are both in the process of coming back to the market for a second chance to attract money from retail investors.

Consider Latitude and its CEO Ahmed Fahour, who most investors know best from his high-profile days as head of Australia Post. A reformulated Latitude, which the local IPO market had already rejected on two separate occasions, this week confirmed a third tilt at the boards.

Latitude is still led by Fahour, but it is a different beast this year and the listing will be a smaller float than last time, with no general offer — only the clients of broker firms will be in the action.

Meanwhile, in the US the considerably more extraordinary story of WeWork continues, with the flexible office space group — minus Adam Neumann as CEO — coming to the market in the form of a cashbox company called BowX Acquisition.

(On the local market, we don’t have so-called SPACs — special purpose acquisition companies — because they were effectively outlawed after they went off the rails in a cashbox craze more than two decades ago.)

You might call it the season of second chances, where anyone can get another bite of the cherry.

At least Latitude, unlike Airtasker — or indeed WeWork — is strongly profitable. Hopefully, that’s a sign of things to come.

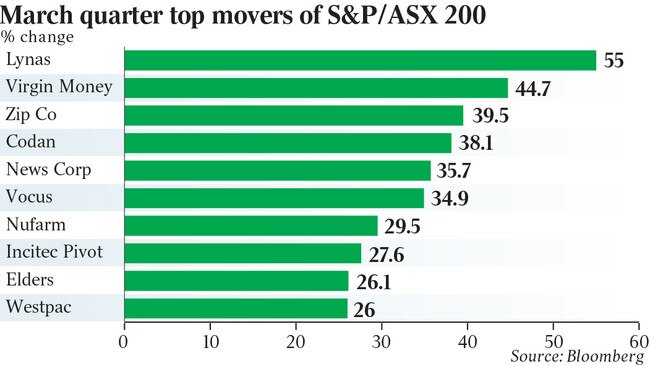

That’s it … Cut! The first quarter of 2021 has just finished. How much did we gain over the past three months? It was 3.1 per cent.