My son is looking at the property market for the first time as a potential home buyer.

The last time he looked at the residential market was with me when he was about seven years old. Every Saturday for many weekends he came with me as I searched for my first investment property.

I bought an investment property because I wanted some diversification from shares and cash in my self-managed super fund.

It all worked out, I got some capital growth and tax breaks and inadvertently I did my bit — along with a million other private property investors — to push prices up to the point where we are now shocked at what first-home buyers might have to pay to get into the market.

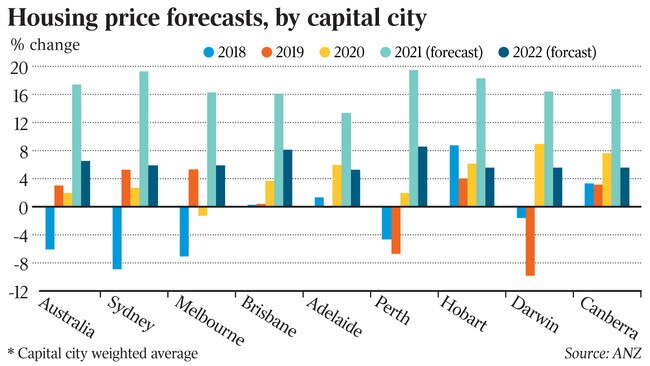

ANZ has just released forecasts suggesting capital city house prices could rise by 17 per cent this calendar year. This forecast is a revision on the bank’s previous estimate of 9 per cent — that’s a major upgrade of estimates.

If the economists at the banks are right, we are about to see one of those stretches when house prices literally shoot higher. We saw something similar in 1988-90 and 2000-03.

As a well-diversified intelligent investor (which I know you are) does any similarity between today and those previous periods strike you?

There are always particular explanations for house price booms — the current lift is thanks to artificially low mortgage rates — but what we have in common with the last two booms is what you might call post-traumatic investment stress: we are in the aftermath of a wrenching sharemarket crash where people once again seek the psychological defence of bricks and mortar.

The same went for 1988-90 which followed the crash of 1987 and 2000-03 which followed the dot.com crash of 2000.

The issue looms: when the day comes do I help my potential first home buyer and if I do, how to go about it?

A very different market

There is no point in my saying ‘‘Well son, I never got any help, so I don’t see why you should.” That’s not fair because if you look at the market today it is seriously different from the market I encountered nearly three decades ago.

Back then the average price in the city of Melbourne was $117,000. At the time the average wage was close to $37,000. An average house cost 3.16 times an average salary.

Mortgage rates back then were around 10 per cent. Today they are around 3 per cent.

Bear with me here because this cuts to the heart of the problems we now all face in relation to house prices.

Today the average salary is closer to $98,000 and the average house price in Melbourne is $720,000. In other words the average house costs 7.3 times the average salary.

To put that another way, if my son wanted to buy his first house on the same terms as his parents did (spending 3.6 times average salary and only needing to take the salary of one partner in a relationship into consideration) he would need to be making more than $200,000 a year.

How many first-time home buyers do you know earning a salary of more than $200,000 a year? And keep in mind we are talking averages here, which can mean little in the larger cities, especially Sydney.

The bank of mum and dad

So what to do as a parent, a potential partner in the so-called ‘‘bank of mum and dad’’?

The market today is different in some key ways — city populations are larger, rates are lower (for now) and government largesse when it comes to first-home buyers has never been so prevalent at both state and federal levels.

But the key issues are the same. Parents often have some money saved, while their offspring often don’t have much — certainly not enough to buy a house.

I’ve asked a range of top advisers what they suggest and these options need to be considered very carefully because life and tax matters can be a lot more complicated than you might expect.

There are two main avenues for helping a family member:

First is a gift. It is simple and there is no gift tax.

It is also fairly blunt as a financial move for two reasons.

It is free money given with no strings or responsibilities attached — sometimes people need to be reminded money is rarely gained with ease.

On many occasions the gift will effectively be going to a couple. Now unfortunately the statistics tell us that a sizeable portion of all couples will break up. When that happens, one half of the couple who is not your son or daughter will gain financially from the separation of assets.

The second way to help is a loan. Every adviser says the same thing here — if you are serious that it is a loan, then be serious about the paperwork and get the loan deed drawn up by a solicitor with the terms of the loan attached.

The distinguishing feature of a loan is that should a couple break up, then the loan must be repaid. In turn that means the half of the couple who is not your son or daughter will not be gaining financially from your earlier financial assistance. This is cold pragmatic forward thinking but it is also standard advice from top financial planners on this issue.

You may wish to charge interest on a loan, which is entirely reasonable. But this could backfire because under the ‘‘responsible lending’’ legislation the bank must take it into account if you have another loan outstanding. If the bank finds it is adding a second loan to an existing arrangement it will need to trim the amount it may lend on that basis!

A third way

There is a middle ground here which is clever: The ‘‘bank of mum and dad’’ can create a no-interest loan which need only be repaid when the property is sold. This should mean the loan is useful but the bank does not cut back what it will lend.

Like I said earlier, life and tax matters are always complicated and I still don’t know if I will do any of this, but at least when the time comes, I will know the smart choices.