As investors gradually move up the risk curve away from low rate cash deposits, the success of recent floats such as the Airtasker group — the gig economy services company which has managed a 170 per cent per cent jump in its first trading week — signals ever more ambitious floats are now likely to succeed on the local bourse.

Airtasker had an issue price of 65c, it finished its first day at $1.05 and its second day on Wednesday ) even stronger by rising another 67 per cent to $1.75.

Among the bigger floats coming down the track is a second attempt at an IPO for Latitude Financial Services, the $2.6bn company led by former Australia Post CEO Ahmed Fahour, which is aiming to raise around $150m-plus from retail investors almost exactly a year after it failed to get across the line on its first attempt.

In mining, veteran entrepreneur Owen Hegarty who led Oxiana Minerals — and more recently a controversial push to open the first new coal mine in the UK in three decades — is reportedly planning a $1bn copper-focused float of 29Metals Ltd based on mines in Australia and Chile.

The Australian’s DataRoom has also reported that the auto dealer Peter Warren is considering a $500m float of the group.

Retail investors are more willing to entertain new floats when there are strong examples of high profile IPOs current in the market.

Airtasker is now valued at more than $600m but by was no means the best new float this year. That title goes to Firebird Metals which jumped 290 per cent on its first day trading on March 18 — though it should be pointed out Firebird has a market capitalisation of only $33m.

IPO investors are also willing to back high revenue growth companies which are making losses in a clear sign that bulls are in control.

Airtasker is now selling on a sales revenue of around 28 times estimated 2021 sales: it reported a net loss of $5m in 2020 in sales of $19m.

The wider IPO scene — along with a swing away from so-called “growth stocks” — endured a mixed few months until now, with some high profile disappointments such as technology services company Nuix which was one of the stars of late 2020 but is now trading below its IPO price.

Nuix is trading at $5.05 after hitting a recent peak near $8 — it had an issue price of $5.31.

With the arrival of pre-IPO funds — which raise money from investors who wish to invest in larger companies before they come to the sharemarket — the value of individual floats has been steadily increasing.

Unlisted new companies offering valuations north of $1bn — known as “unicorns” — are becoming increasingly common.

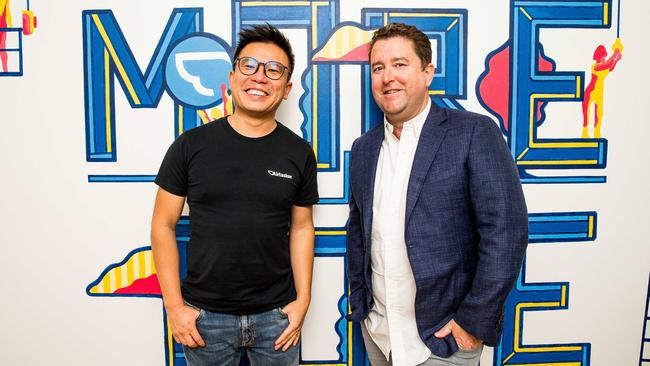

The latest boost to the pre-IPO market came from the international Australian financial technology company Airwallex, which now has a value of $2.6bn after a $100m raising earlier this week.

Investors can expect a string of new major-league sharemarket listings in the months ahead as a buoyant ASX reveals a refreshed appetite for raising capital.